2024 Battery Electric Vehicle Market in China Report

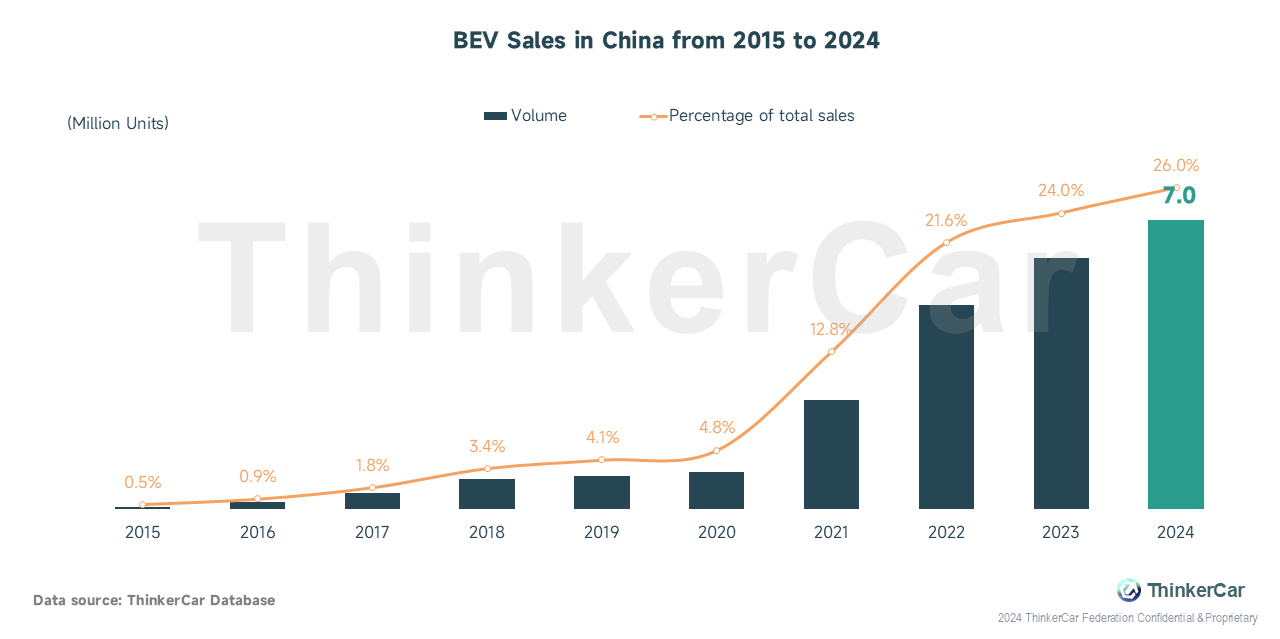

In 2024, China's BEV sales hit 7.05 million units, growing 15.1% YoY and representing 26% of the total passenger vehicle market

In 2024, China exported 859.3k units of BEVs, marking a decline of 10.3% for the first time. The export volume accounted for 22.4% of total sales, which is a decrease of 4.8 pct compared to 2023

