Analysis and outlook of the mid-end and high-end BEV market in 2021

The rapid growth of the middle and high-end BEV market will usher in an outbreak period.

Price range of more than 200,000 yuan and B class is the core sales market.

Sales volume penetrate into non-restricted cities and the second and third lines have become an important incremental market.

Sales volume in 2022 will reach 1.4 million to 1.6 million.

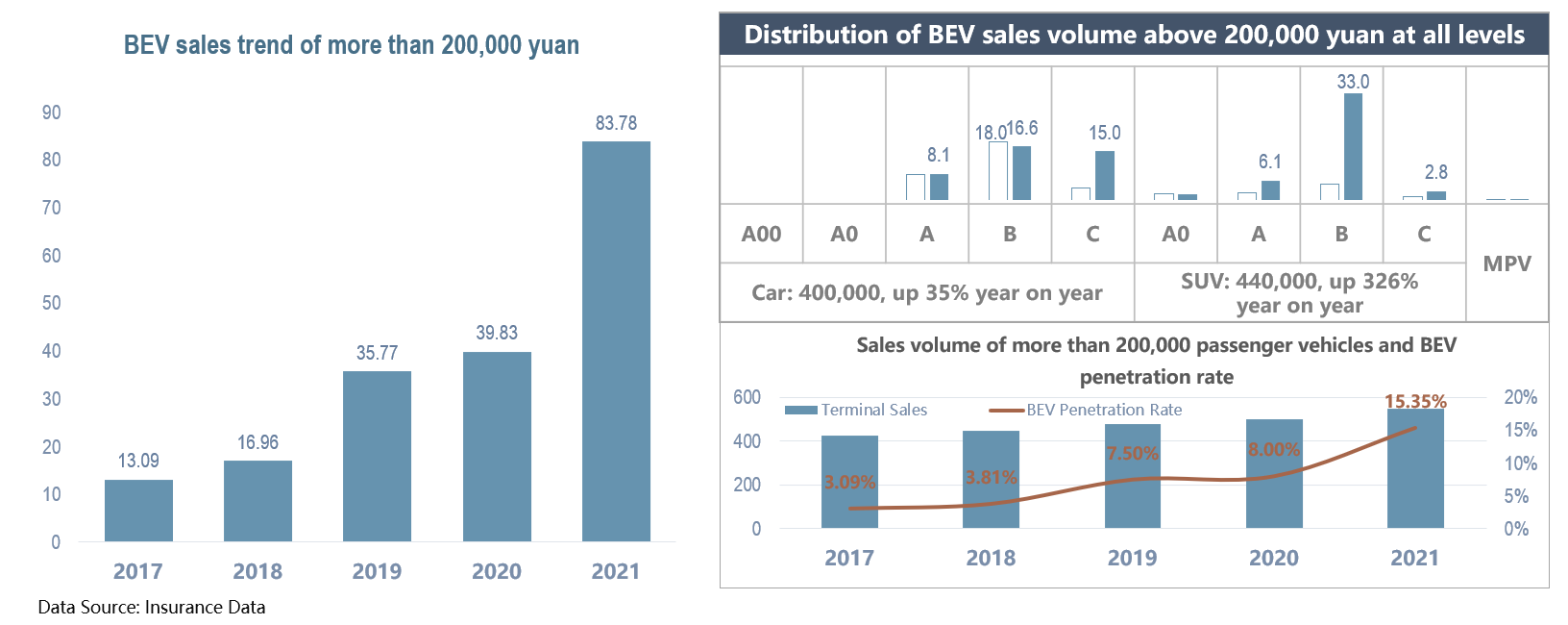

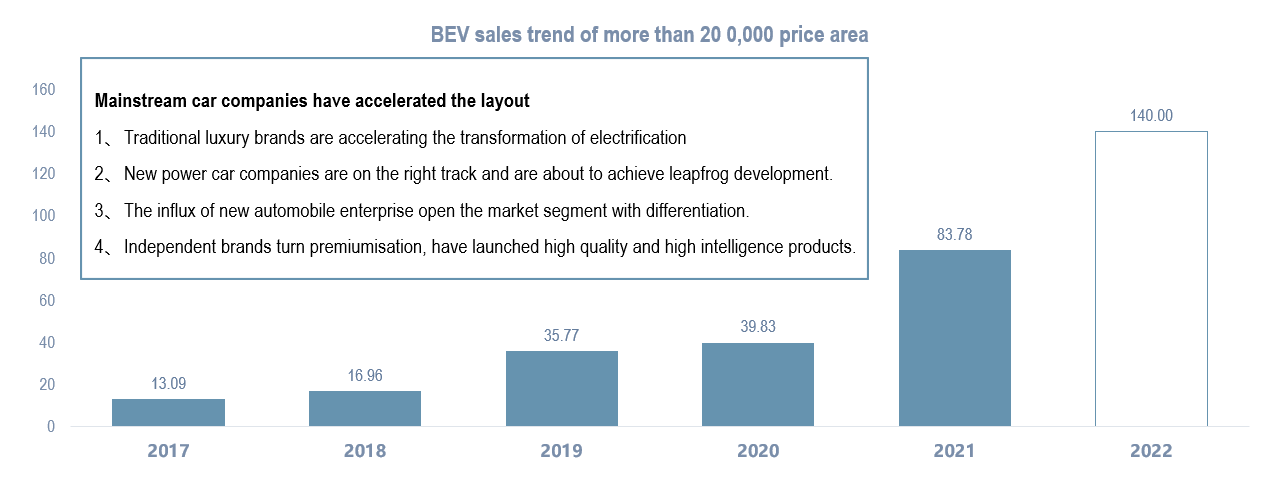

Sales doubled in 2021 to exceed 800,000

In 2021, the sales volume of the price area of more than 200,000 yuan doubled and the sales volume scale exceeded 800,000 units, mainly with B-class models.

- With the improvement of household consumption level, China's passenger car market shows an obvious trend of high-end. In recent years, the growth rate of the middle and high-end market is significantly higher than that of the whole.

- In the BEV market, driven by Tesla and other new power car companies, the middle and high-end market grew rapidly and the market size doubled to exceed 800,000 yuan in 2021.

- From the perspective of sales structure, it is mainly concentrated in the B \ C class market, among which class B sales market is the core sales market of the middle and high-end BEV car market.

Sales volume penetrate into non-restricted cities and the second and third lines have become an important incremental market.

The size of purchase restrictions is limited and the second and third tier will become the main incremental market of high-end new energy in the future.

- High-level cities have always been the main marketing market of high-end BEV, but the first-tier cities are all cities with purchase restrictions. Relatively speaking, the market size is limited and the sales volume of high-end BEV in the second and third cities has been rapidly increasing, which has become an important incremental market for high-end new energy.

- With the improvement of charging and other infrastructure and the improvement of user acceptance, the sales volume in second-and third-tier cities will be rapidly exploded, especially in the Yangtze River Delta, Pearl River Delta and provincial capitals.

