Passenger Vehicle Sales and Production Report in Sep 2024

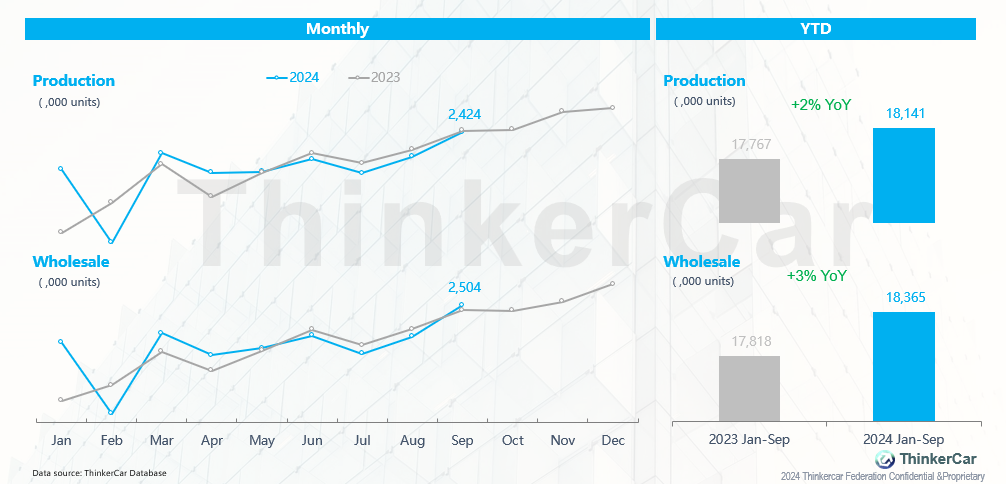

In Sept, production reached 2.42M units, and wholesale reached 2.5M units

- Production: In Sept, passenger vehicle production hit 2.42M units, down 1% YoY but up 12% MoM, 20K units lower than the 2023 peak of 2.44M. Cumulative production reached 18.14M units, up 2% YoY. Luxury brand production fell 7% MoM and 13% YoY; joint venture brand production dropped 32% MoM but rose 12% YoY; Chinese brand production grew 18% MoM and 17% YoY.

- Wholesale: In Sept, total passenger vehicle wholesale reached 2.504M units, up 2.1% YoY and 16.1% MoM, a new record. Cumulative wholesale totaled 18.37M units, up 3% YoY. Chinese brands wholesaled 1.69M units, up 22% YoY and 17% MoM. Joint ventures wholesaled 540K vehicles, down 29% YoY but up 17% MoM. Luxury brands wholesaled 280K units, down 8% YoY but up 10% MoM.

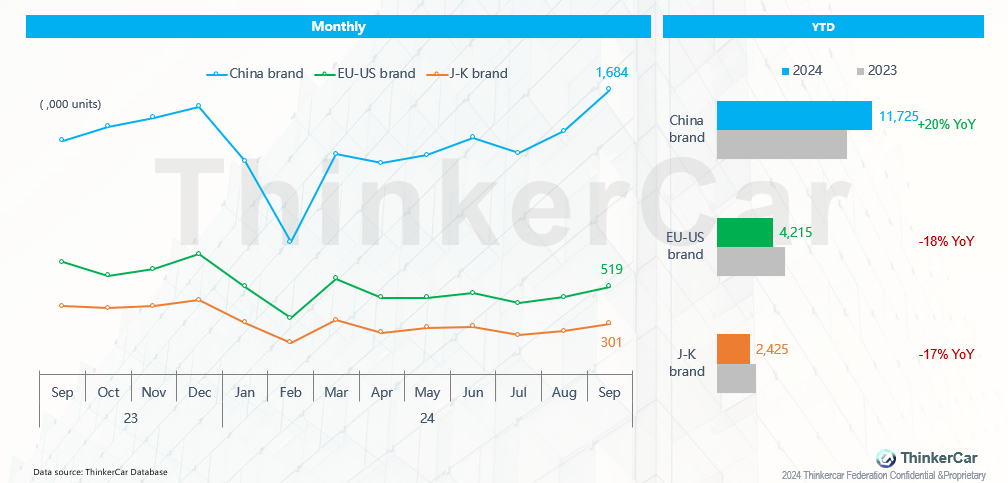

Chinese brands wholesaled 1.68M units (+17% MoM), EU-US brands 519K units (+13% MoM), and J-K brands 301K units (+16% MoM).

