Analysis and outlook of the low-end BEV market in 2021

The low-end market will increase in volume in 2021 and its growth rate will slow in 2022.

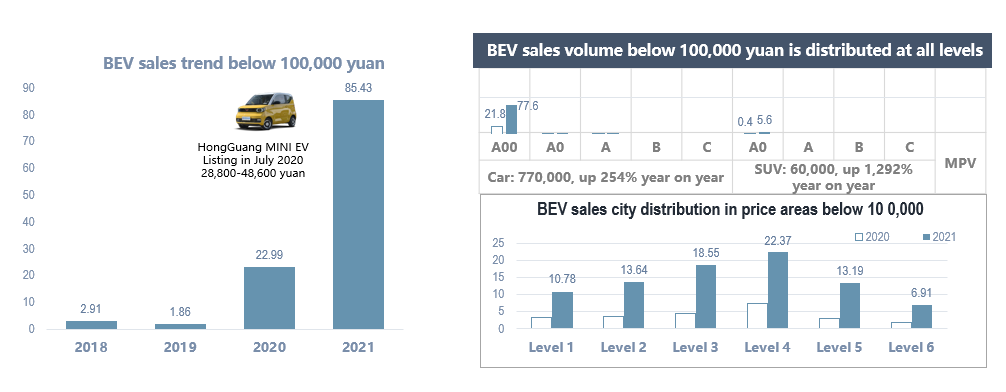

The sales volume in the price area below 100,000 yuan increased rapidly and the sales volume exceeded 800,000 units in 2021.

The sales volume is concentrated in the A00 class market within 50,000 yuan, but with the launch of new models, it will penetrate into the price area of 70,000-90,000 yuan in the future.

In 2022, the market capacity of the price area below 100,000 yuan will be 1 million-1.1 million yuan.

A00 cars drive the low-end market to increase the sales volume rapidly.

In recent years, the sales volume of the price area below 100,000 yuan has grown rapidly, in 2021 the sales volume will exceed 800,000 units, mainly for A00 class cars.

- Users in the price area below 100,000 yuan are the most sensitive to the price and use cost. HongGuang MINI EV enters the market at a low price and quickly becomes a burst, driving the market sales to soar.

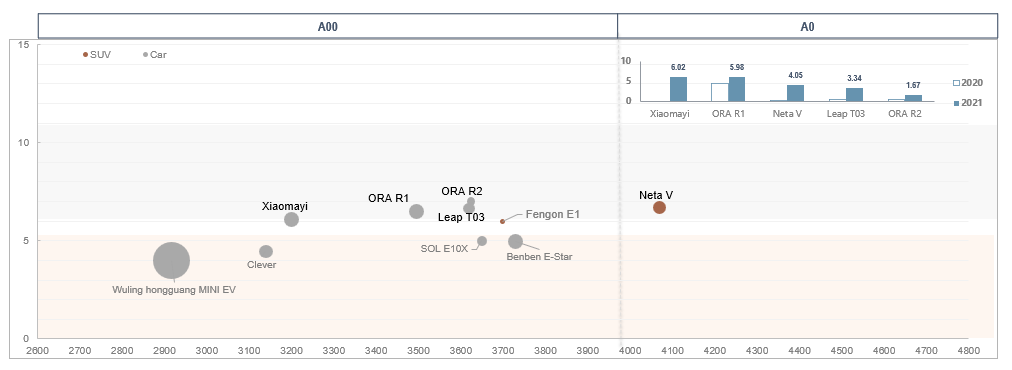

- In 2021, BEV's sales volume in the price area below 100,000 yuan are highly concentrated in A00 class cars, while the A0 class market has not yet increased.

- Non-restricted cities are the main marketing markets of low-end BEV, which are relatively little promoted by policies such as purchase restrictions.

