Analysis and Outlook of BEV market in China in 2021

BEV will see a market outbreak.

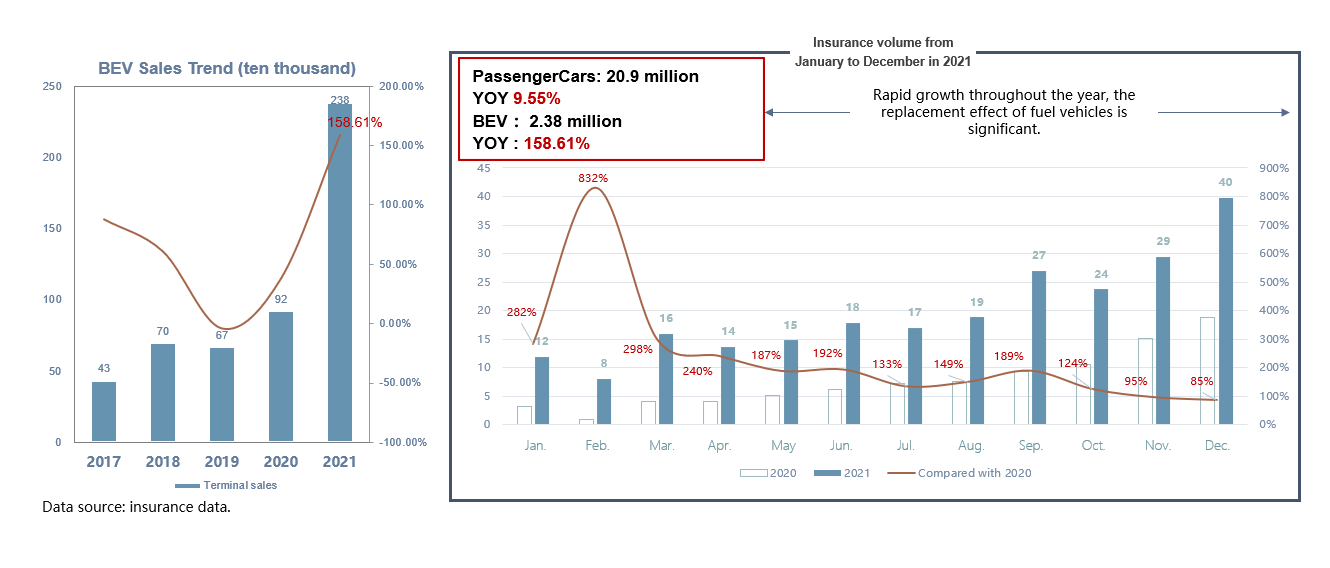

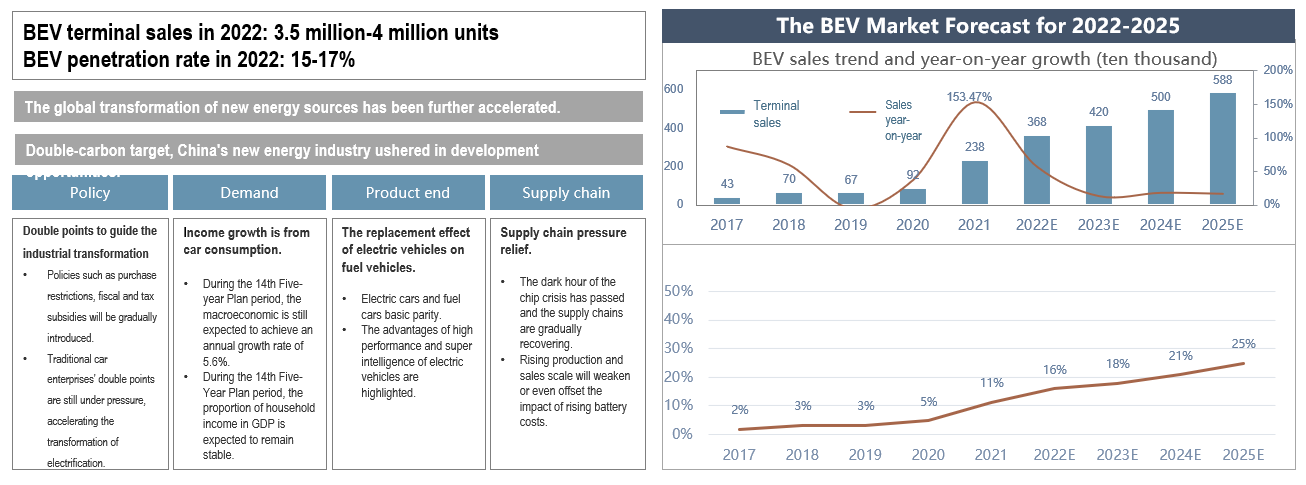

It sold 2.38 million terminal units in 2021 and it will reach 3.5-4 million units in 2022.