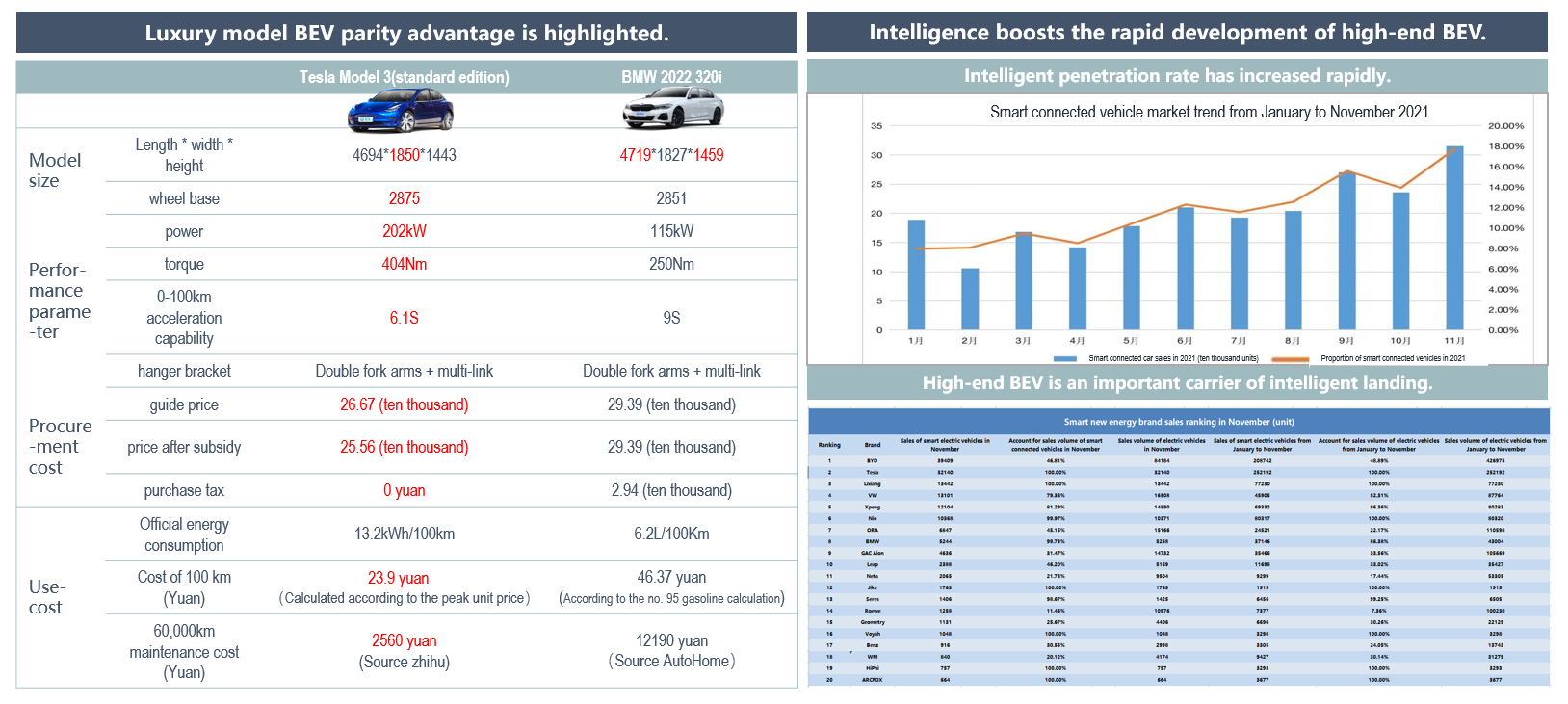

The replacement effect of BEV on fuel vehicles began to penetrate from the high end of the market.

In the high-end market, electric vehicles and fuel vehicles are basically parity and the advantages of high-performance and super-intelligence are prominent. BEV has ushered in the market inflection point of replacing fuel vehicles.

- The Model 3 and BMW 3 are close in size, but the MODEL 3 has more advantages in performance, energy consumption, purchase cost and so on.

- In 2021, autonomous driving has ushered in the first year of commercialization. Enterprises begin to look for the scene landing. The more high-end models are, the more higher-level autonomous driving functions are pursued.