With the strong rise of Chinese brands, sales of EU-US, and J-K brands have gradually declined. As of September 2024, cumulative sales of Chinese brands reached 11.725M units, increasing their market share from 53.3% in 2023 to 63.8% this year. In contrast, the market share of EU-US brands fell from 27.8% to 23%, while J-K brands dropped from 15.9% to 13.2%.

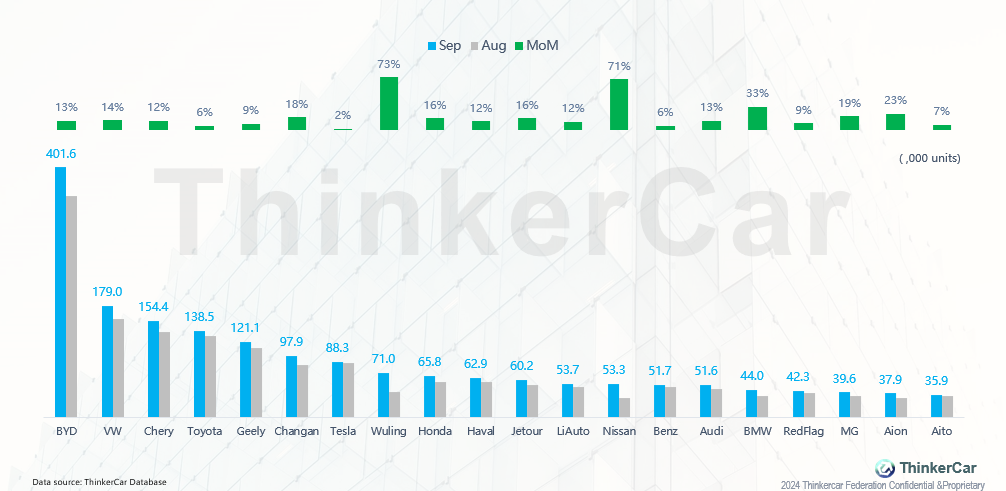

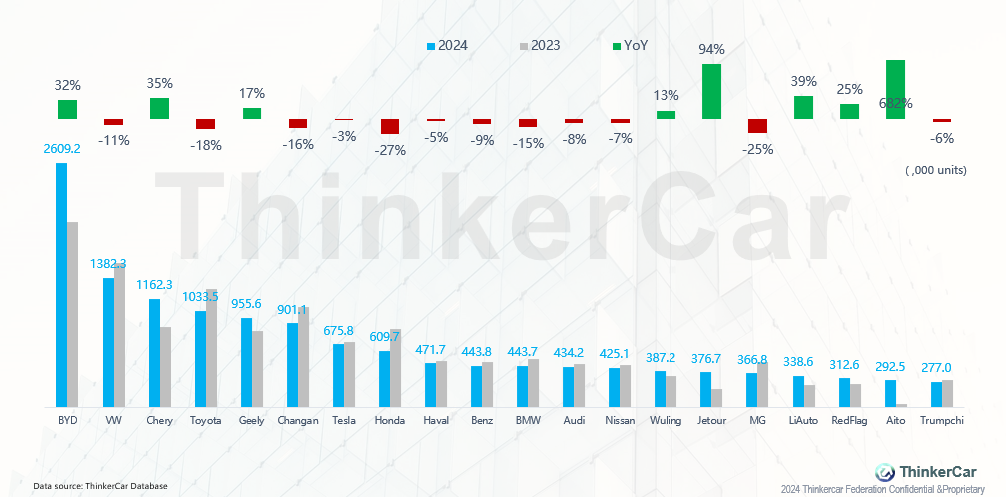

Top 20 Brands Sales Ranking for the Month

- Due to the Sept sales peak and the last month of Q3, all brands saw MoM increases in wholesale volume.

- In the top 20 brands, BYD led with 401.6K units, followed by VW with 179K units, while Toyota fell to fourth, overtaken by Chery.

- Tesla wholesaled 88.3K units in Sept, a slight MoM increase of 2%. Nissan actively reduced inventory, with a Sept wholesale of 53.3K, up 71% MoM.

Top 20 Brands Cumulative Sales Ranking

- In terms of cumulative sales, mainstream joint venture brands, including Volkswagen and Toyota, saw varying degrees of decline in cumulative sales in 2024 compared to the previous year, primarily due to their reliance on ICE vehicles, which are gradually being replaced by new energy vehicles, while their own large systems are transforming too slowly.

- The only brands among the top twenty that showed year-on-year growth were Chinese brands, while luxury brands like Mercedes-Benz, BMW, and Audi struggled on the sales front, with cumulative year-on-year declines.