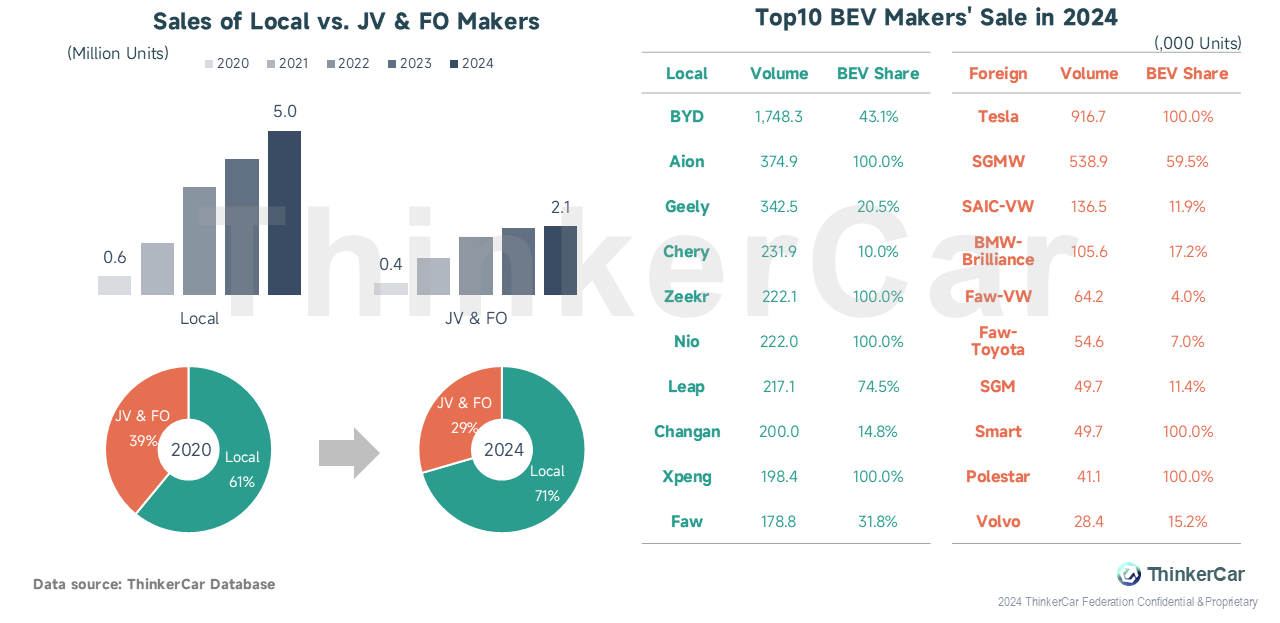

The market share of local makers increased from 61% in 2020 to 71% in 2024, while the share of JV & FO makers dropped to 29%. New car maker startups, represented by NIO, Zeekr, and XPeng, have demonstrated strong momentum in the BEV market

