Insights and Forecasts for the Plug-in Vehicle Market

in China in 2023

Plug-in hybrids lead the acceleration over other markets, with the trend of replacing conventional energy continuing to gain momentum.

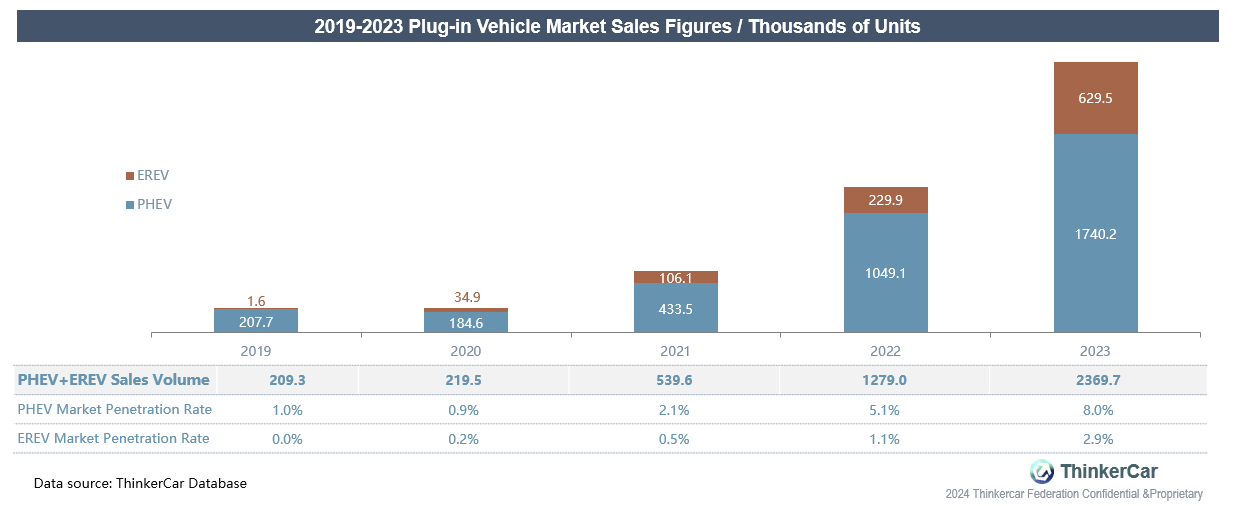

In contrast to the stable expansion of the pure EV sector, plug-in hybrid vehicles have risen as an unexpected contender. In 2023, the segment recorded cumulative sales of 2.369 million units, realizing an impressive YOY surge of 85.3% in growth rate, with a market penetration of 10.9%, thus spearheading the industry's growth.

Reviewing the annual sales performance, following the surge in the EV market in 2020, the plug-in hybrid market was subsequently ignited. It is currently in a period of product abundance and is experiencing rapid growth.