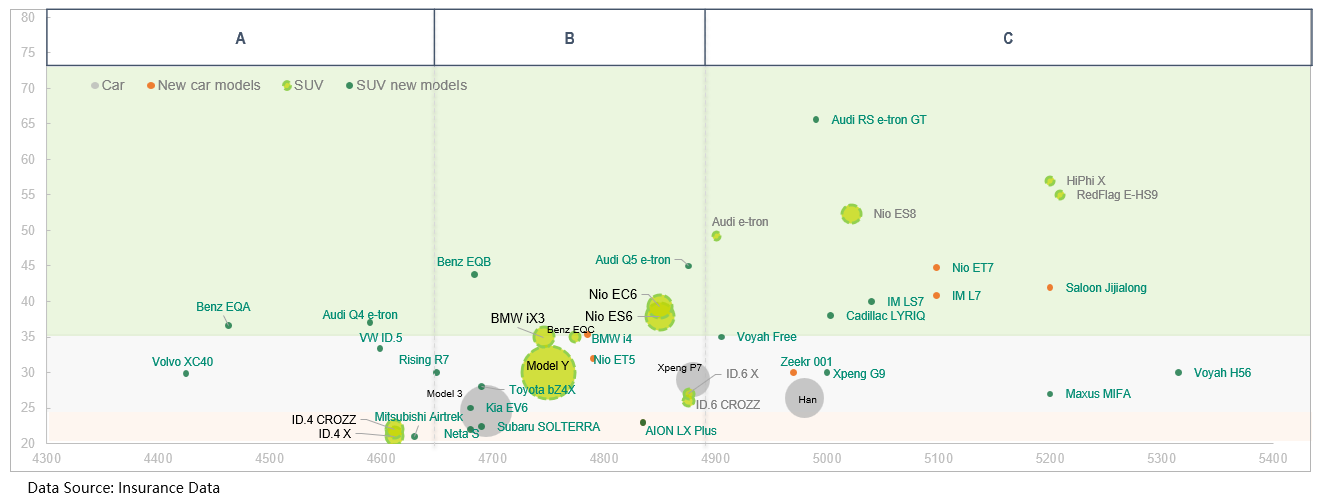

Centralized product placement, the high-end market competition is white-hot.

At present, the sales volume focuses on 250,000-350,000 price area and the competition in the price area above 350,000 price area will gradually become hot.

- More than 200,000 yuan market is mainly intelligent, has emerged Model 3, Model Y, P7, Han and other star models, but are concentrated in 250,000-350,000 price area.

- Nio and HiPhi have made certain breakthroughs in the price area of more than 350,000. In the future, with the promotion of BBA electric transformation, the high-end of independent brands and the influx of new power brands, the products are centralized release and the competition in the price area of more than 350,000 will gradually become hot.

