Analysis and outlook of the mainstream BEV market in 2021

In 2021, the mainstream market has not yet been large volume and the future market potential is huge.

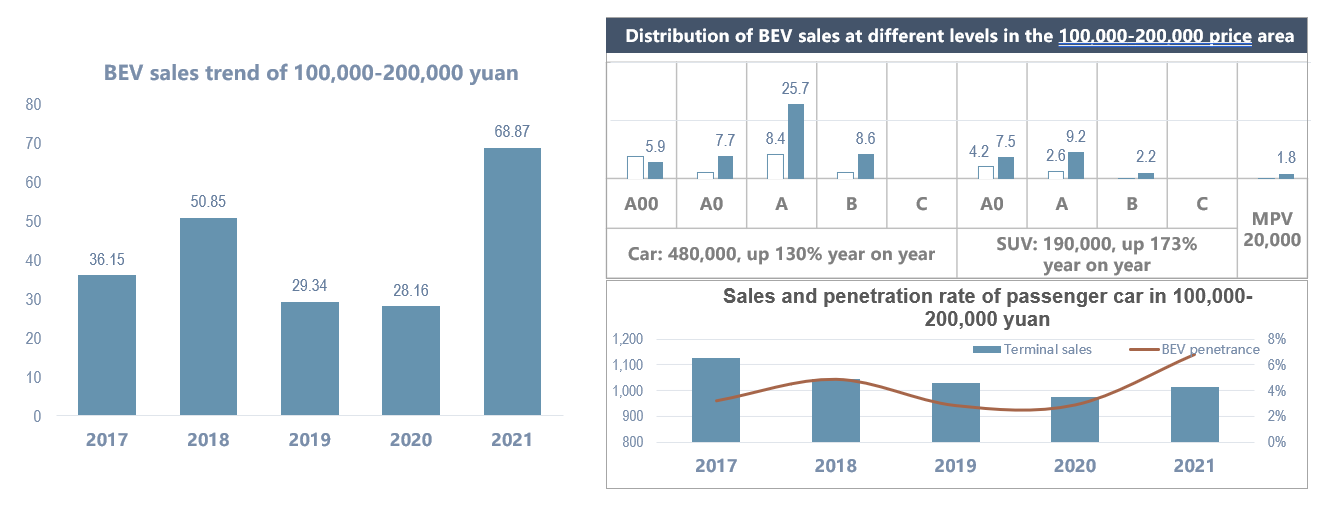

The 100,000-200,000 price area, mainly in the A-level market, is the market with the largest market capacity.

Existing models have not yet appeared popular models, urgently need star models to lead the sales growth.

Sales are expected to double in 2022, with a market size of 1.1 million-1.3 million.

BEV penetration rate is low, and the future market potential is huge.

The 100,000-200,000 yuan is the mainstream price area of China's passenger car market, but the BEV in this price area has not yet been increased, which is an important potential market.

- In 2021, the sales volume of 100,000-200,000 yuan BEVs was nearly 700,000, focusing on the A-class market.

- The 100,000-200,000 price area is the mainstream price area of passenger car sales in China. The sales volume reaches 10 million units, but the penetration rate of BEV is only 6%, with huge potential in the future.

There are no blockbuster models yet and star models are badly needed to lead sales growth.