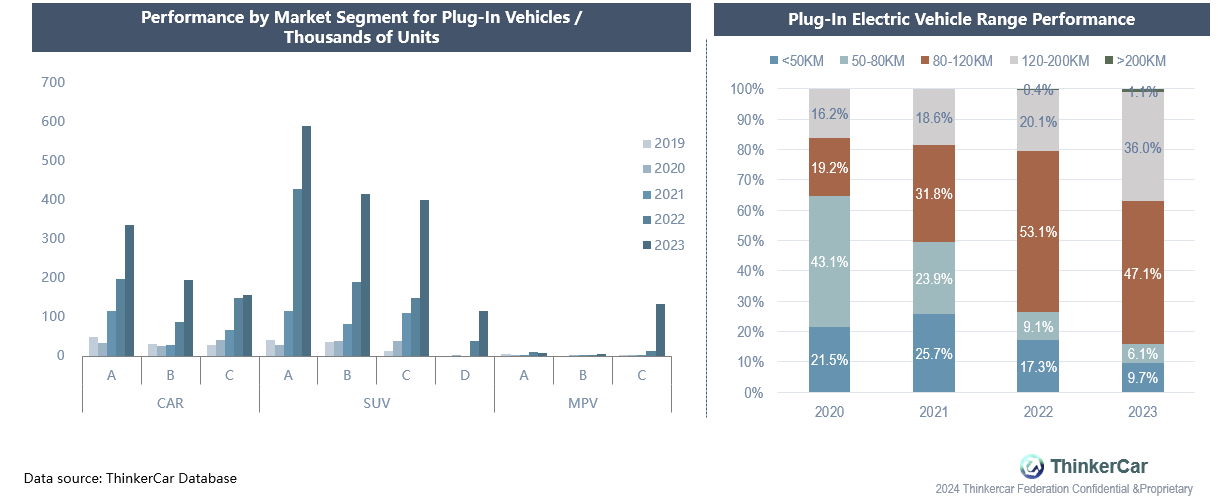

The plug-in vehicle market has experienced substantial transformation following years of swift advancement.

- Despite the stellar performance of the plug-in vehicle market, there is a significant internal disparity within the sector.

- Salient features of the plug-in market include: (1) SUVs outperform sedans; (2) Entry-level segments face constraints, lacking market entries; (3) High-tier sedans show diminishing annual performance, unlike SUVs which improve with higher tiers; (4) EV ranges are growing, with around 100 km becoming standard, though longer ranges fare better.