In 2021, the year-on-year growth rate will more than 150% and the growth rate will continue in 2022 to reach 50-70%.

The penetration rate will reach 11% in 2021 and it will increase rapidly to 15-17% in 2022.

The sales volume of BEV was 2.38 million in 2021, up 158.61% year on year, in strong contrast with the steady growth of fuel vehicles, which accelerates the pace of the transformation of the vehicle market to new energy.

- The BEV market started relatively low in 2020, but the market after the epidemic showed the characteristics of gradual improvement and the super strong trend has continued to this day.

- China's car market entered a relatively stable growth feature in 2021, but the BEV market maintained a high growth trend. From January to March, the new energy started strong and continued to strengthen from May to December.

Situation Of Market :

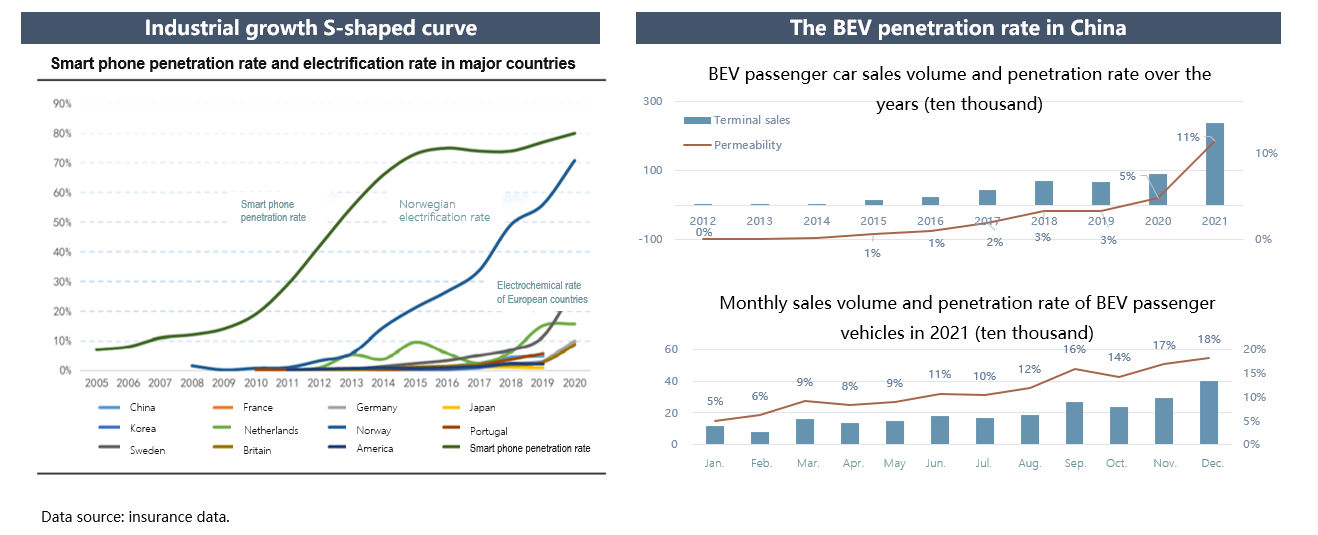

BEV penetration rate exceeded 10% in 2021, which will usher in the market explosion.

- Industrial growth is in line with the "S-shaped curve" and 10% -15% is the rapid rising inflection point. If the penetration rate exceeds 10% in 2021, BEV will usher in the outbreak period.

- In 2021, the BEV market exceeded 10% for seven consecutive months and gradually increased, reaching 18% in December. Referring to the industrial development curve and the European market with rapid electric transformation, China's BEV market will usher in a market explosion period.

