BMBS 2022 - 2031 Capacity Analysis

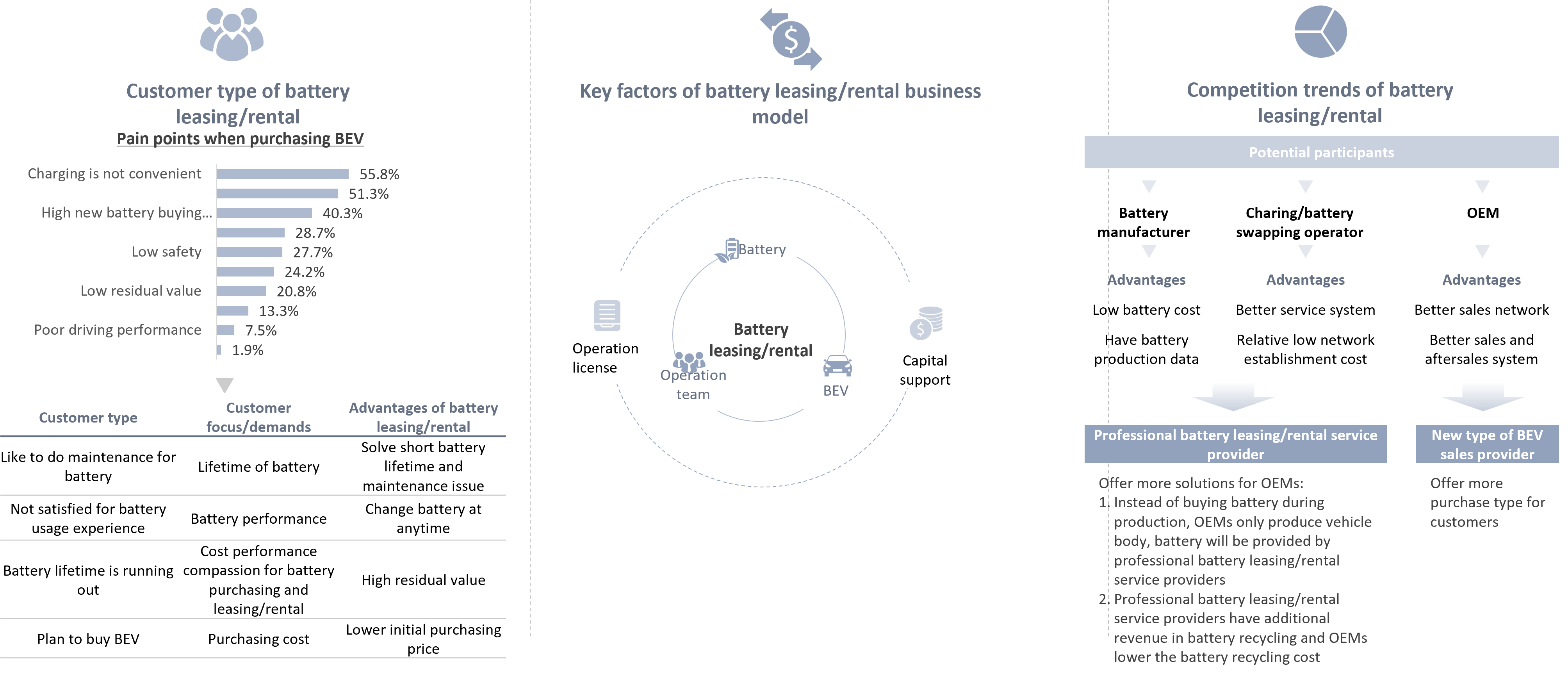

Emerging OEMs such as NIO and XPENG announced battery leasing products to lower the purchasing threshold and enhance the customer acceptance on NEV

