Automotive Market Annual Summary in China in 2023

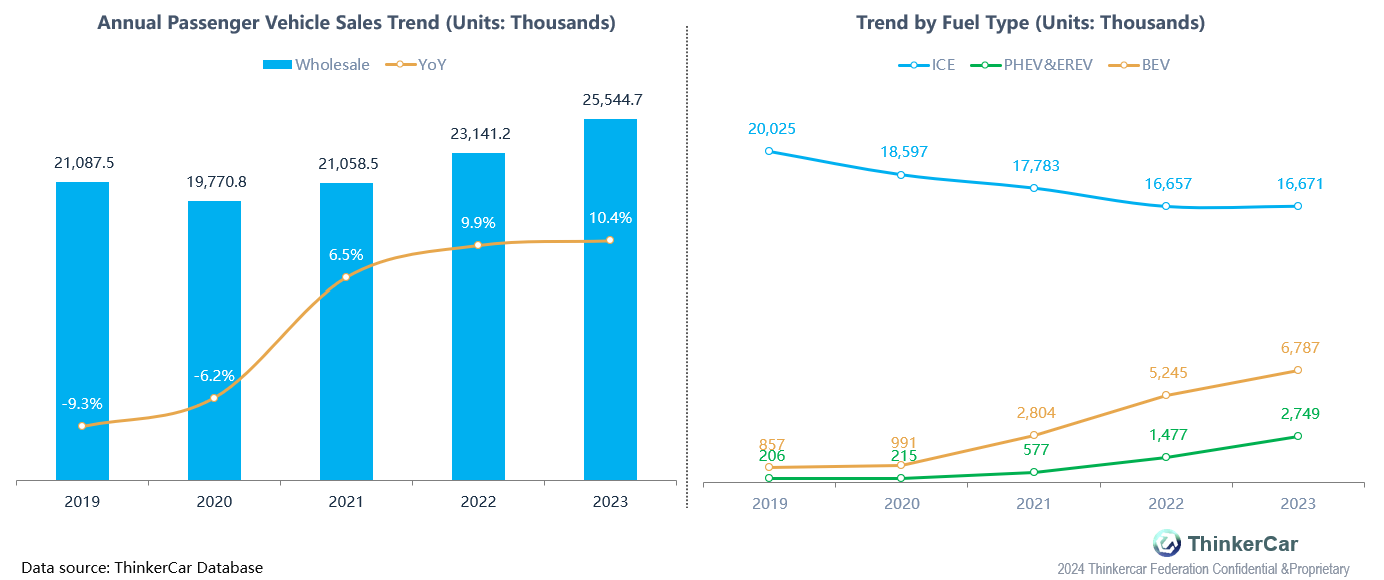

Passenger vehicle market demand rebounds, with NEVs challenging the dominance of traditional internal combustion engine vehicles.

- PV sales reached 25.54 million units in 2023, up 10.4% year-on-year, marking the first time in five years the growth rate has exceeded 10%. This surge is attributed to the stronger-than-expected economic recovery in the second half of the year and the automakers' extensive strategies of trading price for volume.

- NEVs and traditional fuel vehicles will be in a long-term battle for market share, with sales of the latter still experiencing a steep downward trend.

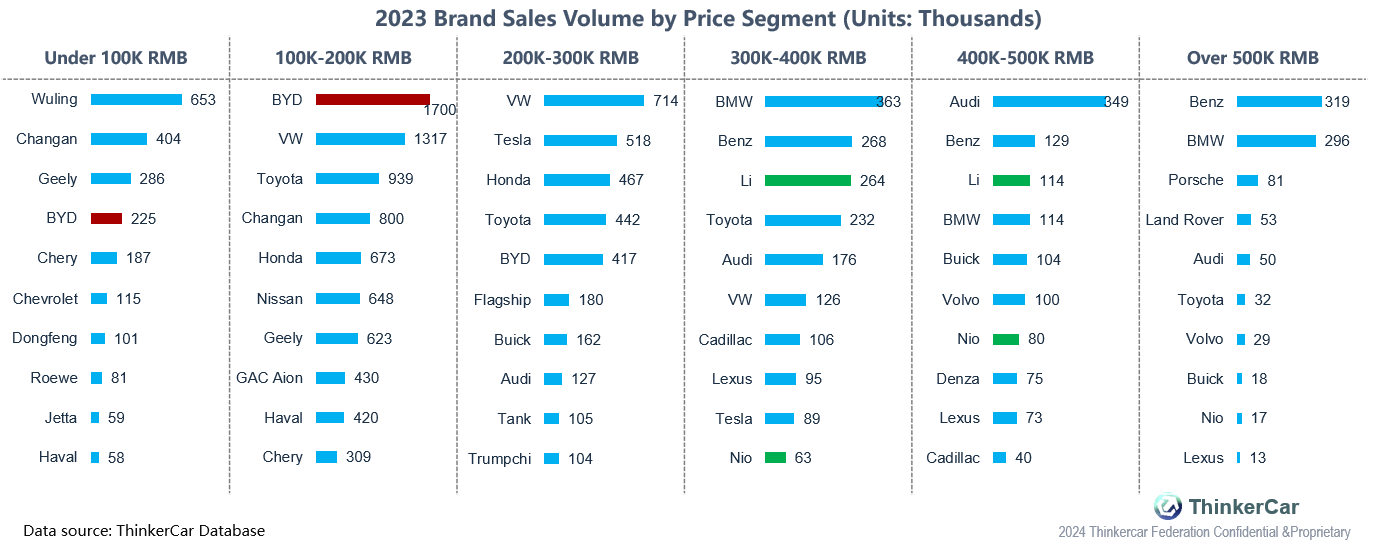

Market demand sub-200K RMB rationalizes, while the 300K-500K RMB bracket is set for a showdown between smart features and luxury amenities.