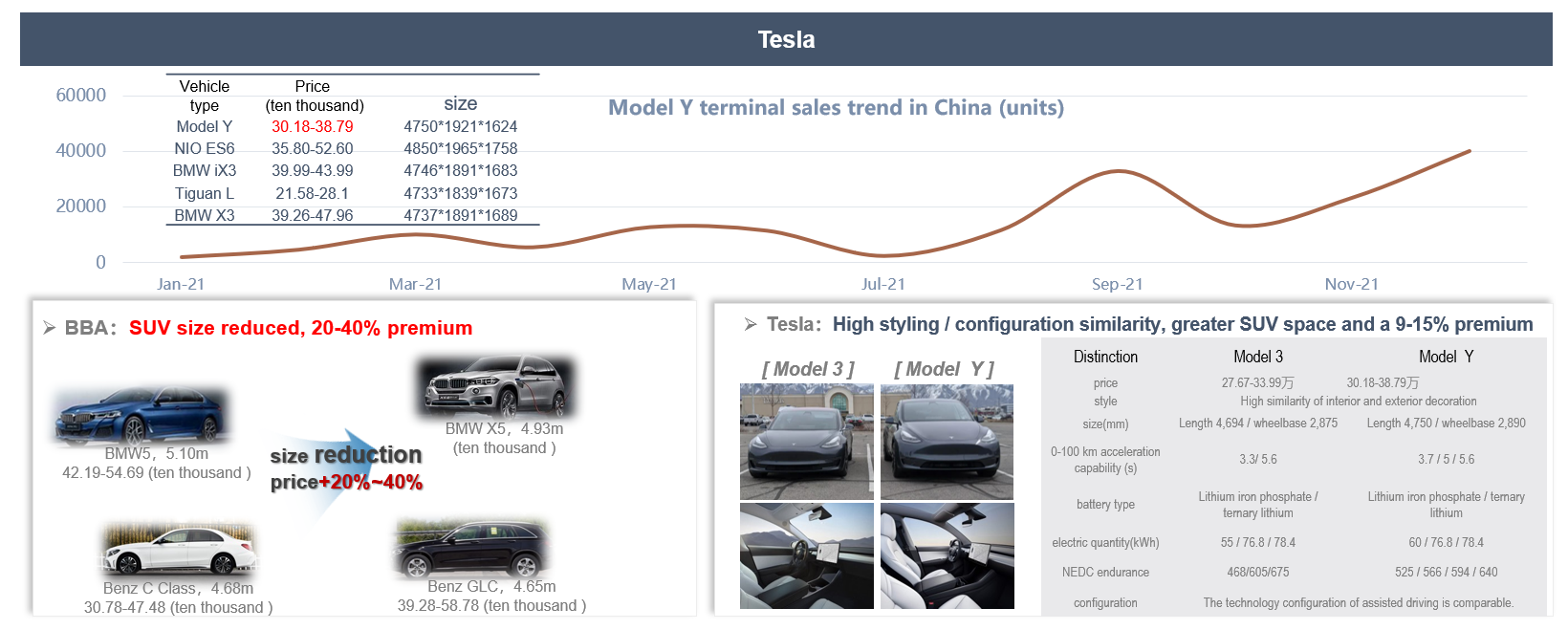

Model Y breaks the pricing rules and starts the sales harvest mode.

Tesla breaks the traditional fuel car pricing rules, outstanding price advantage, harvest SUV dividend.

- Since the launch of Model Y, with the gradual increase of production capacity, the sales volume has continued to rise. In September 2021, it surpassed Haval H6 to become the sales champion in the SUV market.

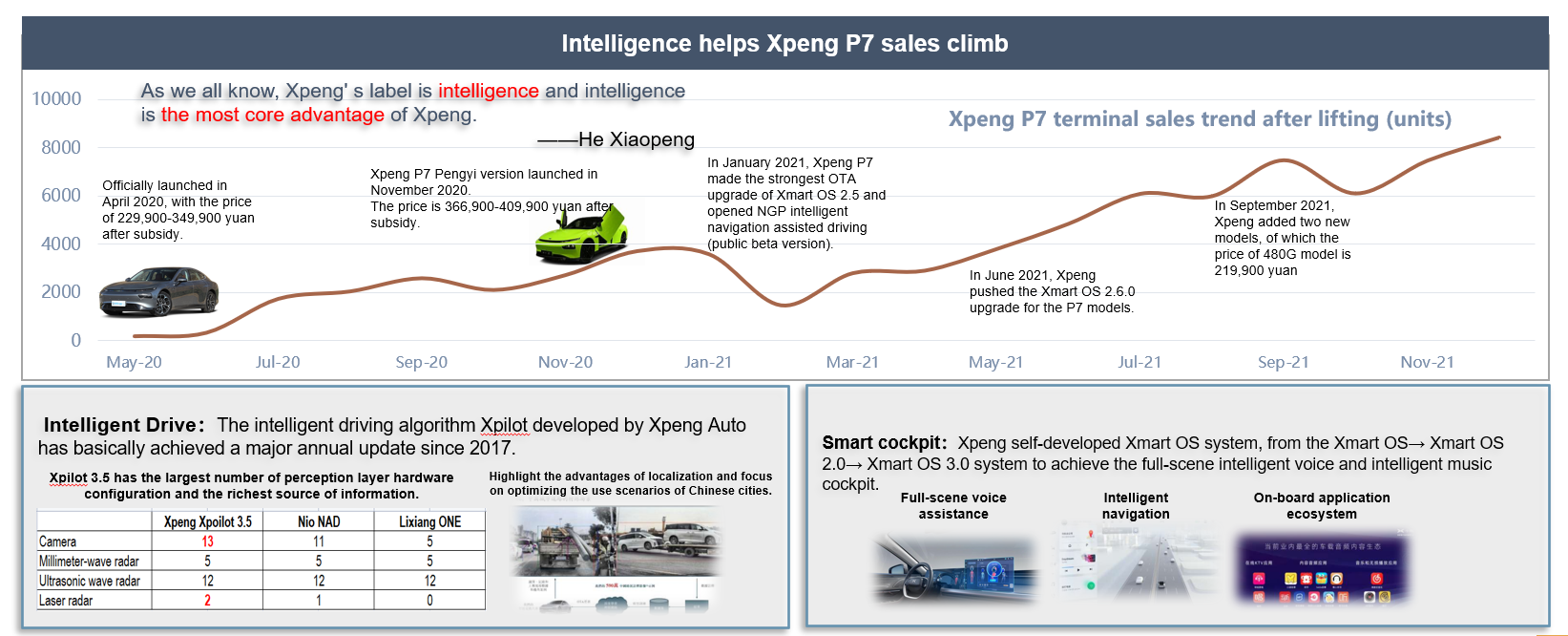

Intelligent support, Xpeng P7 sales nearly ten thousand.