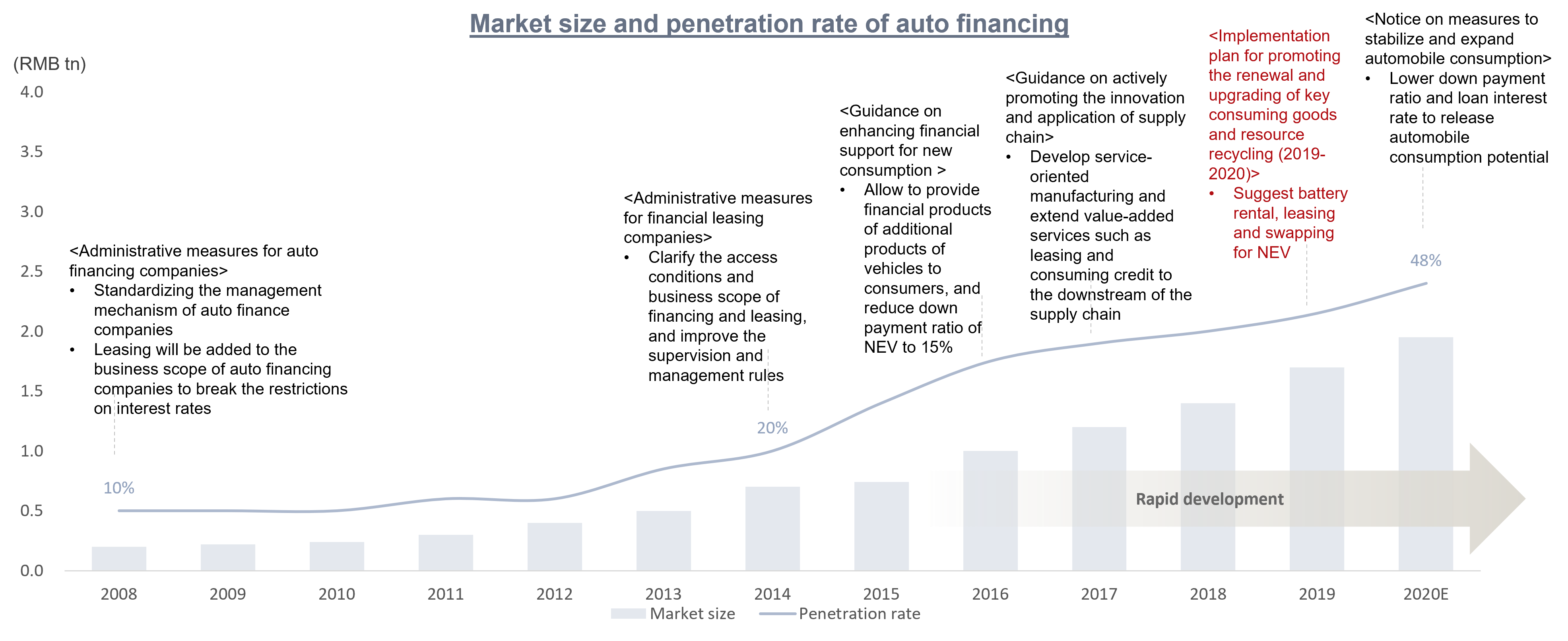

Vehicle financing business expands from vehicle to key components due to the development of NEV market increase since 2016; In 2020, new polices clearly encouraged the development battery rental/leasing mode