- From the perspective of consumer budgets, the competitive landscape at the top of the market is divided into three price ranges. Below 200K RMB, the segment is dominated by electric vehicles, with BYD standing out as a leader. In the 200K to 300K RMB bracket, VW faces stiff challenges. For the 300K-500K RMB segment, the leading position is contested by BBA and intelligent brands such as Li Auto and NIO, while the market above 500K RMB is still led by the BBA group.

- The 200K-500K RMB market segment is poised to welcome several new models from popular NEV brands like Li Auto, AITO, and Xiaomi in 2024, marking the year's most significant industry highlight. Meanwhile, the perennially stable luxury market share of the BBA may face disruption in 2024.

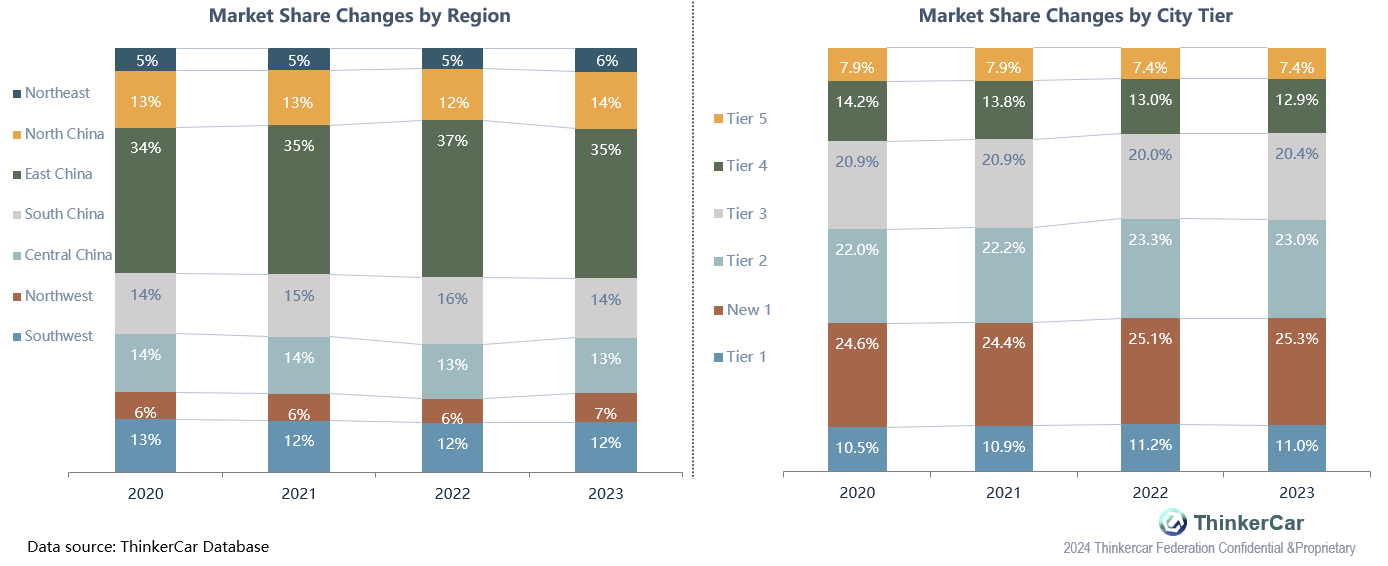

The automotive market is increasingly shifting towards the central-northern regions and mid-tier cities.

- Regionally, market shares in the Northeast, North China, Northwest, and Central China regions have grown, while other areas have seen a decline in their market share.

- By city, the market share in fourth and fifth-tier cities continues to decline, while second and third-tier cities have seen an increase in their shares, indicating a market shift towards mid-tier cities.