Users in the mid-to-high end market have a stronger perception of value. Under the blessing of intelligent tag, the sales volume of Xpeng continues to rise.

- Xpeng P7, listing in April 2020, after many OTA and with new models join, cumulative sales volume in 2021 attained 60,000 units.

- The orientation of Xpeng is the mid-to-high end, mainly focus on intelligence. Xpeng P7 adopts SEPA intelligent electric platform architecture and continues to upgrade to deepen the intelligent label.

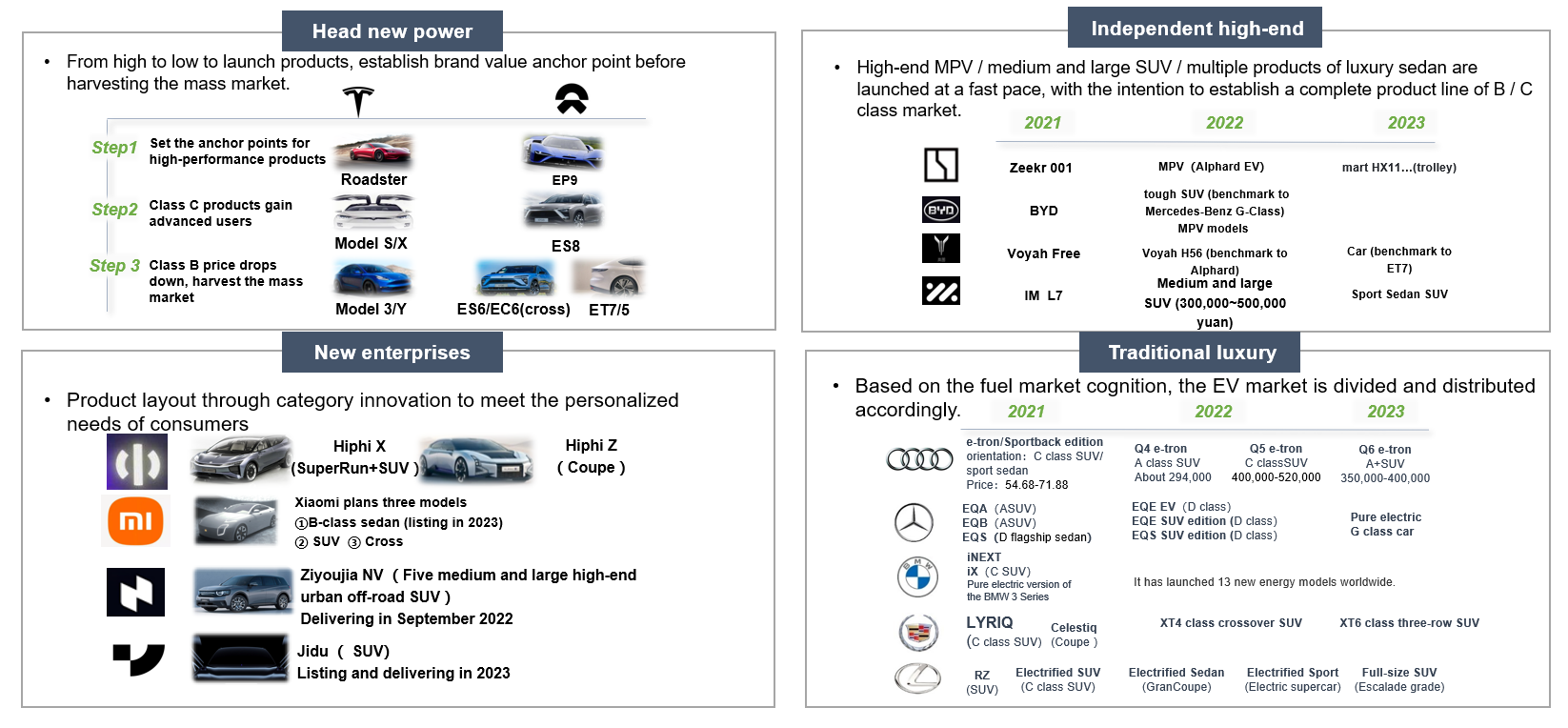

Competitive subjects accelerate their product layout.