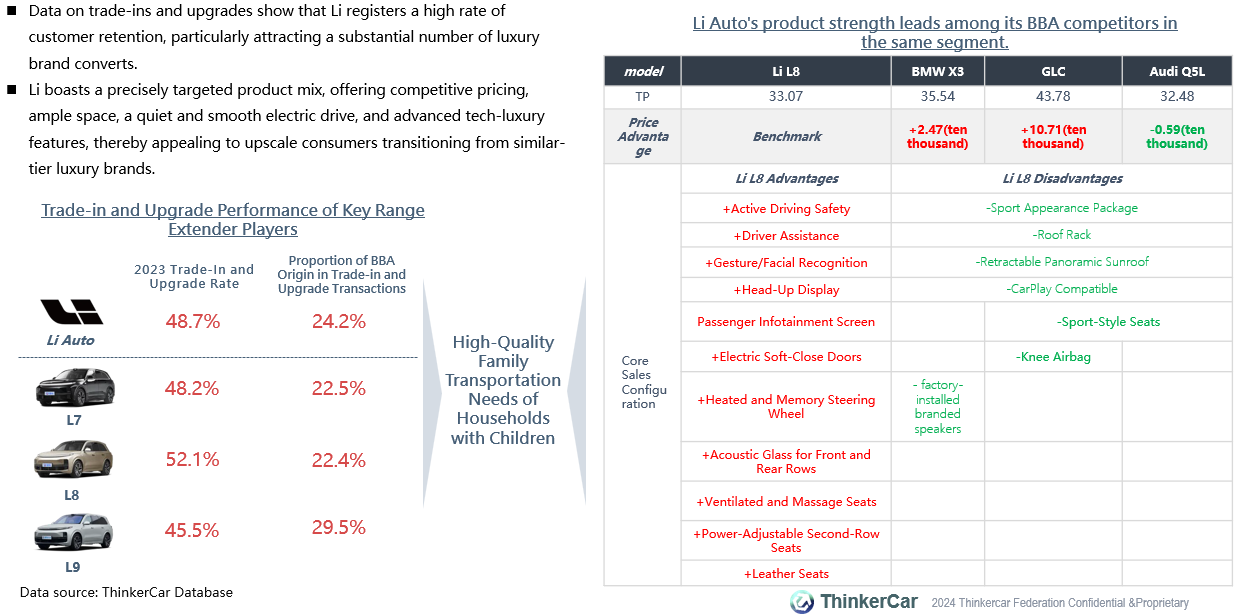

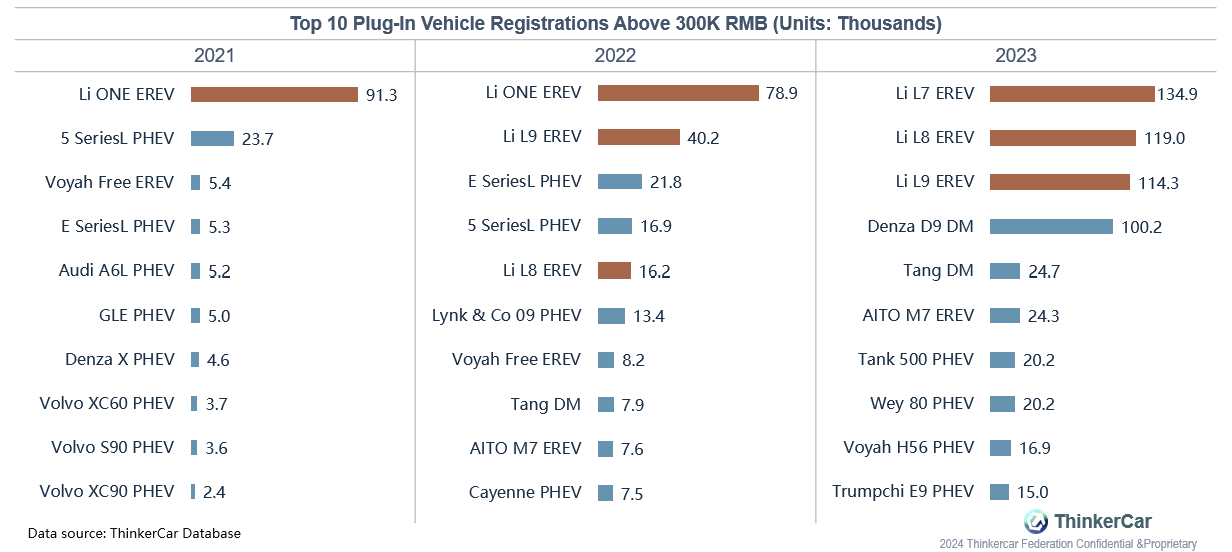

The EREV market is invigorated by Li Auto, which, with its exceptional cost-performance ratio, precisely captures market share from BBA incumbents.

Post-launch, Li Auto continues to dominate the plug-in hybrid market in the 300K RMB and above price segment.

- Data indicates that the launch of Li Auto's extended-range vehicles has broken the monopoly held by BBA in the market segment above 300,000 RMB, with their L series emerging as a blockbuster product.

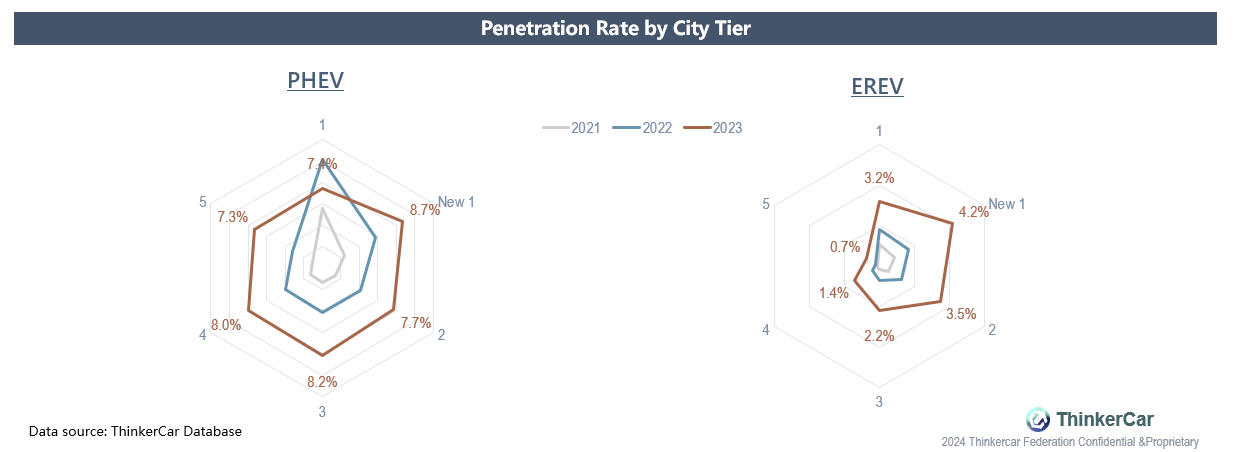

The plug-in vehicle market adheres to a tiered city penetration model, with PHEVs' tendency towards gasoline power contributing to their swift penetration into lower-tier markets.