Supply side :

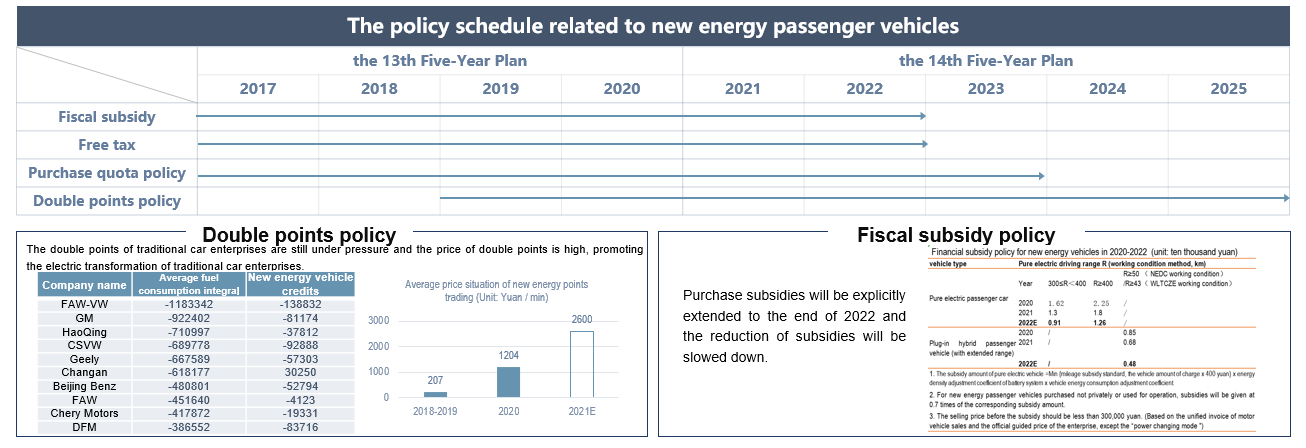

Double points to promote the electric transformation of the industry and boost the outbreak of the BEV market.

- Under the background of "carbon peak and carbon neutrality", during the 14th Five-year Plan period, the new energy policy has been changed from purchase restriction and subsidies to double points to guide the industrial transformation.

- According to the relevant policies of the Ministry of Industry and Information Technology, the proportion of new energy vehicle credits needs to reach 14% in 2021 and will continue to improve in the future. However, from the specific performance of car companies, the double points of traditional car companies are still under pressure and the transaction price of double points is high and the pressure of electric transformation of car companies in 2022 is still large.

- According to the relevant policies of financial subsidies for new energy vehicles issued by the four ministries and commissions in 2020, the subsidy standard in 2022 will be reduced by 30% on the basis of 2021. Under the same conditions, the EV with pure electric mileage above 400km will be reduced by 5400 yuan and the EV with pure electric mileage of 300-400km will be reduced by 3900 yuan.

Supply side :