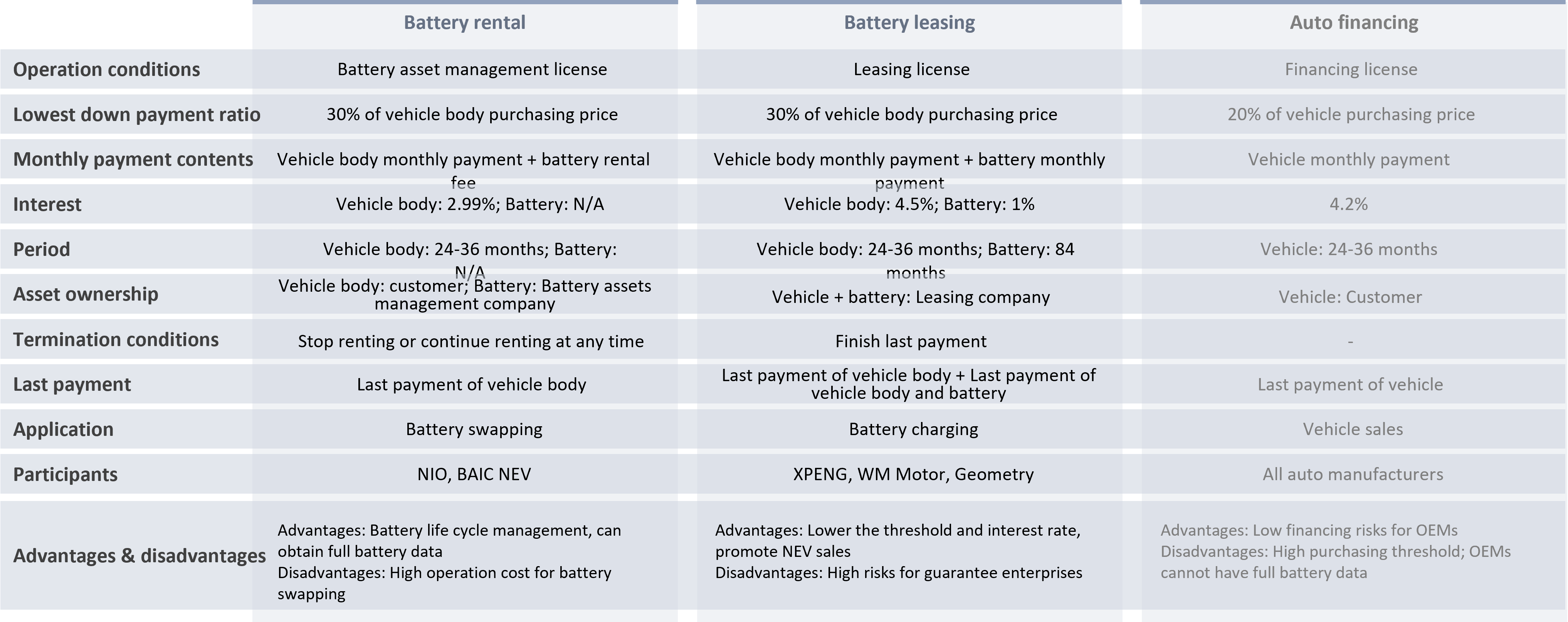

Currently, NEV battery financial products can be divided into battery rental and battery leasing; Battery rental is more appropriate for battery swapping