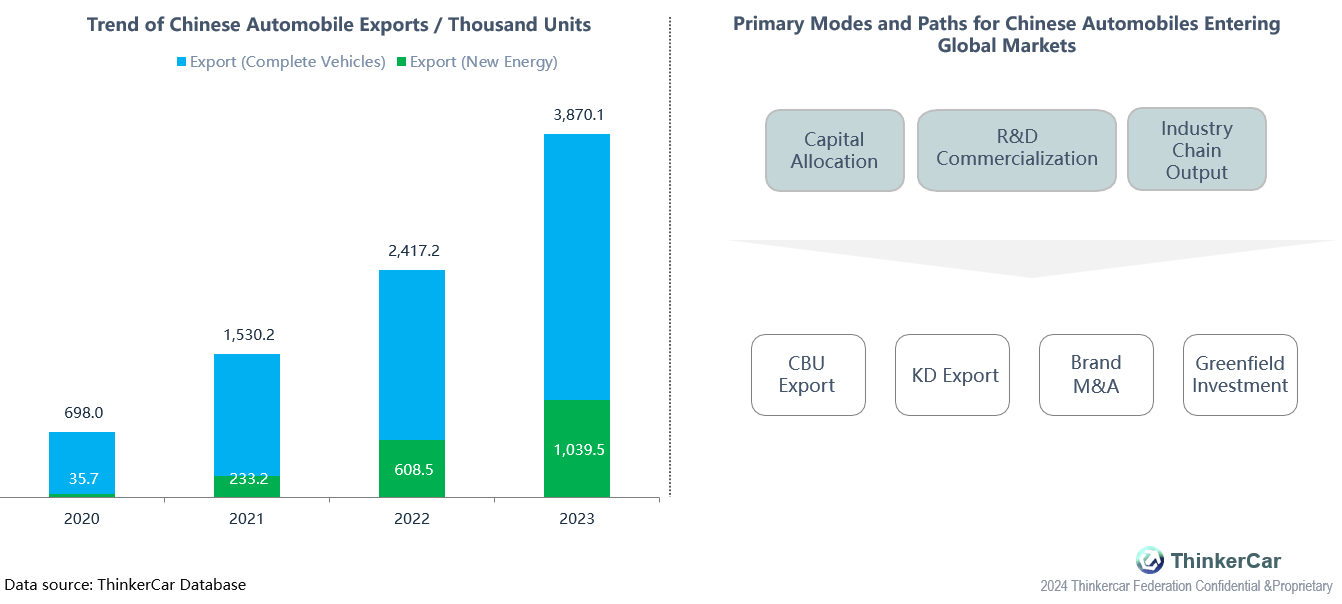

As overseas influence has grown, PV exports have become a new volume growth area.

- PV exports have maintained a high growth trend. In 2023, the export of complete vehicles reached 3.8 million units, a year-on-year increase of 60%, with new energy vehicles hitting 1 million, a 71% increase.

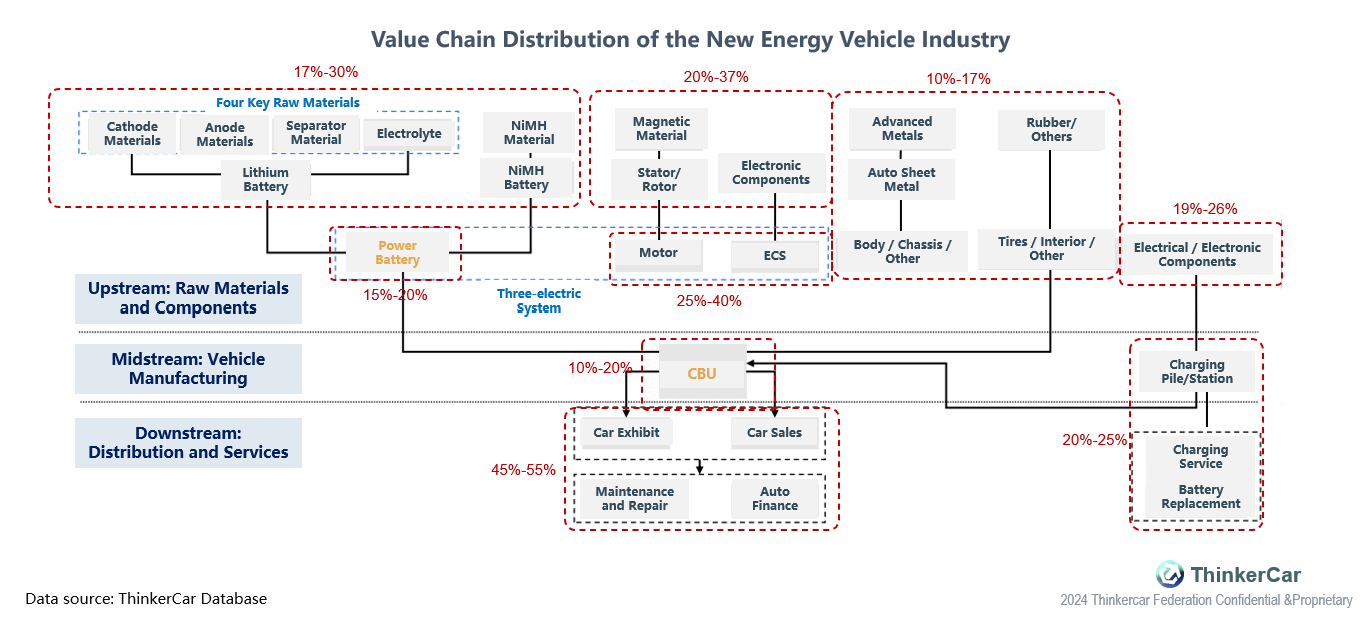

High-quality development leads to the reshaping of industrial chain ecosystems.

- The automotive industry once centered around OEMs, but in the past two years, industry profits have begun to disperse upstream and downstream.