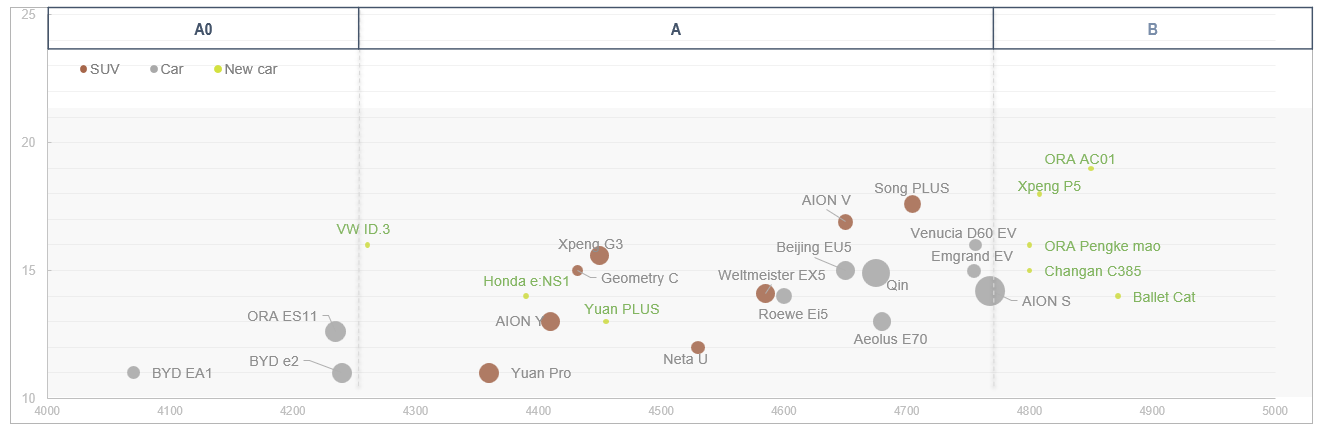

The sales volume of the 100,000-200,000 price area is focused on the A-class market, but the existing models have not yet appeared popular models and star models are urgently needed to lead the sales growth.

- Traditional independent brands: Has achieved initial market results, is exploring the way to burst sales, such as BYD, Aion, ORA, etc.

- Traditional joint venture brands: As an important main body of the traditional fuel price area, it has released electric strategies to accelerate the strategic transformation, such as: Volkswagen, Honda, etc.

- New power brand: After consolidating the existing price area, the price area drops to 150,000-200,000 yuan, such as: Xpeng P5, Nio Gemini, etc.

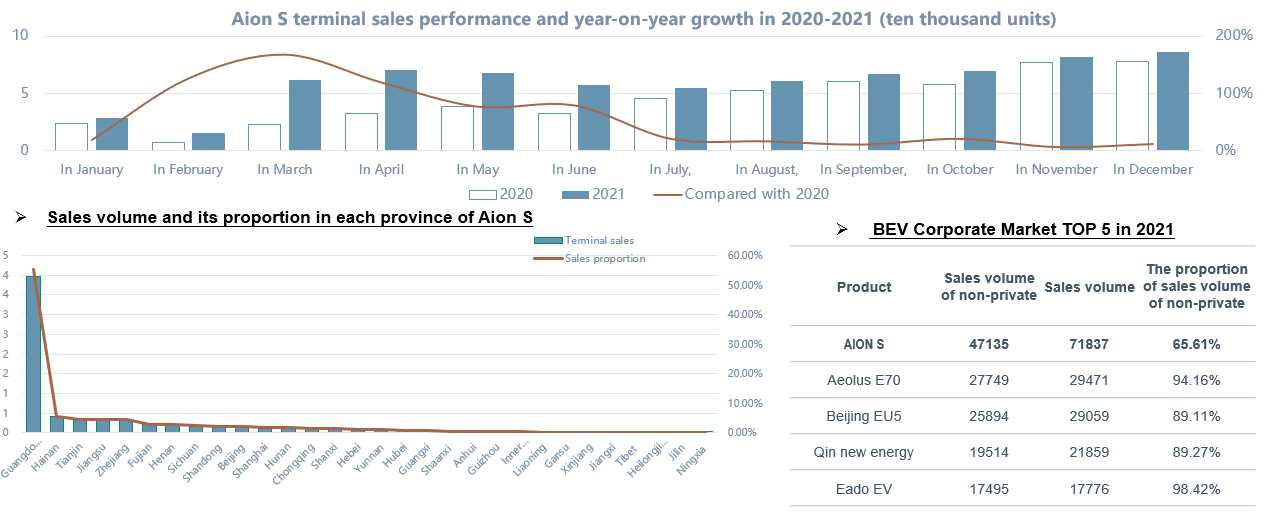

Whether the private market can be opened up is the key to the subsequent development of Aion S.