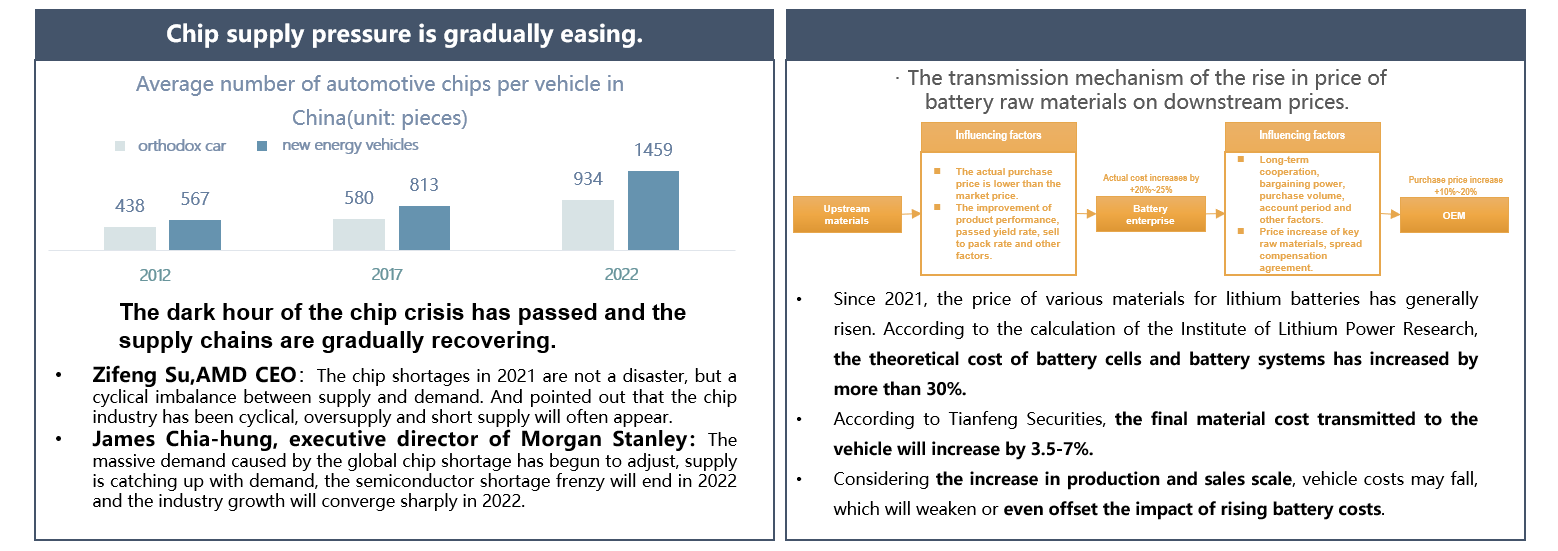

The relief of supply chain pressure provides a good industrial environment for BEV outbreak.

- China's auto supply was shrouded in a dark cloud of core shortage and rising raw materials in 2021 and the supply chain pressure will gradually ease in 2022.

- Due to the global epidemic combined with the trend of automobile intelligence, China's automotive chips were widely scarce in 2021 and the supply is catching up with the demand in 2022 and the supply of automotive chips will gradually recover.

- The continuous rise of raw material prices has brought huge cost pressure to downstream automobile manufacturers and with the expansion of production and sales scale in 2022, the rising cost of raw materials will be diluted.

Demand side :

Domestic demand continues to grow, providing a good macro environment for the BEV outbreak.

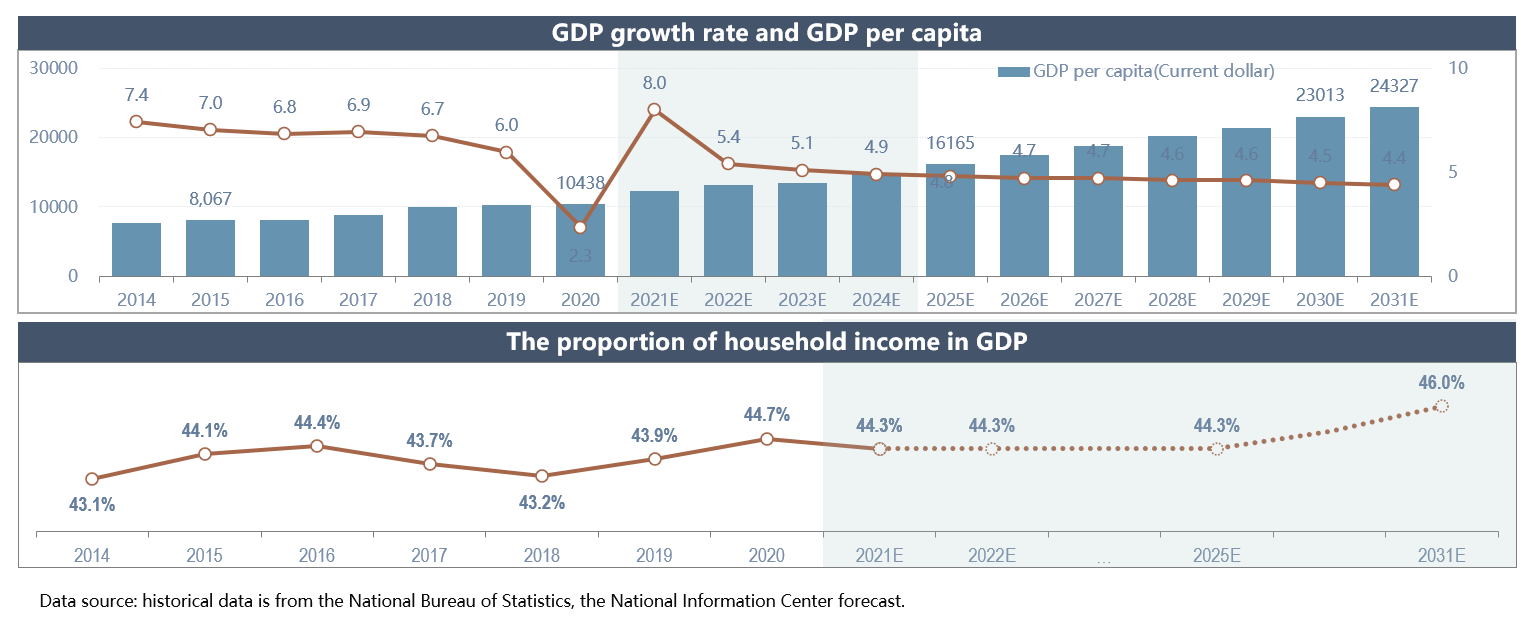

- During the 14th Five-year Plan period, the macroeconomic and residents' income increased steadily and the growth of income is the basic driving force for the growth of automobile consumption demand.