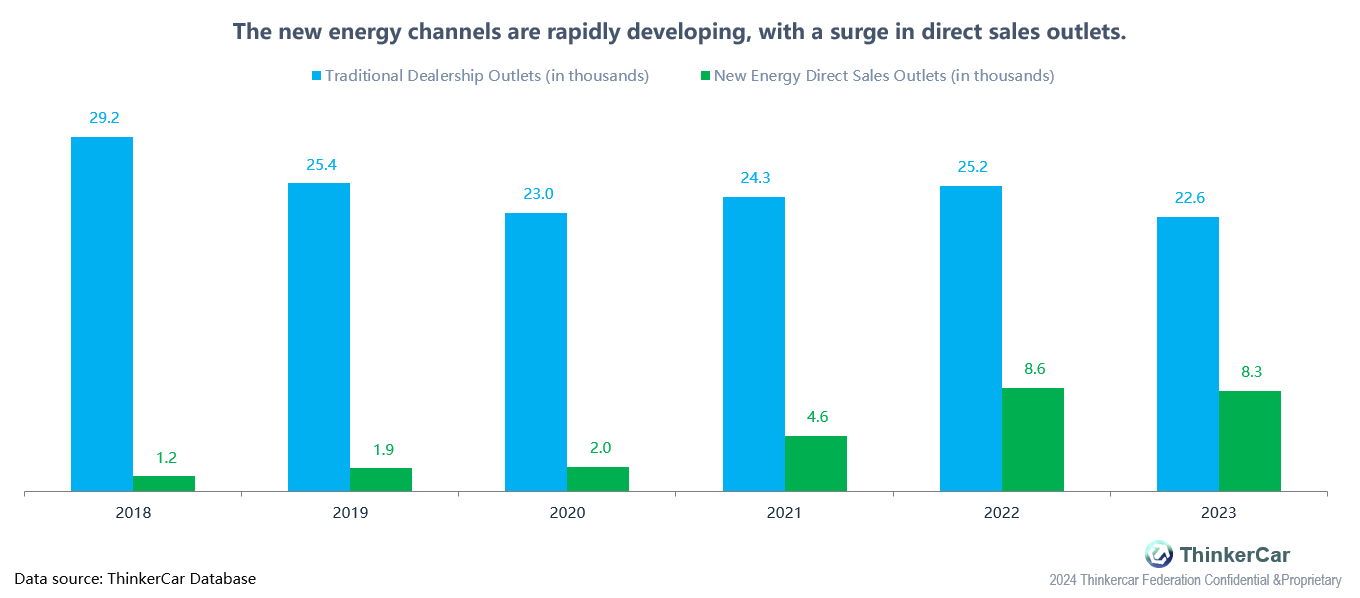

High-quality development leads to innovative exploration of channel models.

- The rise of direct sales models presents new opportunities for the automotive industry, transforming not only the sales channels but also contact points such as finance, maintenance, and software services in the aftermarket.

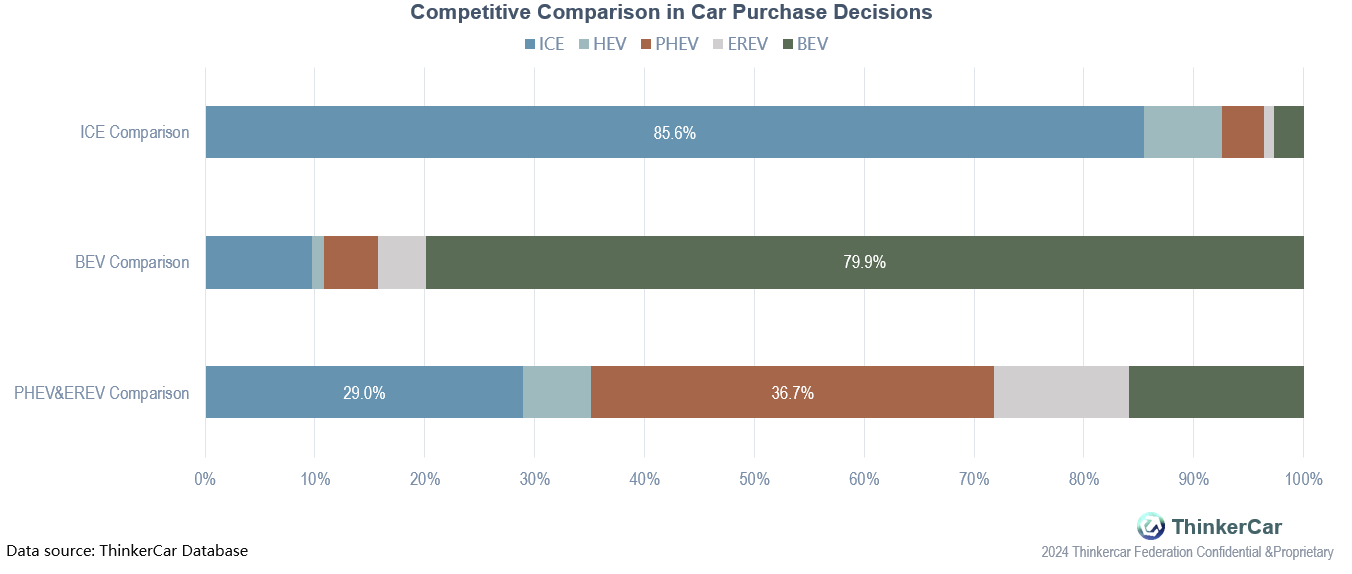

A more distinct segmentation in purchasing decisions has emerged.

- Nearly 90% of gasoline consumers make comparisons within the fuel vehicle market, creating an independent competition; approximately 80% of pure EV users compare among electric models, forming a separate competitive segment in the EV market.

- Plug-in hybrid & range extender users not only compare within their own vehicle types but also with gasoline vehicles, posing a threat to the fuel vehicle market.