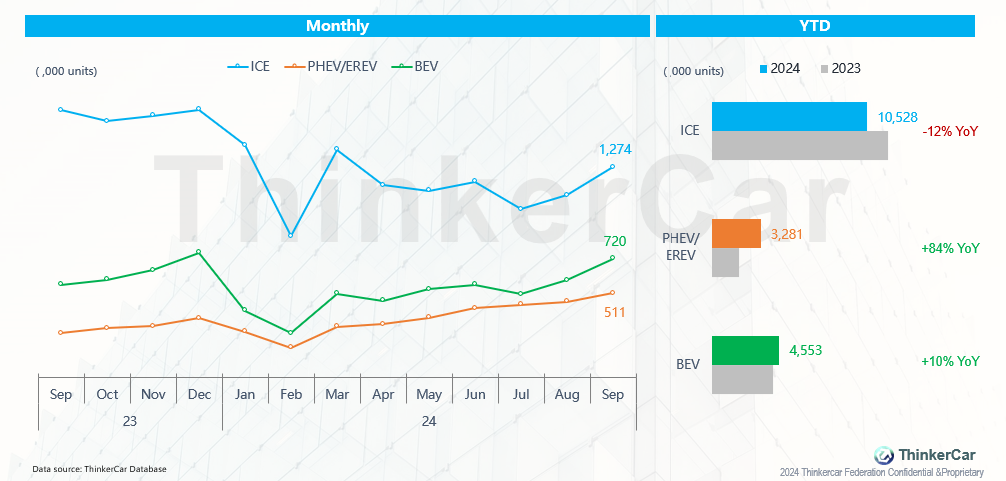

In Sept, ICE sales reached 1.274M units (+15% MoM), PHEV/EREV sales hit 511K units (+11% MoM), and BEV sales totaled 720K units (+22% MoM)

ICE sales were 1.274M units (+15% MoM), but down 21% YoY. PHEV/EREV and BEV sales rose 90% and 28% YoY, respectively, setting record highs. Cumulatively, PHEV/EREV saw the fastest growth at 84%, with market share increasing from 10% last year to 18% this year, prompting most brands to enter this segment. Although BEV market growth continues, the rate is slowing, with market share rising from 23.2% last year to 24.8% this year. Meanwhile, cumulative ICE sales dropped 12%, with shares falling from 66.8% to 57.3%.

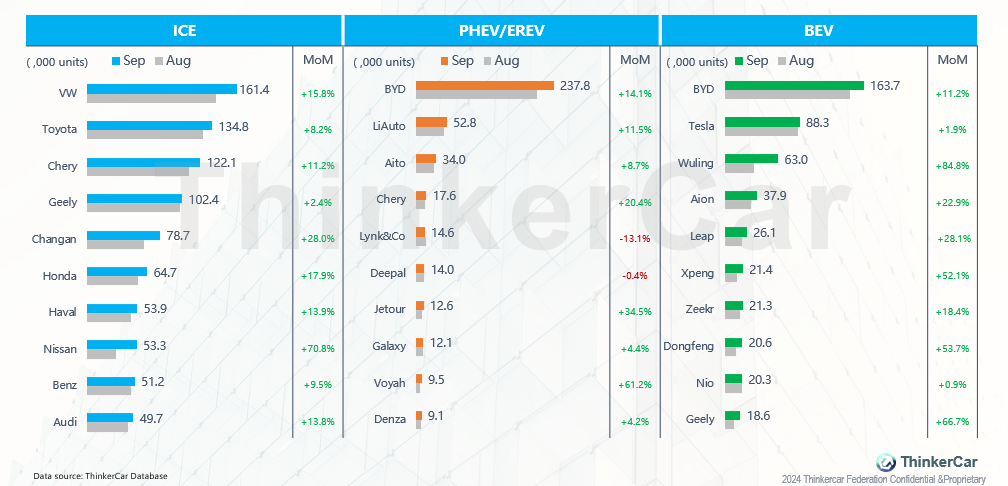

Top 10 Brands' Monthly Sales by Energy Type

In September, the top ten brands by energy type saw varying degrees of MoM growth. Volkswagen, Toyota, and Chery ranked the top three in the ICE market, while BYD excelled in both the PHEV/EREV and BEV markets, leading both segments. Li Auto and Aito ranked 2nd and 3rd, respectively, in the PHEV/EREV market. In the BEV market, Tesla ranked 2nd with sales of 88.3K units, while XPeng saw a MoM increase of 52.1%, ranking 6th in the BEV market.