Local industry support, opening up to the public market, has a strong regional nature, whether it can open the private market is the key to its subsequent development.

- In 2021, the cumulative sales volume was 72,000, with a monthly average of 5,986 units and 100,000 to 200,000 BEV MS% was 10.4%.

- In 2021, Guangdong province accounted for 55.3% and the public share reached 65.6%.

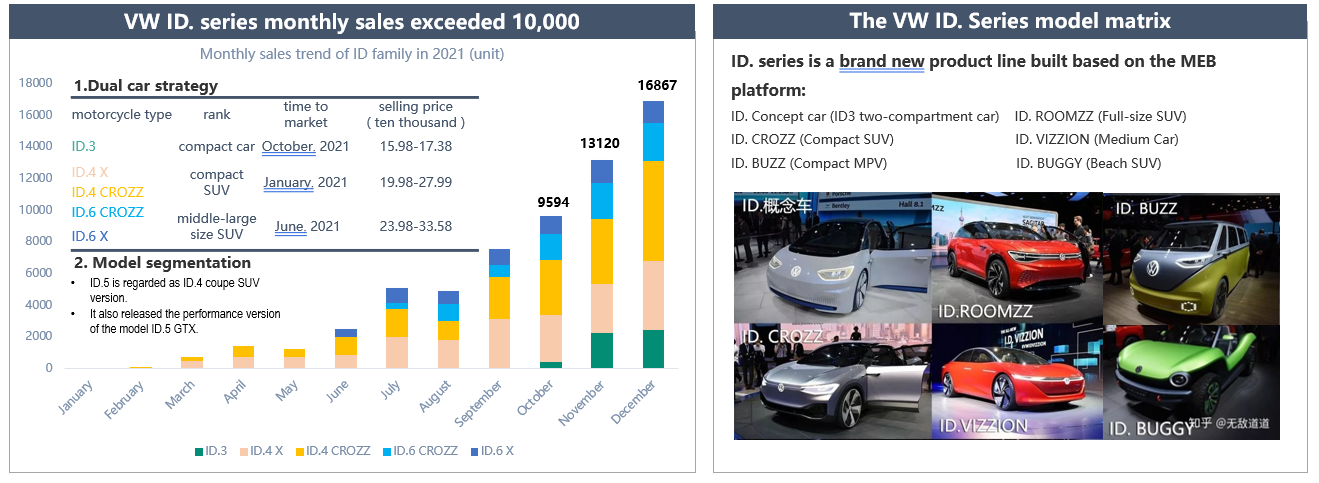

Volkswagen and other ordinary brands accelerate the transformation or will emerge star models.

Volkswagen has always been a leading brand in the Chinese market, but its electrification transformation is relatively backward and Volkswagen will accelerate its launch of ID. series in 2021. The monthly sales of more than ten thousand.

- The VW Group said it will invest 89 billion euros in the next five years in new technologies, such as electric vehicles and digitization and lessen the gap with Tesla.

- A quarter of VW's new cars sold are expected to be battery-driven by 2026 and it plans to become the global electric vehicle market leader by 2025.

- In 2021, the monthly sales volume of Volkswagen ID. series has exceeded 10,000. In the future, with the introduction of more models and the promotion of the dual-car strategy and model segmentation strategy, the electric transformation of VW will accelerate.