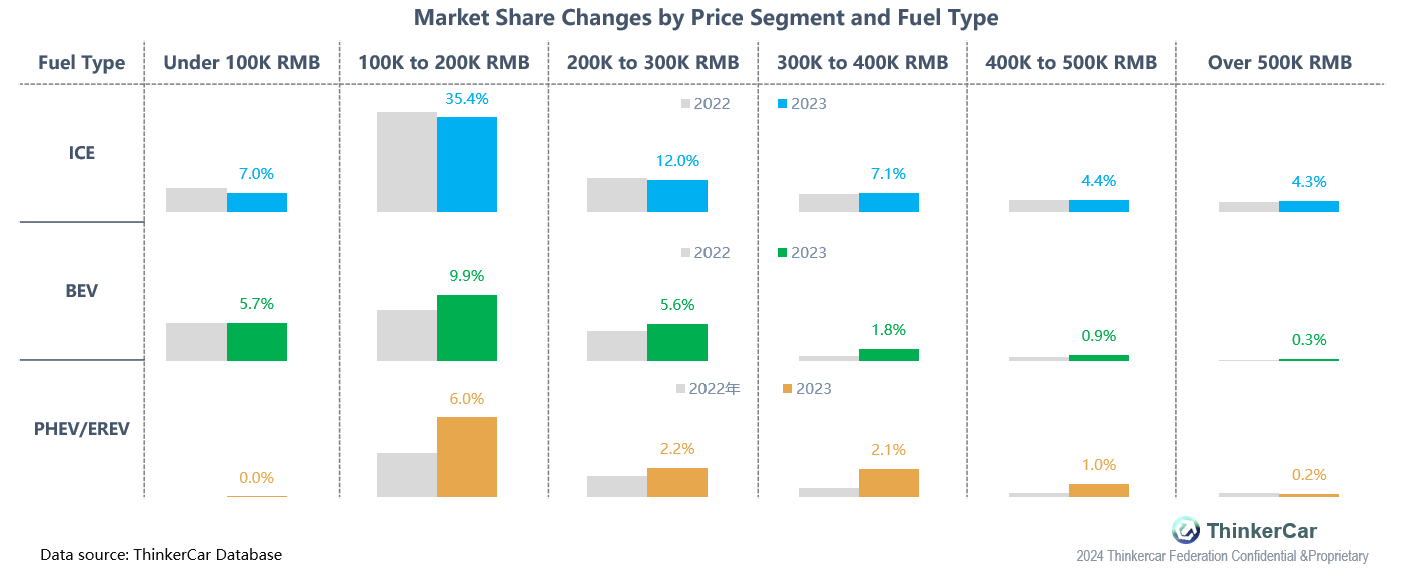

The market share of fuel vehicles in the 100K to 200K RMB price range has declined the most, gradually being encroached upon by new energy vehicles.

- In the fuel vehicle market, market shares have declined in price segments below 300K RMB, while shares remain stable above the 300K RMB price point.

- Pure electric vehicles have seen a market share increase in the 100K to 400K RMB price range, while plug-in hybrids/range extenders have maintained rapid growth in price segments above 100K RMB.

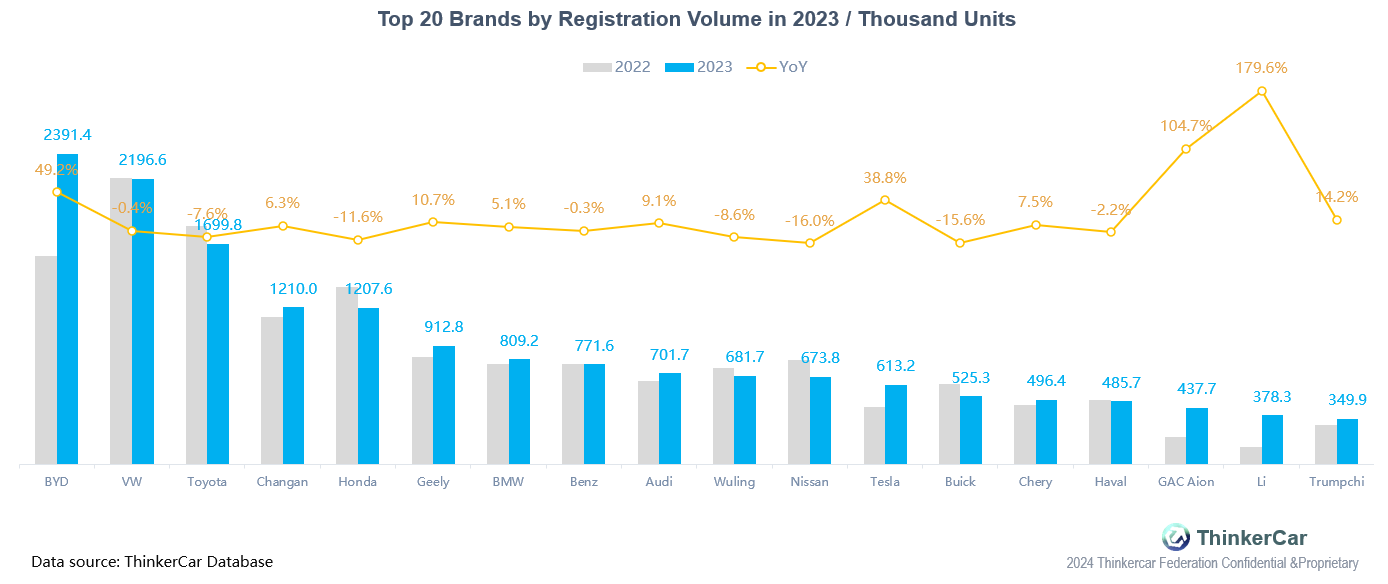

BYD surpassed VW and Toyota to become the sales champion of 2023.