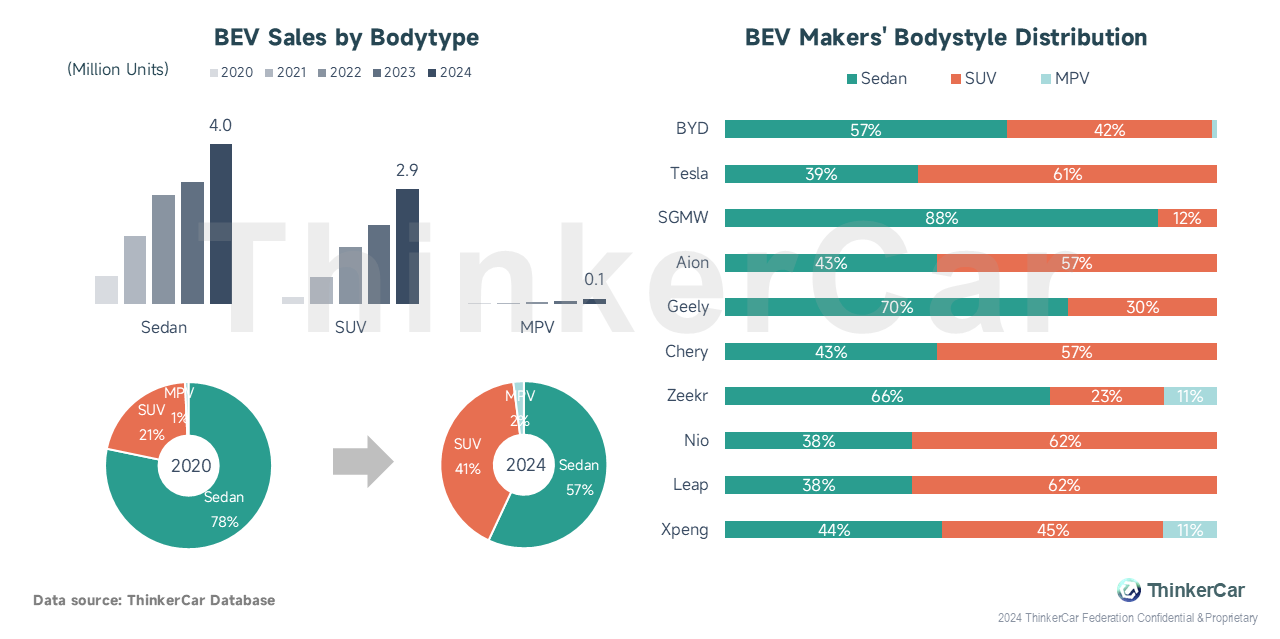

In the BEV market, sedans still dominate, but the share of SUVs has now reached 41%. As makers gradually focus on the MPV sector, the MPV market shows significant potential for growth

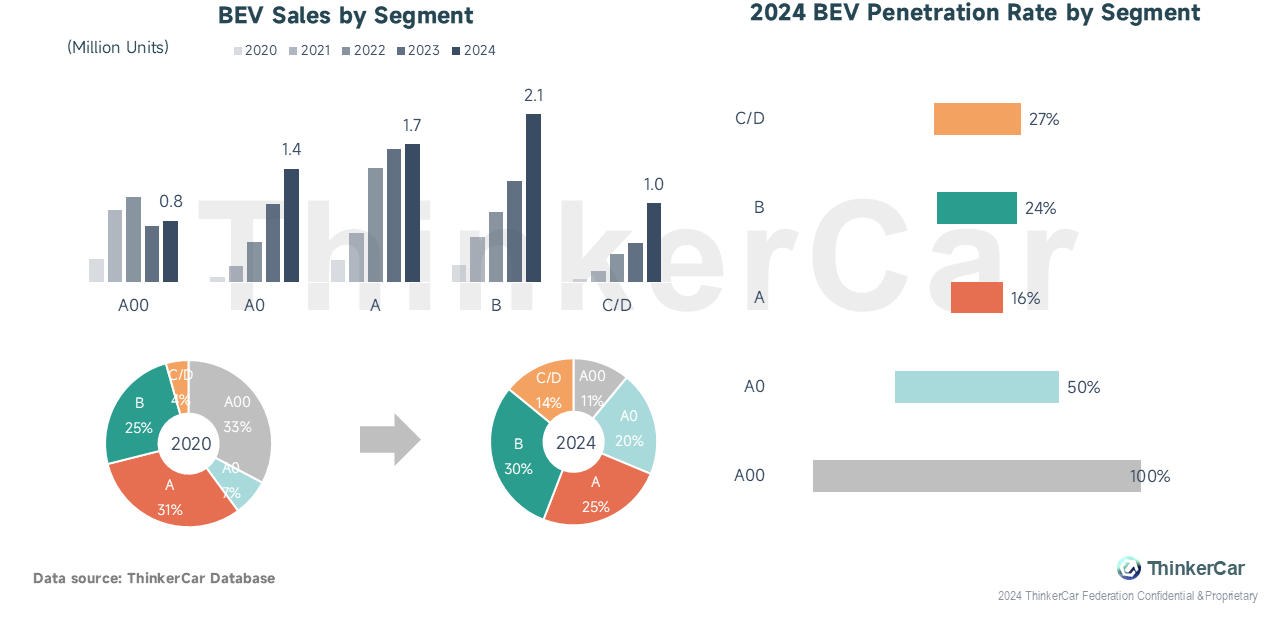

By 2024, B-segment and above BEVs reached 44% market share. A00-segment went fully electric, A0-segment 50% BEV, and B+ segments over 20% BEV. This suggests significant growth potential in larger BEV segments