- The plug-in vehicle market exhibits a structured penetration across urban tiers, with first- and second-tier cities serving as the primary engine for growth and channeling development momentum to third- and fourth-tier cities.

- Examining PHEV and EREV trends, PHEVs are penetrating rapidly across all city tiers, with little difference in penetration rates, as some users in lower-tier cities view PHEVs akin to gasoline vehicles. EREVs, facing higher mainstream product prices and increased reliance on charging infrastructure for their extended range, are primarily gaining ground in higher-tier cities.

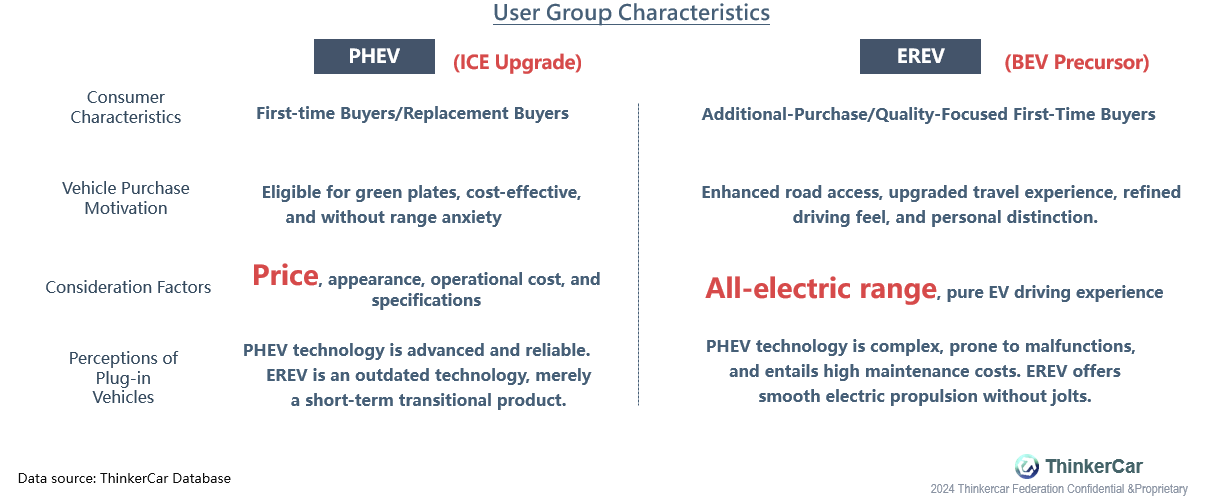

Mainstream consumer attention varies significantly.

- The purchasing considerations of mainstream PHEV and EREV consumers differ. PHEV buyers lean more towards the characteristics of conventional vehicles, with a keen pursuit of cost-effectiveness and a desire for distinctive new-energy features in their cars; EREV buyers, on the other hand, tend to be additional purchasers who experience some range anxiety but prefer the smooth driving dynamics and robust power of all-electric vehicles, thus their focus is more aligned with pure EVs.