- Benefiting from the explosive growth of the new energy market, BYD surpassed Toyota and VW, achieving the sales champion of 2023 with a growth rate of nearly 50%.

- Traditional market leaders such as VW, Toyota, Honda, Nissan, and others experienced a sales decline in 2023.

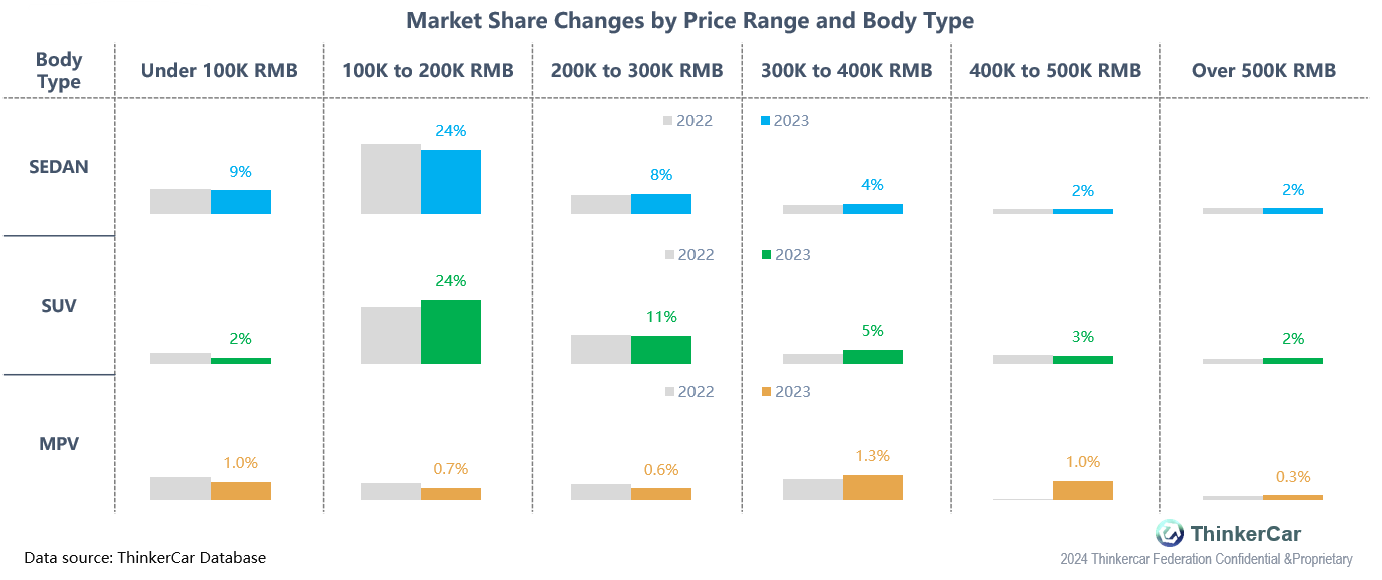

The SUV segment saw the largest growth in the 100K to 200K RMB price range, while the market share of sedans has gradually declined.

- In the sedan market, the under 200K RMB price segment experienced a significant reduction in market share, while the 200K to 400K RMB range saw some growth.

- In the SUV market, the market share in the 100K to 200K RMB price range is now on par with that of sedans, and the 300K to 400K RMB range has also seen some growth.