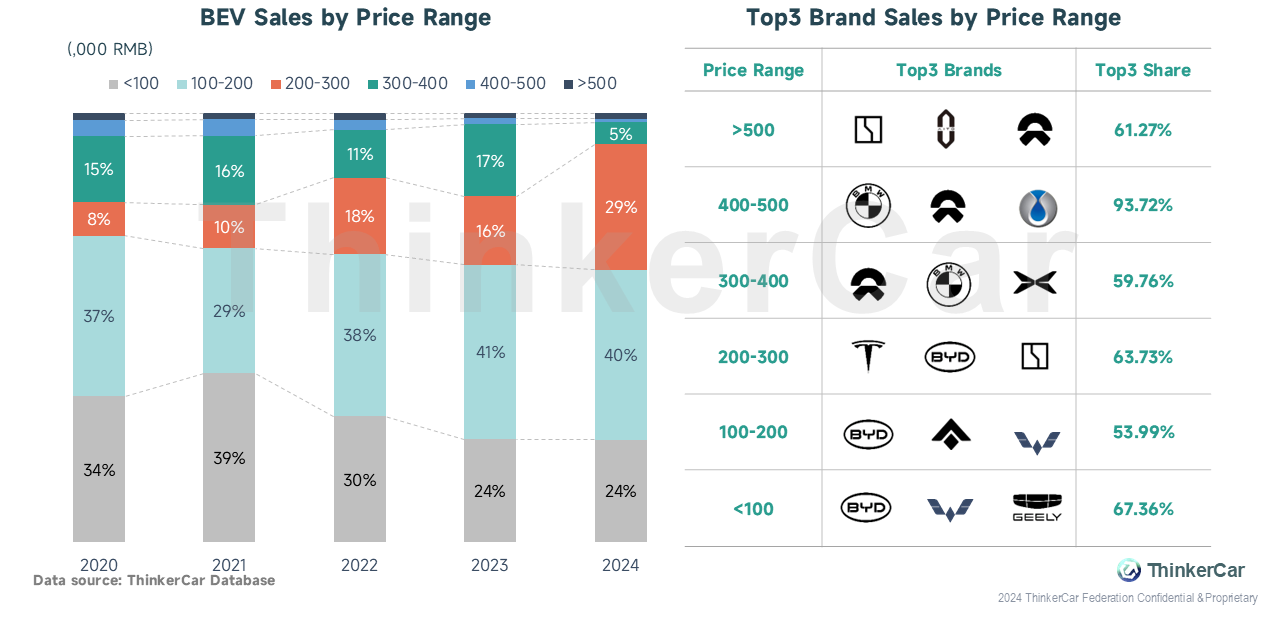

The market share of BEVs priced below 100k yuan is gradually declining, while the share of the 100k-200k yuan and 200k-300k yuan segments is rapidly increasing. In contrast, the market for BEVs priced above 300k yuan is growing slowly.