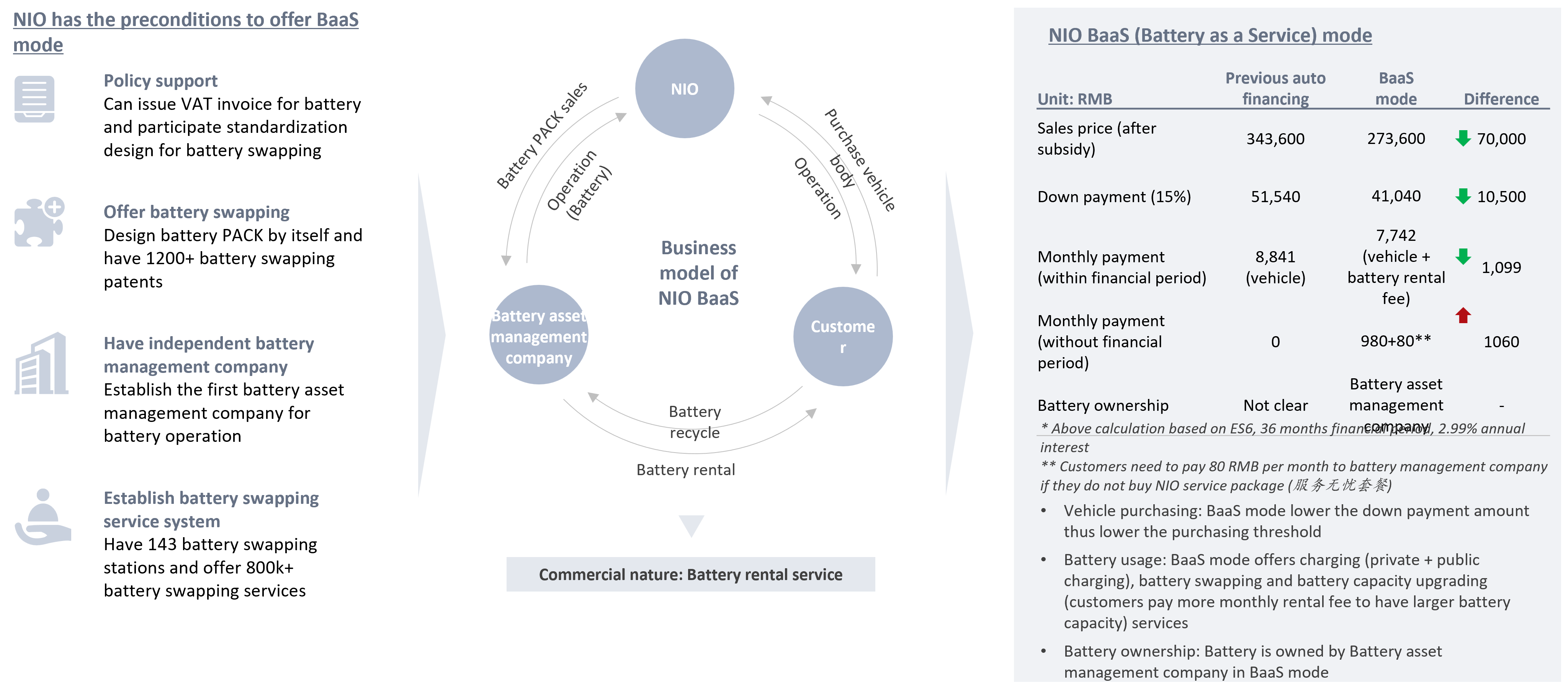

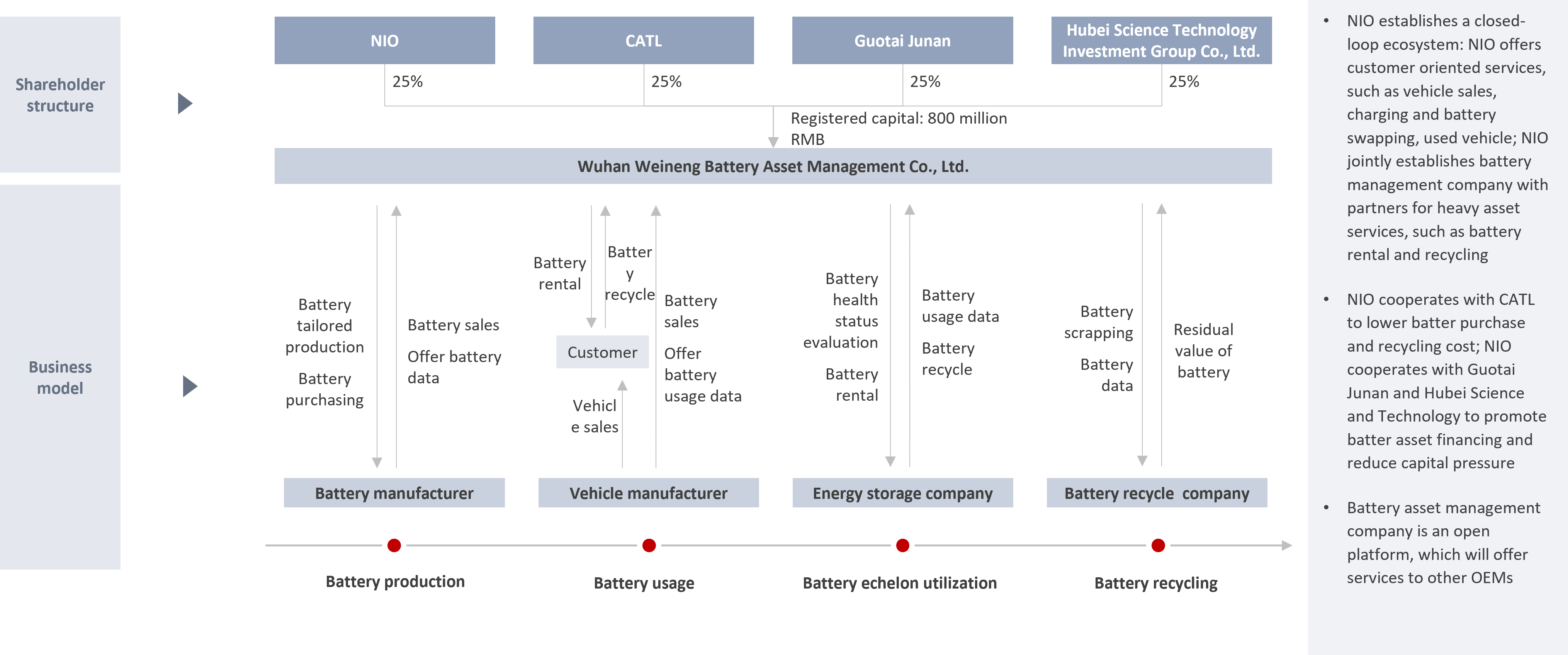

NIO applies BaaS mode (vehicle purchasing + battery rental) to optimize its charging solutions and forms a closed loop business model

NIO jointly establish battery asset management company with its partners, which reduces the financial pressure on charging and battery swapping operation and tries to have the full life cycle battery operation profit by exploring new business