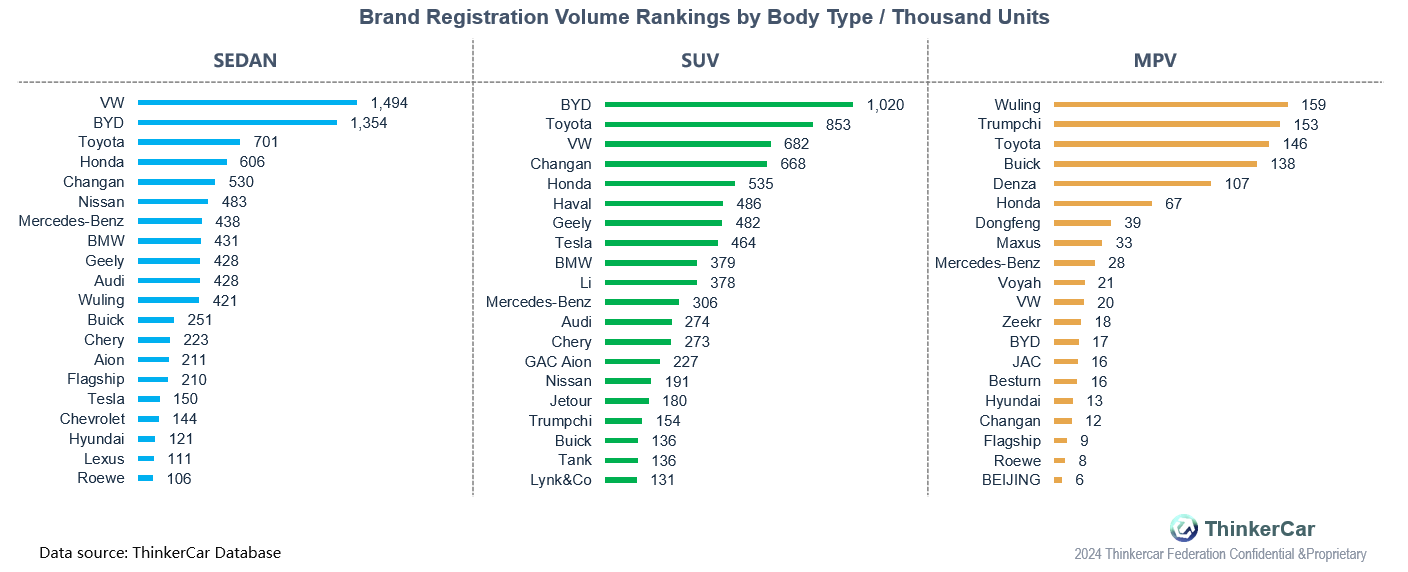

VW continues to lead the sedan market, while BYD dominates the top spot in the SUV market.

- In the sedan market, VW's sales reached 1.494 million units, followed closely by BYD, with Toyota falling far behind the first two.

- In the SUV market, BYD achieved sales of 1.02 million units, with Toyota ranking second and VW in third place.

- In the MPV market, Wuling, primarily with its Hongguang models in the budget segment, ranks first, followed by Trumpchi in second place.

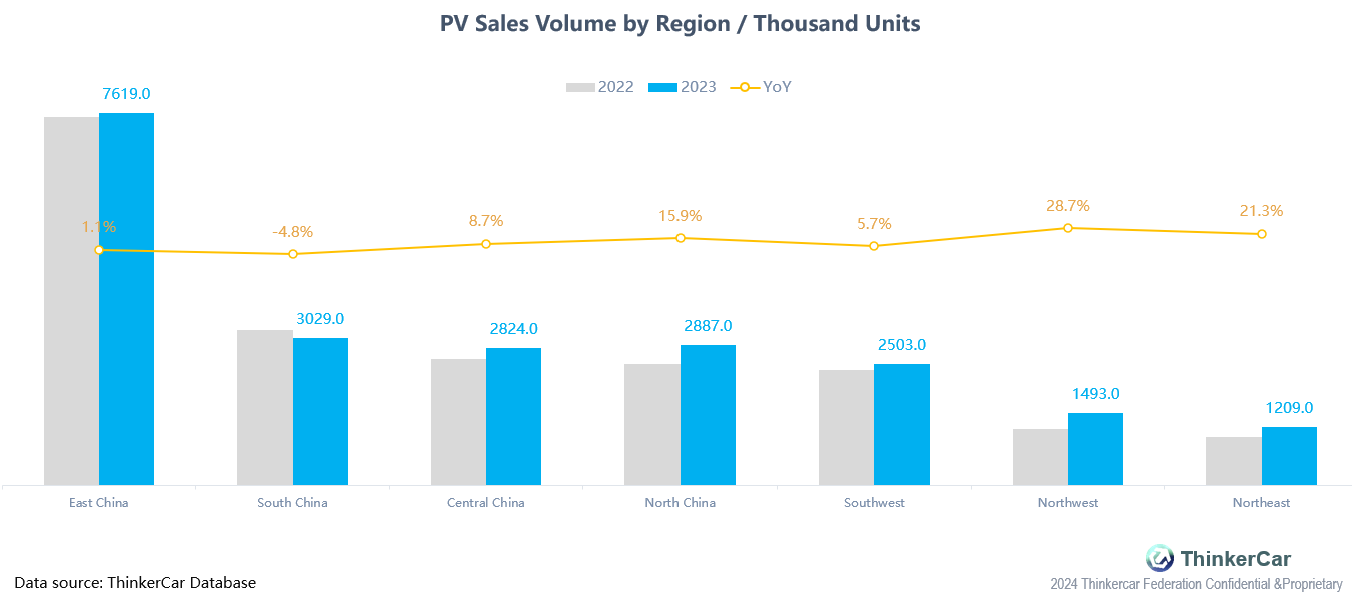

Sales in the East China region lead and continue to grow, while the Central and Northern regions have all seen an increase in sales.

- In 2023, except for a decline in sales in the South China region, all other regions experienced growth in sales, with the Northwest increasing by 29% and the Northeast by 21%, showing remarkable performance.