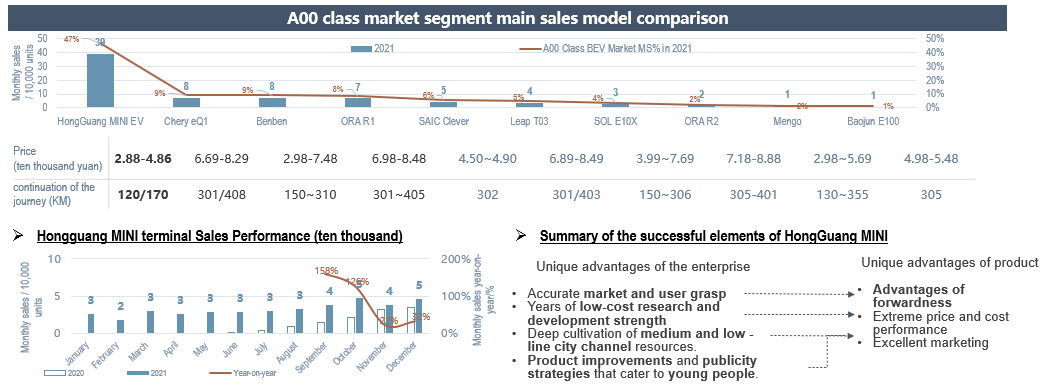

HongGuang MINI EV develops the A00-level market with a low price.

As a pioneer of the A00-level market segment, HongGuang MINI EV has absorbed many short-distance transportation users with the lowest price and the extreme cost performance.

- In the first 11 months of 2021,344,000 products were sold out, with a monthly average of 31,000 units. The market performance was stable and positive. It is the supply side driving the market demand and has become a phenomenon product.

- In the BEV market segment with an entry price below 50,000 yuan, Hongguang MINI occupies 68% of the market share and is the absolute dominant.

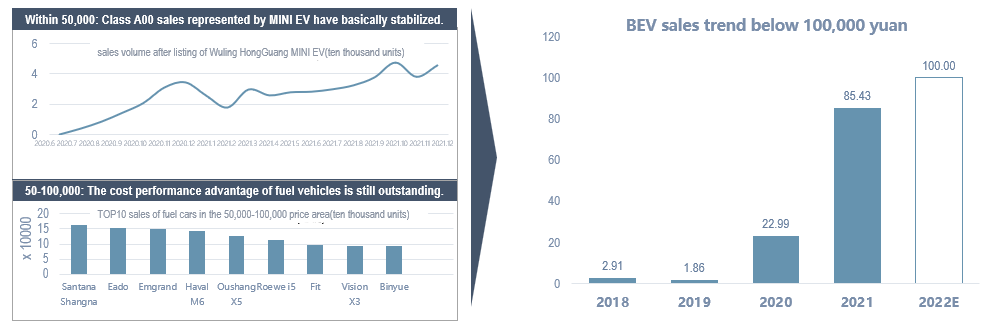

Sales focus on within 50,000, the future will penetrate to 70,000-90,000 yuan.

At present, the sales volume is concentrated in the A00 class market within 50,000 yuan, but with the launch of new models, it will penetrate into the price area of 70,000-90,000 yuan in the future.

- Within 50,000 yuan, mainly A00 class cars and the penetration rate of this class has been close to 100%.

- In the 50,000-100,000 price area, there have been no popular models, but some potential models with rapid sales growth have emerged, which will become an important incremental market in 2022.

Sales growth slowed in 2022, with a market size of 1 million-1.1 million.

The market of less than 50,000 yuan is stabilizing, and the market competition is fierce between 50,000 and 100,000,000 yuan. It is expected that the market capacity of the price area below 100,000 yuan is 1-1.1 million yuan in 2022.

- In the price area of below 50,000 yuan, the star model Hongguang MINI EV has gone through a complete sales cycle, and the sales volume has basically stabilized, and the sales growth rate will slow down significantly in the future.

- In the 50,000-100,000,000 price area, although some potential models have emerged, the fuel vehicles in the price area are significant, while the users in the low price area are highly sensitive to the cost performance, and the future sales growth is limited.