Competitive enterprises are divided into four factions: head new power / independent high-end / new enterprises / traditional luxury, from high to low layout products.

- The first three factions innovate from layout strategy, category differentiation and other dimensions and traditional luxury maintains thinking layout products in the field of fuel vehicles.

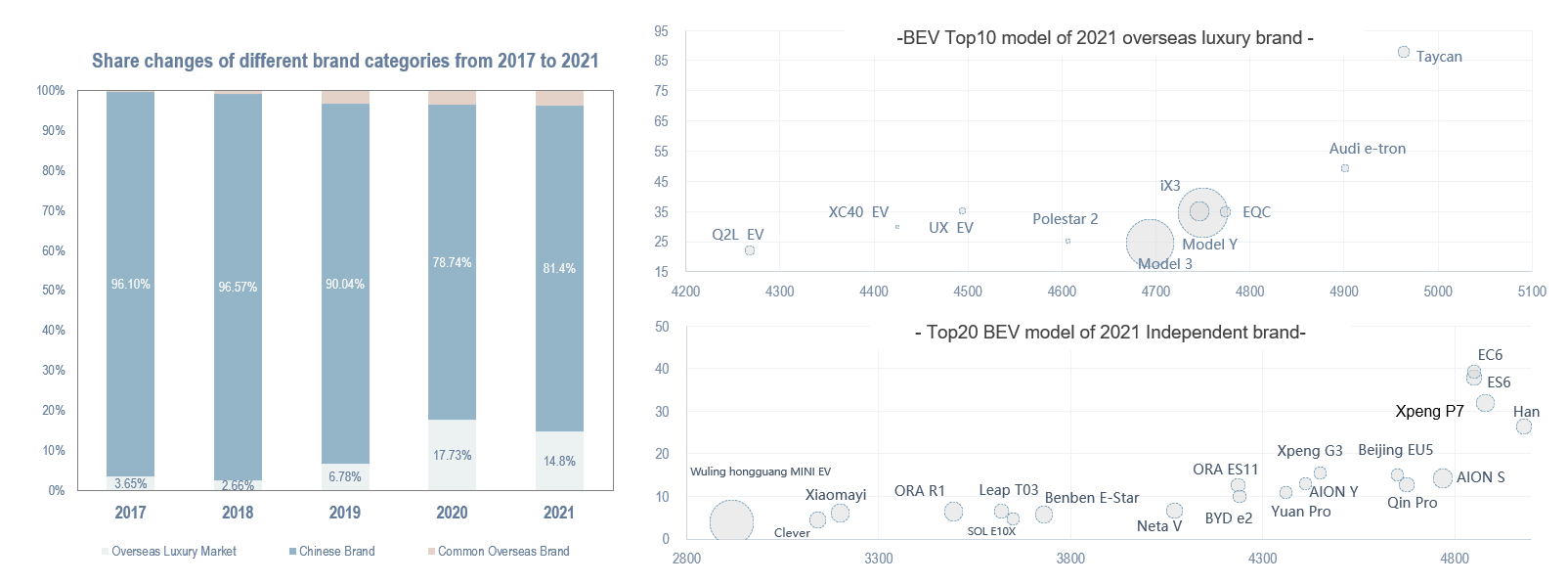

Overseas luxury brands seize the middle and high-end market share.

Independent brands are still the main body of the BEV market, but the overseas brands represented by Tesla are gradually seizing the high-end market share.

- Traditional car companies are represented by BYD, GreatWall and Wuling Hongguang and their launched models focus on the price area of less than 200,000 yuan, focusing on the mass market.

- Nio, Xpeng and other new power car companies maintain the pace of launching a model every year, focusing on the market of more than 200,000 yuan.

- Among overseas brands, Tesla, as a benchmark brand, has seen steady and rapid growth in sales volume, while the e-tron and EQC launched by BBA have not yet aroused warm feedback from the market due to its pricing and product launch logic that still follow the traditional logic.