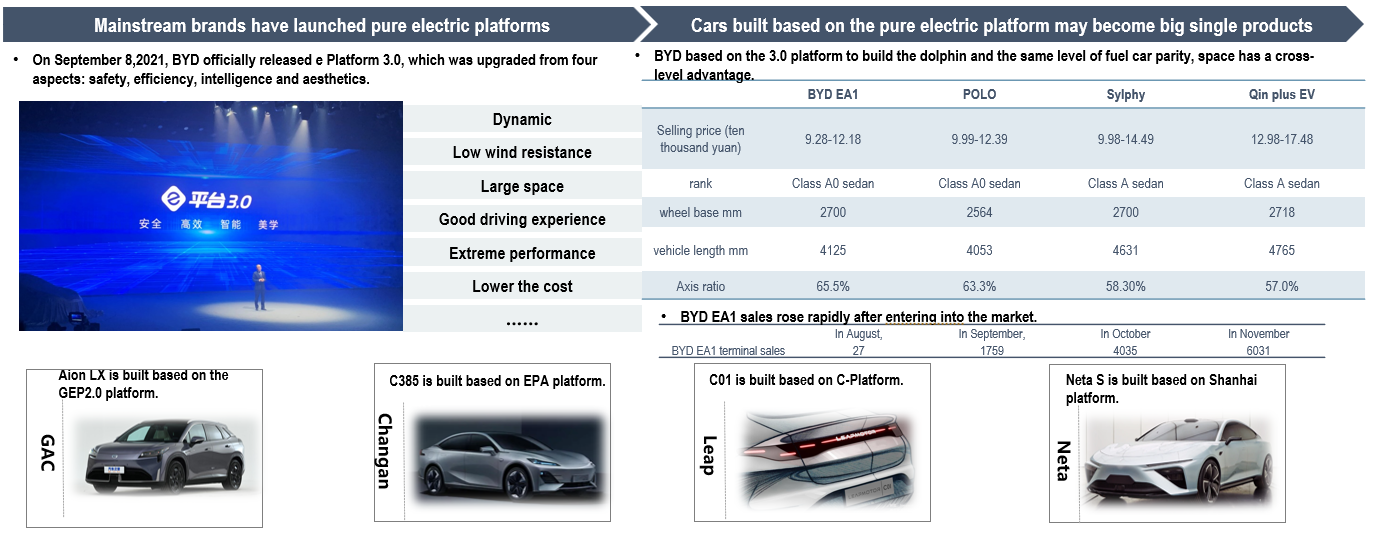

The models built based on the pure electric platform have high cost performance, or will emerge the star models.

Users of 100,000-200,000-price area pay close attention to the cost performance, with the cost performance of fuel vehicles may become star models.

- With the deepening of the electrification process, the mainstream car companies have launched pure electric platforms, such as: BYD, Volkswagen, Honda, GAC, Leap, Neta, etc.

- The models built based on the pure electric platform have the advantages of large space, good driving experience and low cost and the models and fuel vehicles are basically affordable and have advantages in space, use cost, driving experience and other aspects, or will launch the replacement effect on fuel vehicles, and become the key to detonate the mainstream market.