- During the 14th Five-year Plan period, the macro economy is still expected to achieve an average annual growth rate of 5.6%. In 2020, in response to the epidemic, the central government increased and reduced taxes and fees for private enterprises and the proportion of household income in GDP increased. In 2022, under the central government's "six guarantees" policy, the proportion of household income in GDP is expected to remain stable.

- In 2021, the overall passenger car market of China stopped falling and recovered and the passenger car industry after shock and adjustment will enter a period of steady growth, laying a good foundation for the growth of BEV.

Demand side :

Private consumption is dominated, providing a solid user base for the BEV outbreak.

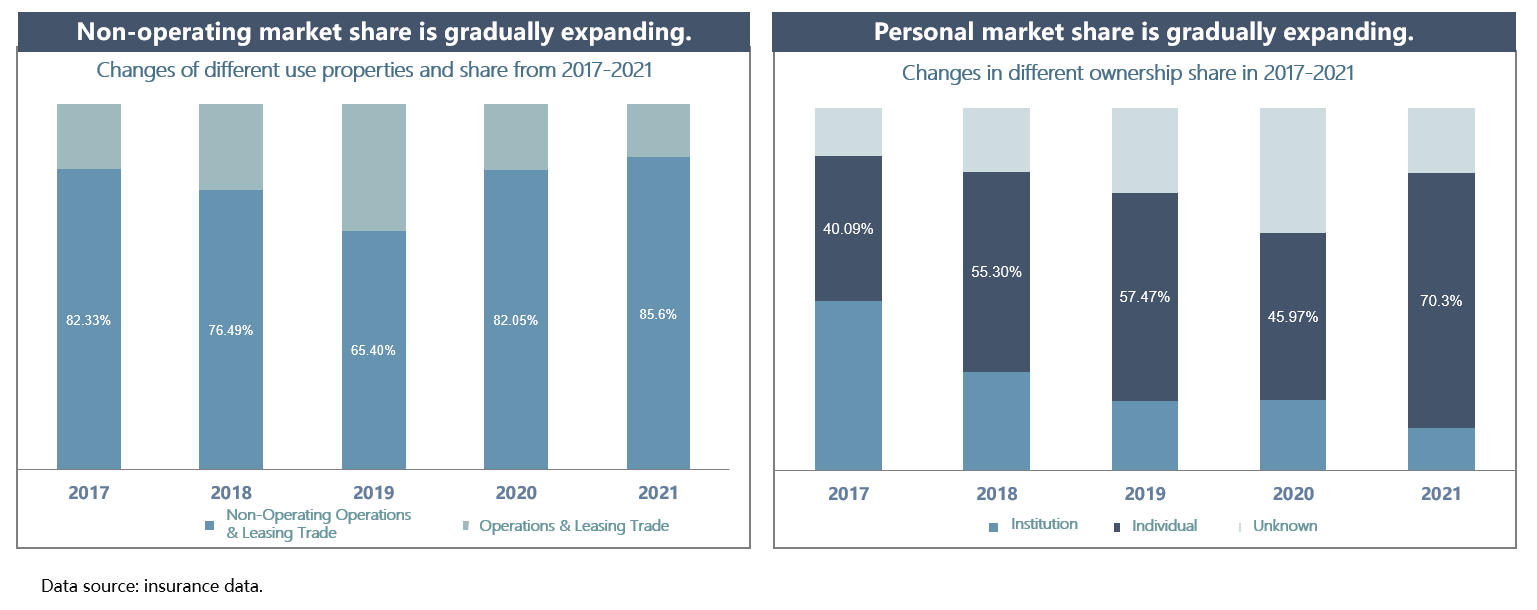

- Private consumers will become the dominant market. After the opening of the private market, the acceptance degree of BEV models will accelerate, and the sales volume of BEV will increase rapidly.

- Taxi and online ride-hailing will no longer be the dominant force in the BEV market. From 2017 to 2019, the proportion of BEV rental category gradually increased, decreased slightly in 2020 and low in 2021, less than 14%.