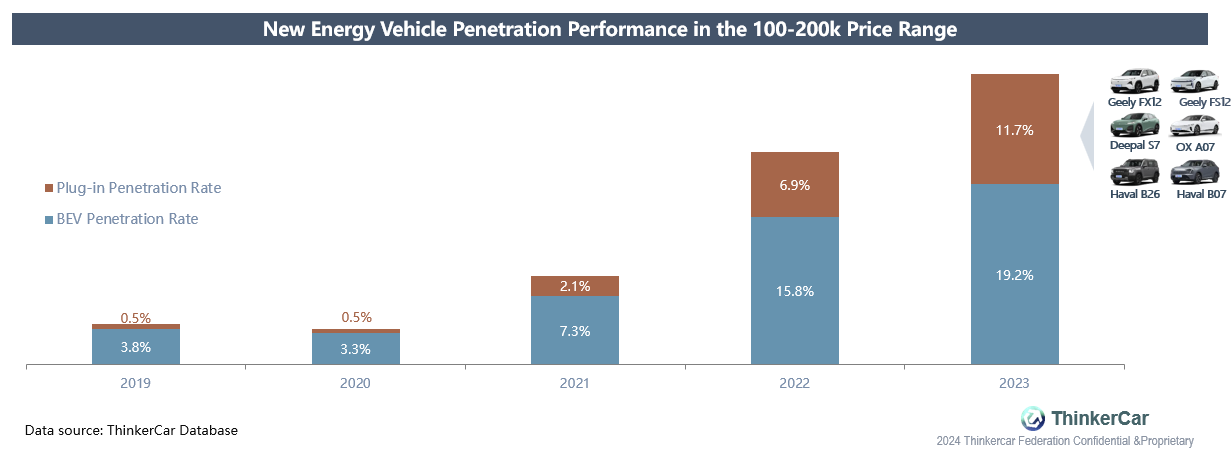

Short-term forecasts show the 100-200k plug-in segment outpacing pure EVs, with sustained growth into 2024.

- Beginning in H2 2023, numerous automakers will roll out plug-ins within the 100-200k bracket. Balancing cost and consumer appeal, plug-ins are poised for a competitive edge in this price segment in the near to mid-term.

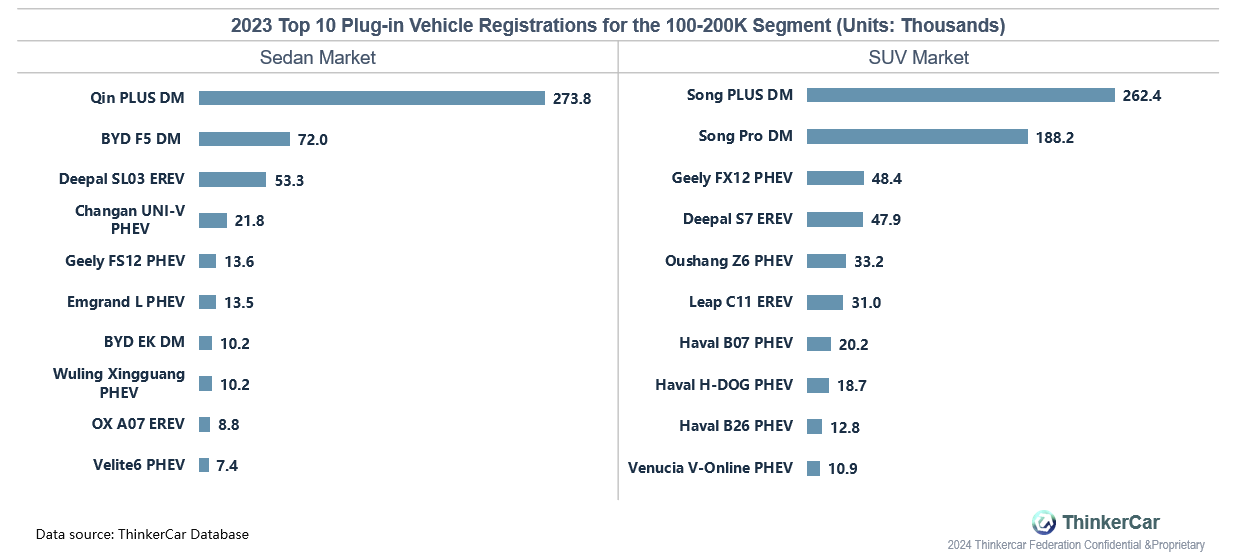

- The current plug-in market in the 100-200k bracket has evolved into a 'one leader, multiple strong contenders' competitive landscape, with mainstream players like BYD, Geely, and Changan, traditional automakers expected to dominate in 2024. Additionally, the steady flow of new models from other enterprises will further fuel continuous high growth in this price range.