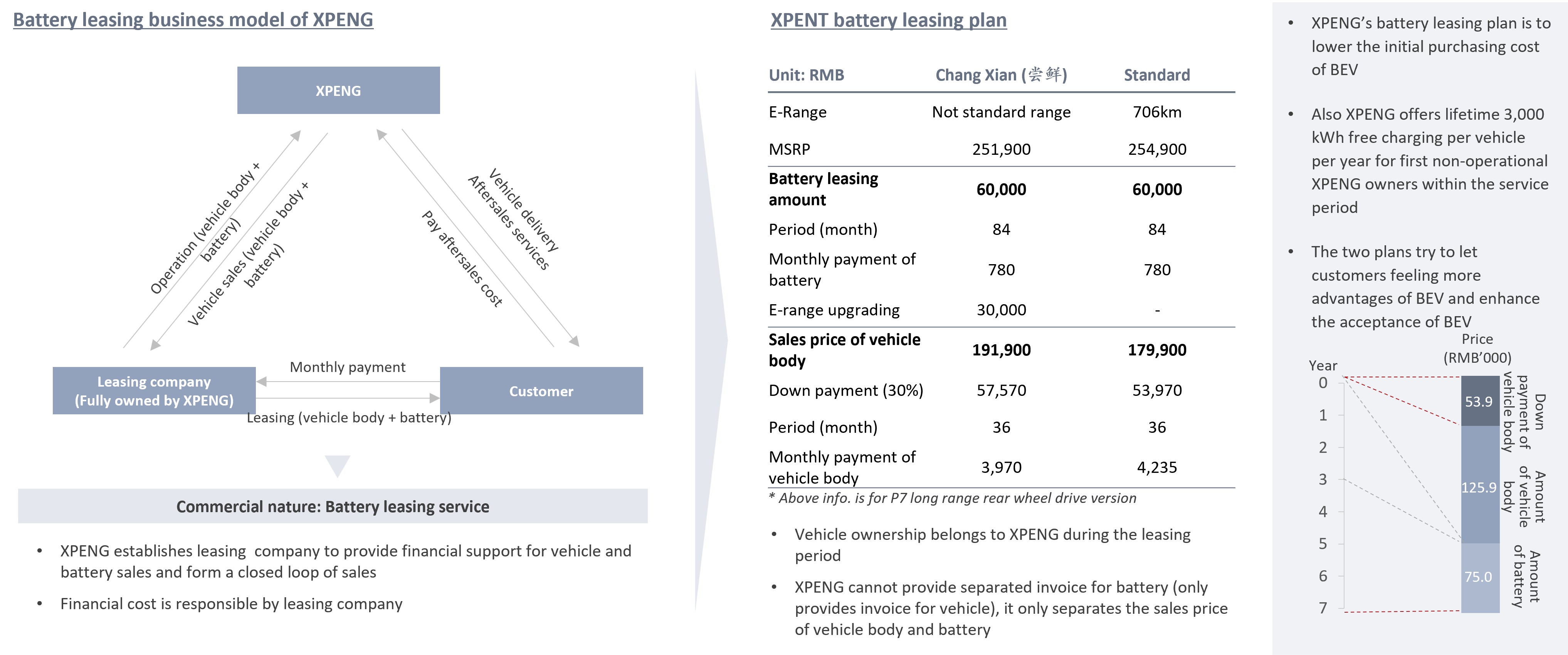

XPENG offers battery leasing plan, which lower the BEV initial purchasing cost compared with ICE and put forward the BEV usage advantages to customers

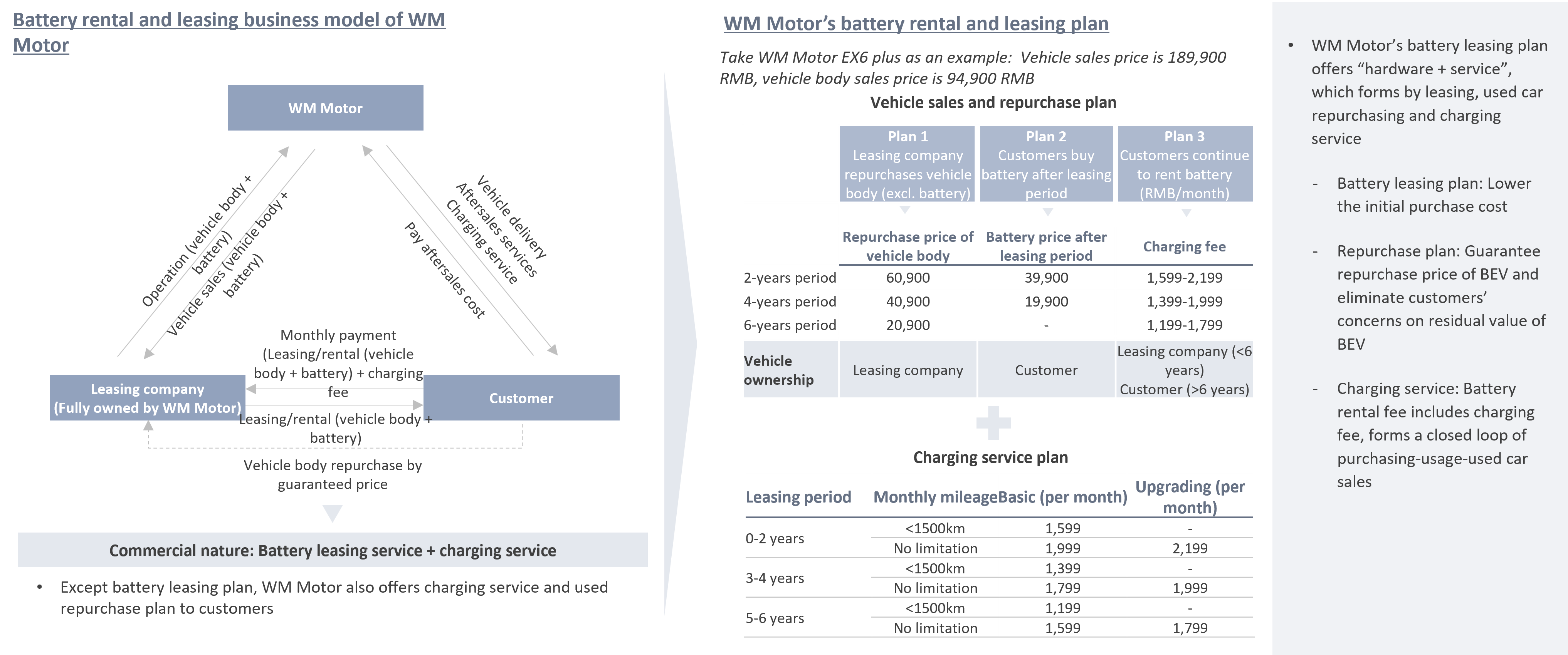

WM Motor offers leasing and rental services to customers and forms closed loop of purchasing-usage-used car sales