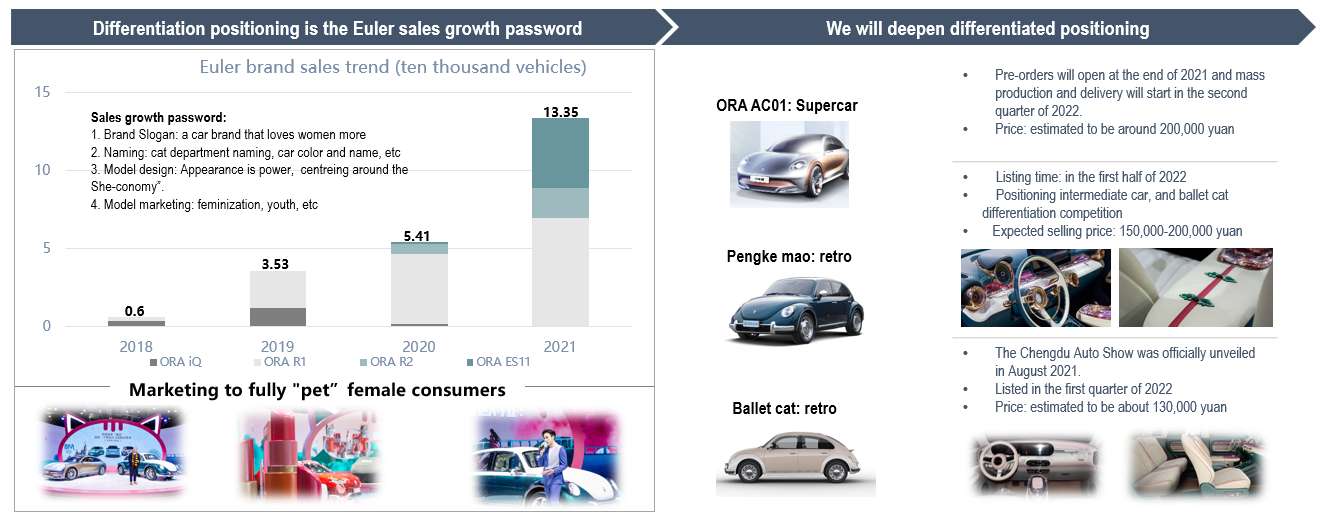

Models based on differentiation positioning may become star models in the market segment.

The largest market capacity in the 100,000-200,000 price area is the fertile soil for cultivating hot style models in the market segment. ORA has achieved certain success with differentiated positioning.

- ORA is positioning a car brand that loves women more, focusing on the women's car market. The Cat family helps ORA sales continue to increase.

- In the future, ORA will continue to deepen its differentiation positioning, deeply cultivate the female car market and may become the star product of the subdivided car market in the future.

- The evolution of the car market towards diversification, or will emerge more star models in the market segment and become the key to detonate the mainstream market.

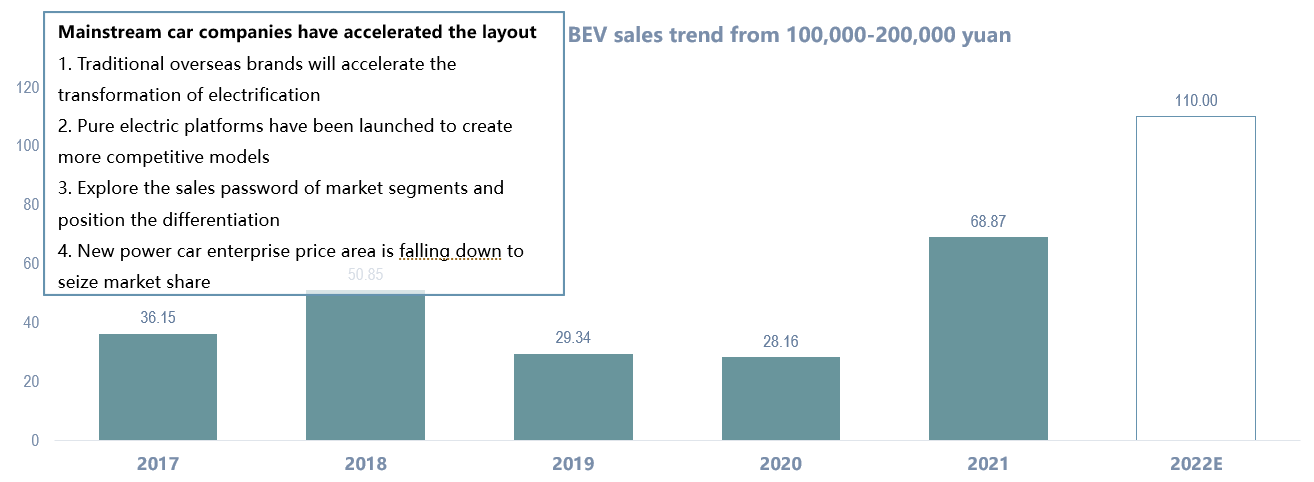

Sales are expected to double in 2022 to 1.1 million-1.3 million yuan.

The 100,000-200,000 price area is an important potential market. With the accelerated layout of mainstream car companies, the sales volume may double in 2022 to 1.1 million to 1.3 million.

- At present, the BEV penetration rate in the mainstream price area is relatively low and it has not yet been increased. The sales volume in 2021 is only 680,000 units.

- But 100,000-200,000 price area is the core sales market of traditional fuel vehicles, the market capacity of 10 million, the mainstream car companies have layout.

- In 2022, the mainstream market may emerge with star models, leading the sales surge and the market size may reach 1.1 million-1.3 million.