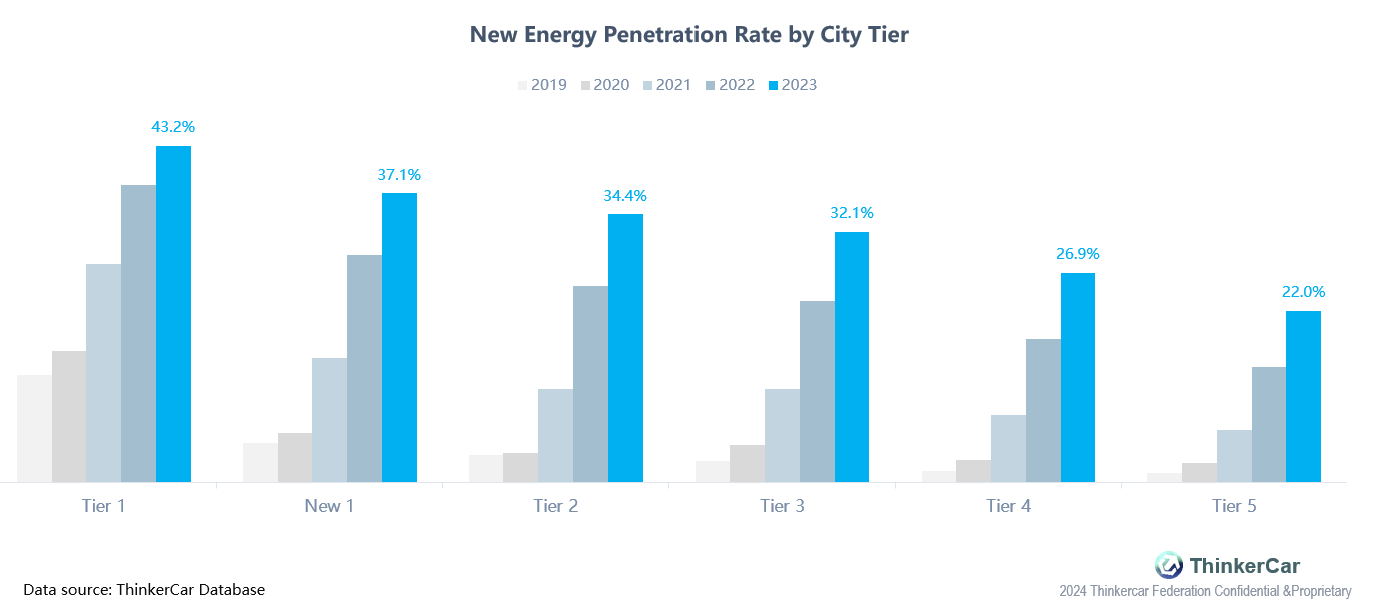

The penetration rate of new energy products has been increasing year by year, exceeding 40% in first-tier cities.

- The penetration rate of new energy products in first-tier cities reaches as high as 43%, with the rate in new first-tier cities also surpassing 35%.

- The penetration rate in second and third-tier cities has seen a substantial increase of up to 9%.

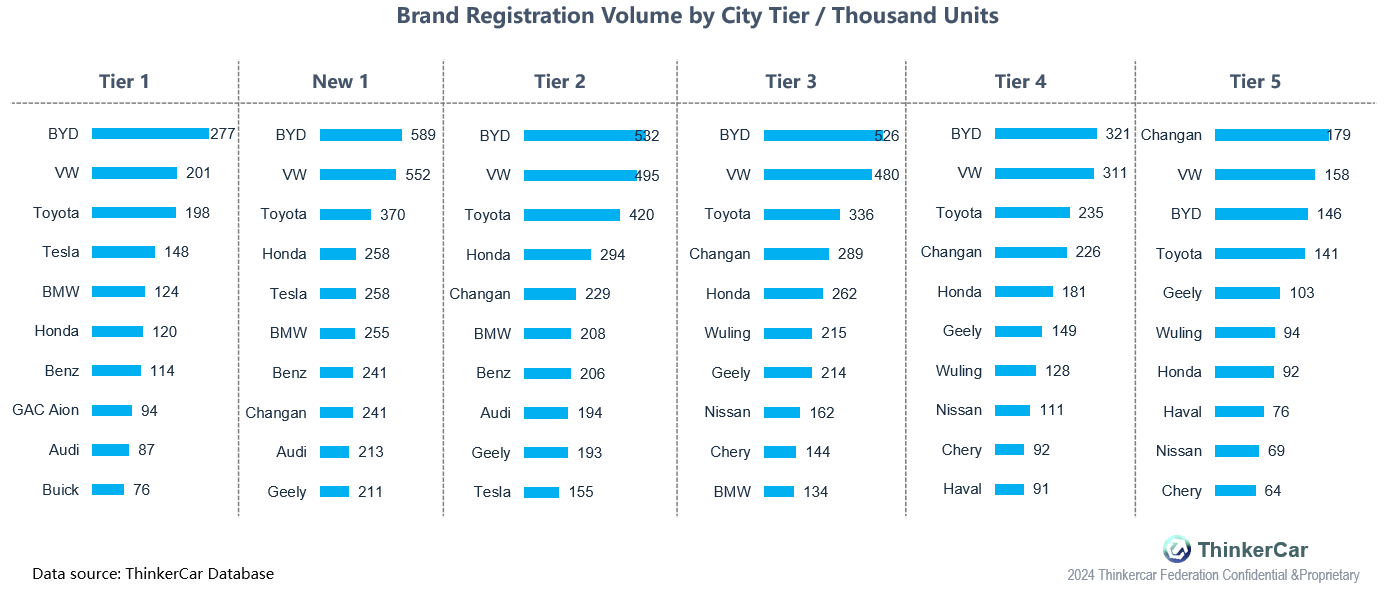

BYD leads its competitors across first to fourth-tier cities, while Tesla's customer base is concentrated in first-tier and new first-tier cities.

- Across first- to fourth-tier cities, BYD has, for the first time, overtaken VW to claim the top spot, with VW and Toyota following in second position.

- Tesla's sales are concentrated in first-tier and new first-tier cities.