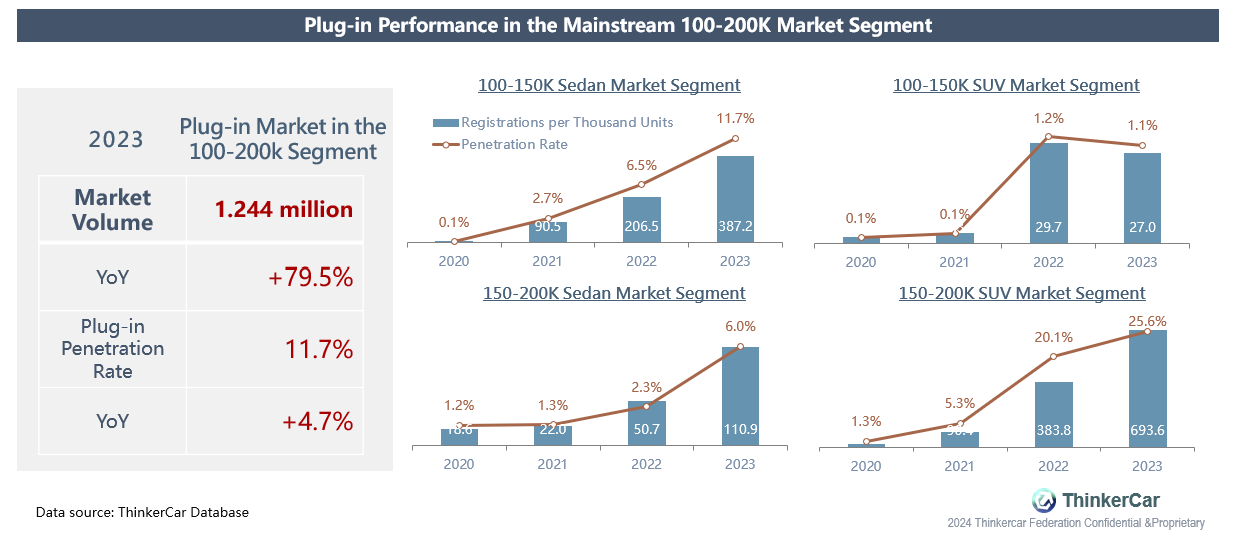

The plug-in market shows a distinct advantage in the 100-150k sedan segment and the 150-200k SUV segment.

- The 100-200k price range dominates the plug-in market with over half the share, chiefly driven by 100-150k sedans and 150-200k SUVs accounting for nearly 90% of sales. Plug-in vehicle penetration is on a swift rise, rapidly displacing fuel vehicles.

BYD dominates the 100-200K price segment in the plug-in market.

- The 100-200K price range is BYD's stronghold in the plug-in market, with models like Qin Plus DM, Destroyer 05 DM, and Song Plus DM and Song Pro DM leading their respective segments.