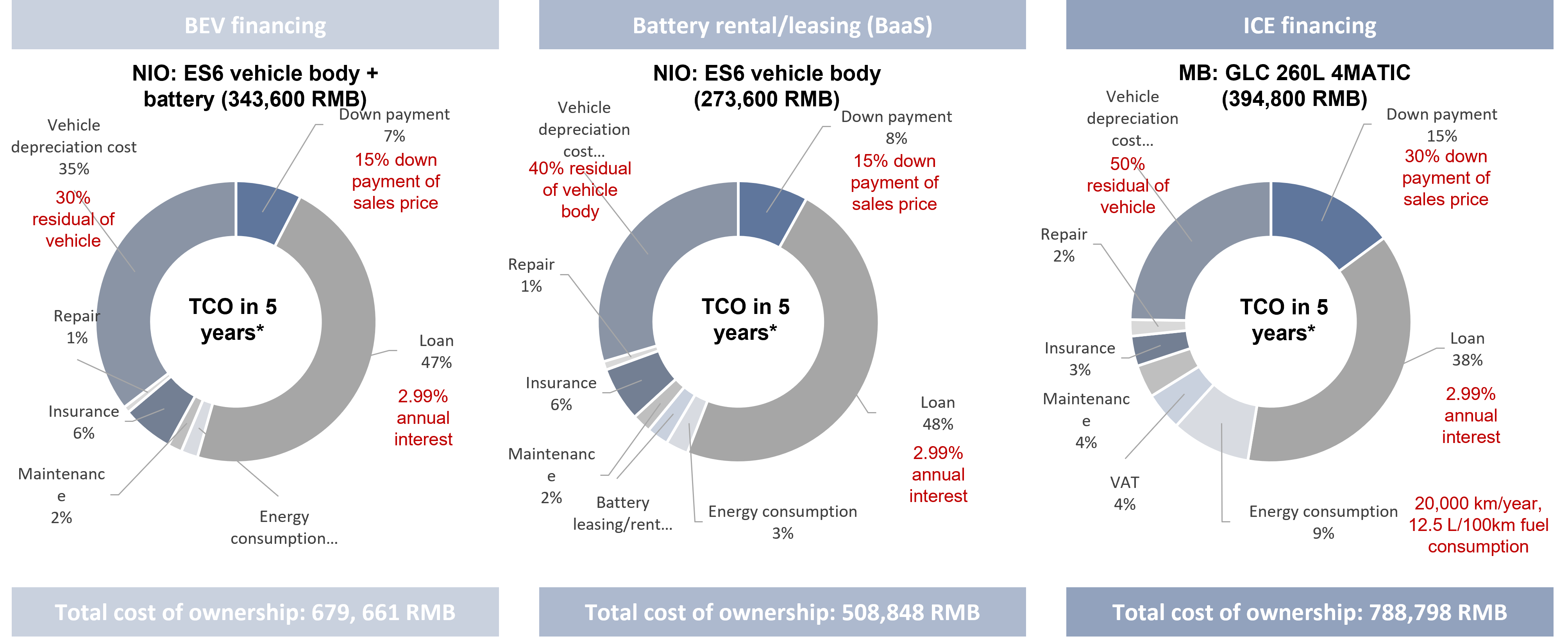

Battery leasing/rental plan have lower total cost of ownership if customers only own the vehicle by 5 years, which provide better usage cost and experience

Battery rental/leasing is a new subsegment under the development of NEV market and customer demands, more OEMs will offer such service in future