- From 2017 to 2021, the personal market share gradually increased, with the most significant increase in 2021, reaching 70.3%.

Market prediction :

In 2022, the BEV market size will exceed 3.5 million and the penetration rate will reach 16%.

- Under the combined action of policies, supply, demand and products, the terminal sales volume will reach 3.5 million units in 2022, with a penetration rate of 16%.

- At present, the Chinese market is still in the transition stage from the early stage to the late stage of popularization and the new car sales are gradually shifting from the incremental market to the stock market. Although China's auto market fluctuated in 2018, in the long run, the production and sales of China's auto market are now at the end of the short-term adjustment and it will maintain a moderate growth trend in the future.

- In the context of the global energy transformation, under the joint action of policies, supply, demand and products, China's BEV market has entered an outbreak period.

Market prediction :

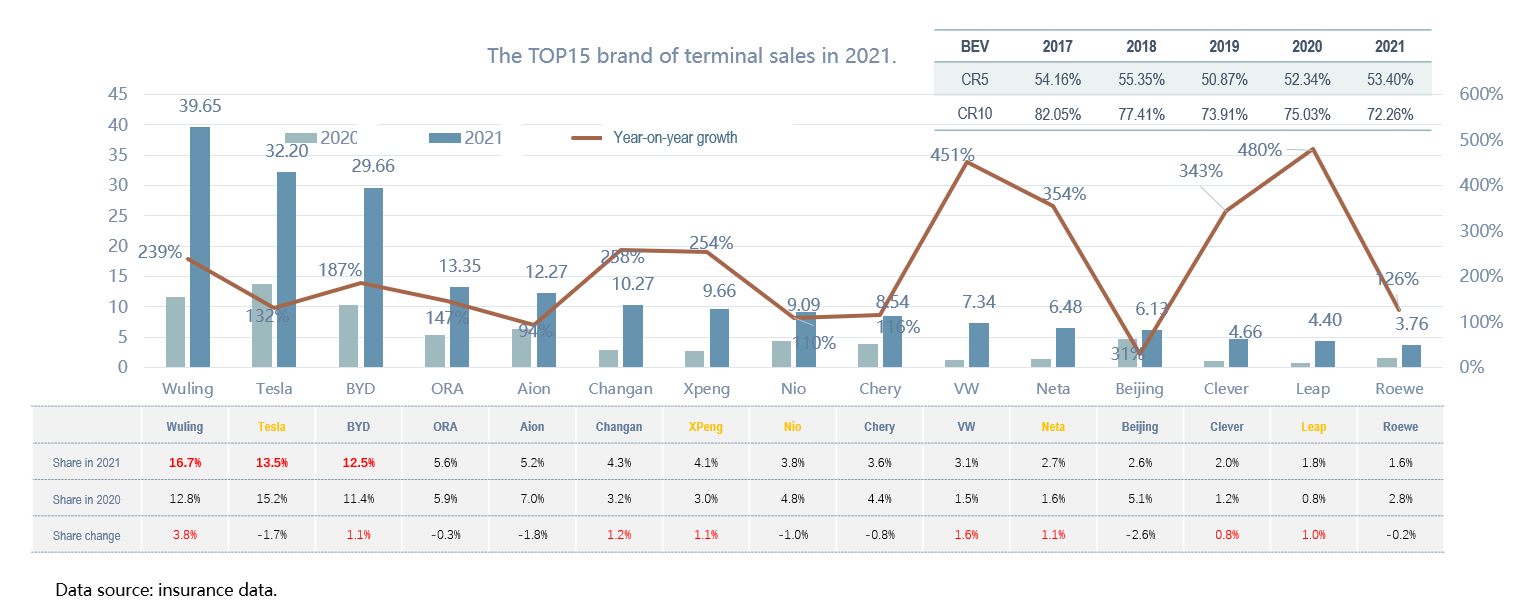

Sales to the head concentration, the market competition in 2022 intensified.

- Traditional brands accelerate their efforts and the rapid growth of new power brands drives the continuous increase of BEV market concentration and intensifies the market competition.

- Among the traditional joint venture brands, Volkswagen accelerated the transformation of electrification and the ID family entered the sales TOP10 brand for the first time.

- The sales of new power brands grew rapidly, not only the first echelon of NIO and XPeng Motors grew rapidly, but also the second echelon of which NETA and LEAPMOTOR.

- In 2021, the market concentration continued to increase and the sales share was rapidly concentrated to the head and mainly concentrated in the traditional independent brands and new power brands.