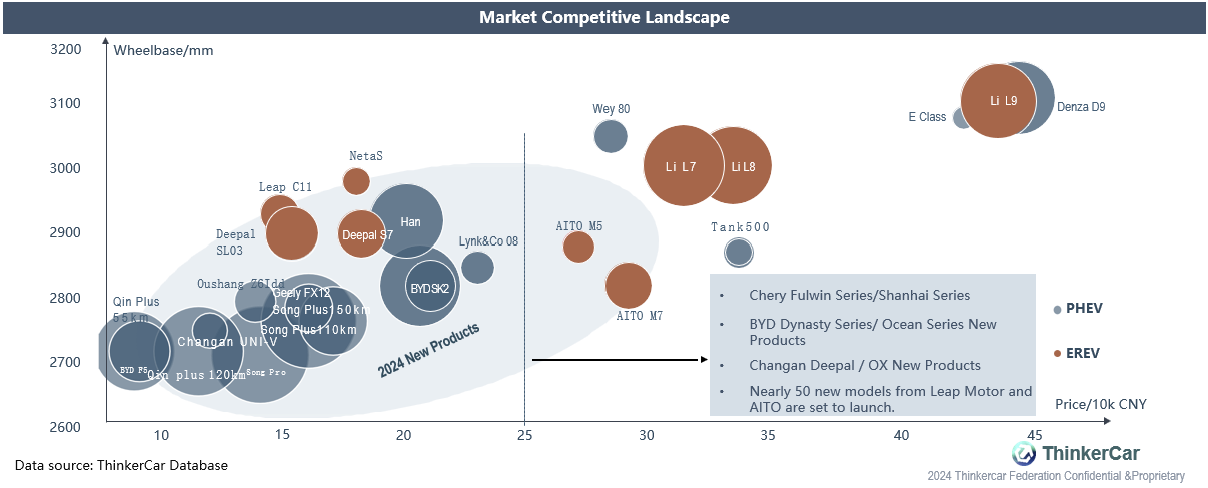

Recognizing the plug-in market's vast potential, 2024 is set to see a significant influx of products from a myriad of companies.

- Currently, the plug-in market is chiefly concentrated in the 100-250K price range, with BYD products setting the competitive benchmark in the PHEV sector, notably within the mainstream Class-A segment which is rapidly refreshing its lineup. Extended-range models, predominantly from the Deepal series, are engaged in direct competition with PHEVs.

- In the market above 250K, range-extender products prevail, with AITO's updated lineup challenging Li Auto's predominant position. Nearly 50 new models are set to enter the market in 2024, likely fueling rapid market growth.

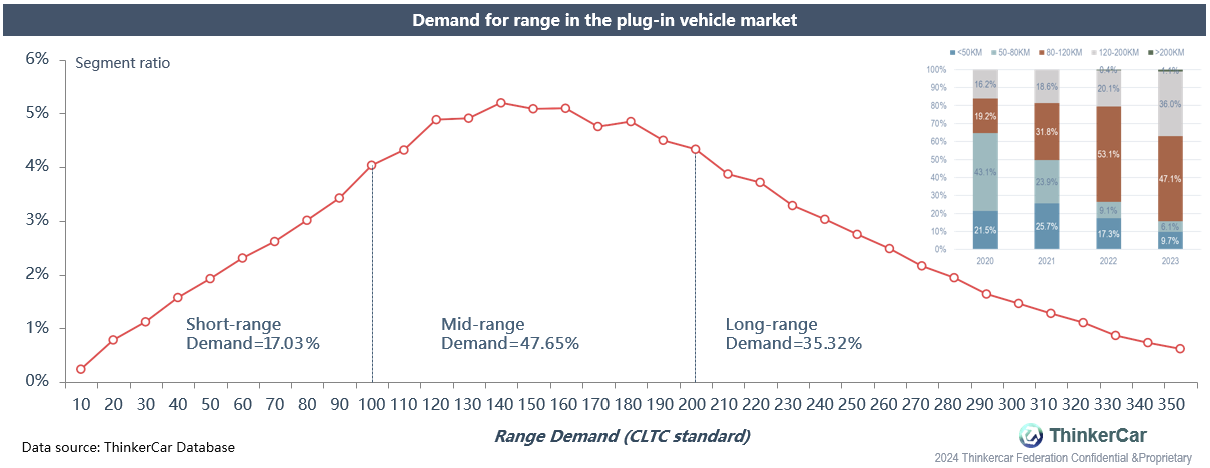

Demand for enhanced electric-only range in plug-ins is escalating, with PHEVs set to parallel the extensive range of BEVs in the future.

- From 2021 to 2023, plug-in vehicles with 100-120km ranges lead the market, catering to most household needs. Ranges of 150-200km have risen sharply with new entrants like Li Auto, AITO, and Deepal S7. Later in 2023, PHEVs such as Lynk&Co 08 and Tang Champion Edition surpassed 200km, reaching parity with the longest-range vehicles.

- Data research has revealed that if a product's pure electric range is rated at CLTC 100 kilometers, it would only meet the needs of 17% of users. If rated at CLTC 200 kilometers, it could satisfy 65% of users, and a rating of CLTC 231 kilometers would meet the needs of 80% of users.