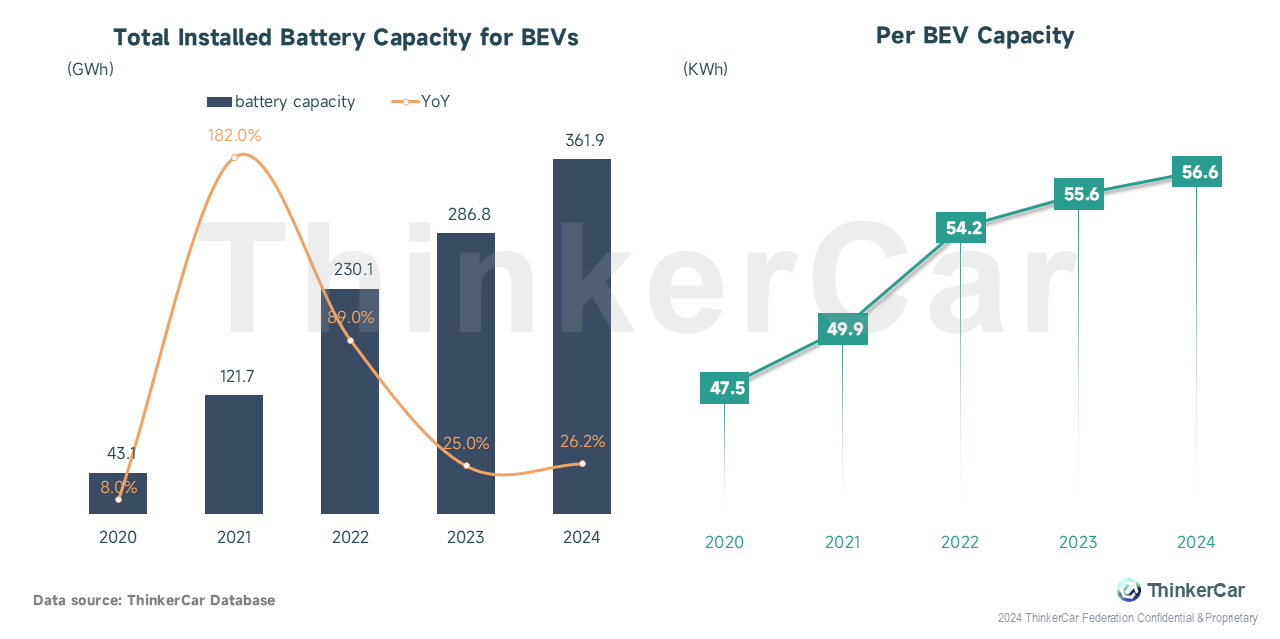

BEV battery demand continues rapid growth, reaching 361.9 GWh in 2024, up 26.2% YoY. However, growth in battery capacity per vehicle has entered a stable phase.

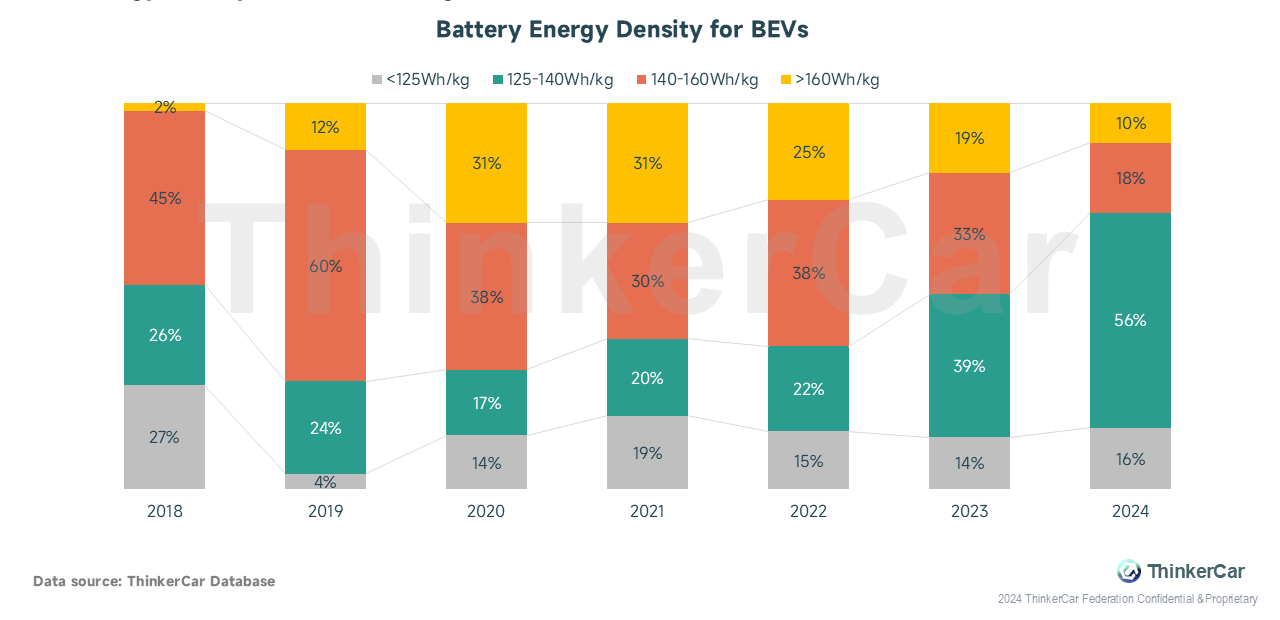

Currently, the battery energy density range for BEVs is concentrated between 125 to 160 Wh/kg. The increasing demand for low-cost LFP batteries has led to a significant decline in batteries with energy density above 160 Wh/kg