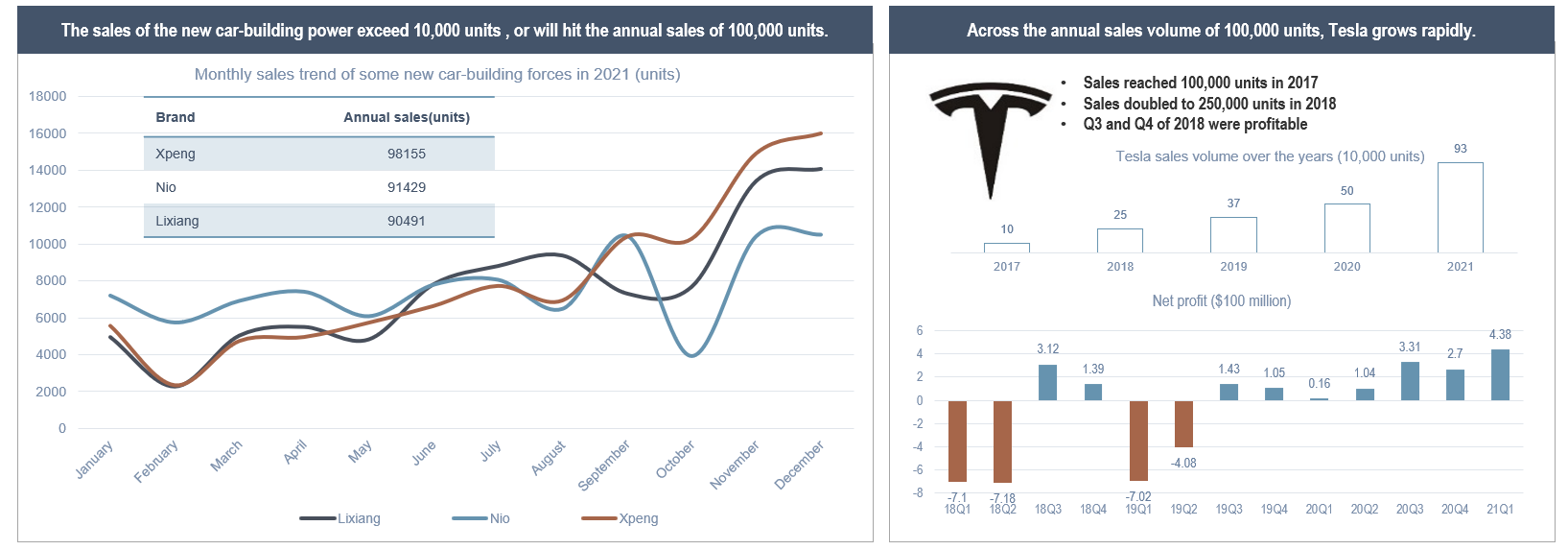

The delivery volume of new car-building forces continues to break through, showing a bright performance.

In 2021, the new power of car manufacturing developed rapidly, with monthly sales continuously exceeding 10,000 units and annual sales of nearly 100,000 units.

- In 2021, the delivery volume of new car manufacturing forces such as Nio, Xpeng and Lixiang will continue to break through and the monthly delivery volume continuously exceed 10,000 units, with the annual sales volume of nearly 100,000 units.

- Annual sales of 100,000 units is usually considered as a sign that a business is on track. Compared to the development process of Tesla, Tesla achieved sales of 100,000 units in five years, but the annual sales volume reached 250,000 units in the next year and made a profit from the third quarter from the following year.

Sales volume in 2022 will reach 1.4 million to 1.6 million.

The market growth of more than 200,000 yuan price area is rapid and the innovative BEV products lead the sales growth. The sales volume scale may reach 1.4 million to 1.6 million yuan in 2022.

- Consistent with the high-end trend of the traditional fuel vehicle market, the BEV market has an obvious trend of high-end. The sales volume reaches 800,000 yuan in 2021 and focuses on the 250,000-350,000 price area market.

- At present, the demand of the high-end market is strong. With the intensive release of products, the sales volume will continue to grow. The market of over 350,000 price area has exploded rapidly and the overall market size will reach 1.4 million-1.6 million in 2022.