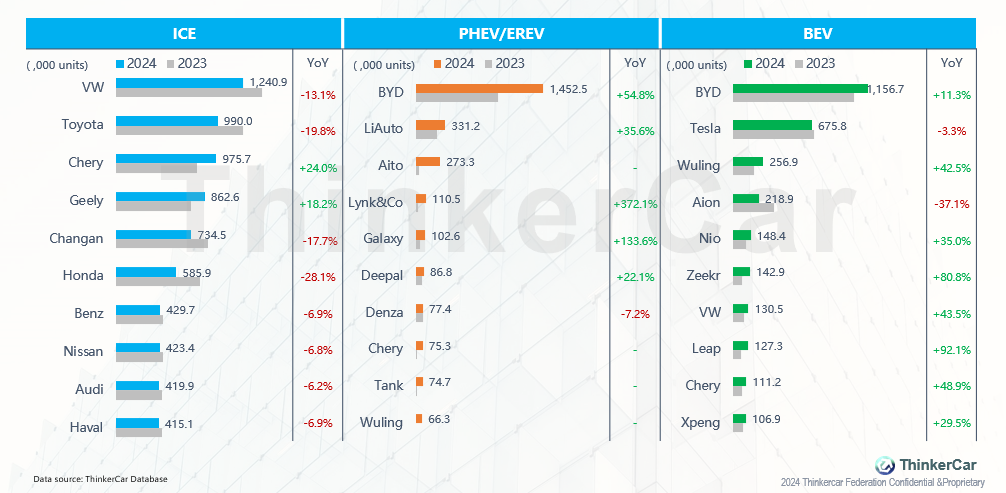

Top 10 Brands' Cumulative Sales by Energy Type

- ICE market, only Chery and Geely saw YoY growth among the top ten, mainly due to increased ICE exports. Other brands experienced YoY declines, with Honda down ~30% and Toyota nearly 20%.

- PHEV/EREV market, BYD dominated with sales of 1,452.5K units, maintaining the top spot, while Denza fell 7%.

- BEV market, BYD grew 11.63%, Tesla declined 3.3% YoY, NIO increased 35%, and XPeng rose 29.5%.

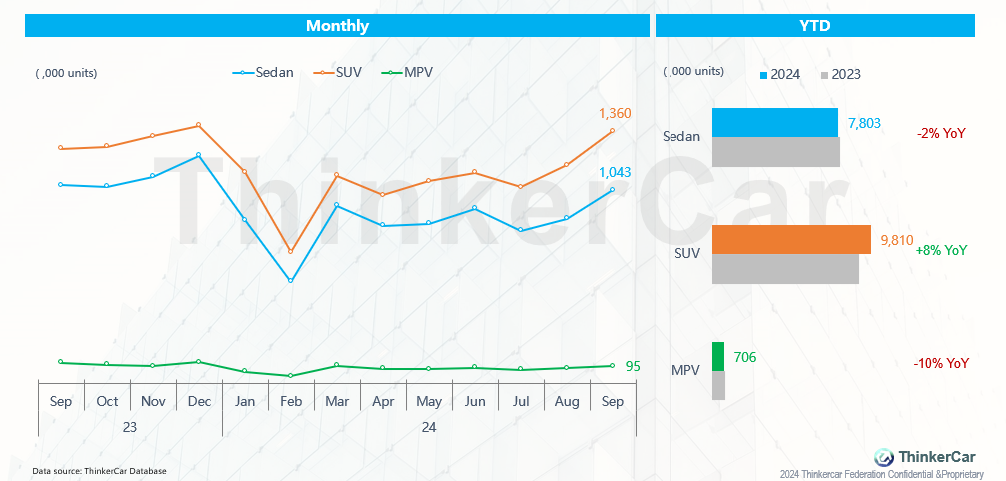

SUV sales hit 1,360K (+16% MoM); sedan sales were 1,043K (+17% MoM); MPV sales were 95K (+14% MoM)

Driven by new car launches, the SUV market boomed, with sales of 1.306M units, a 16% MoM increase. The sedan market had sales of 1.043M units, up 17% MoM. The MPV market saw sales of 95K units, a 14% MoM increase. For cumulative sales in the first 9 months, SUVs reached 9.810M units, an 8% YoY growth. In contrast, the sedan market declined 2% YoY, with cumulative sales of 7.803M units. The MPV market remained sluggish, down 10% YoY.

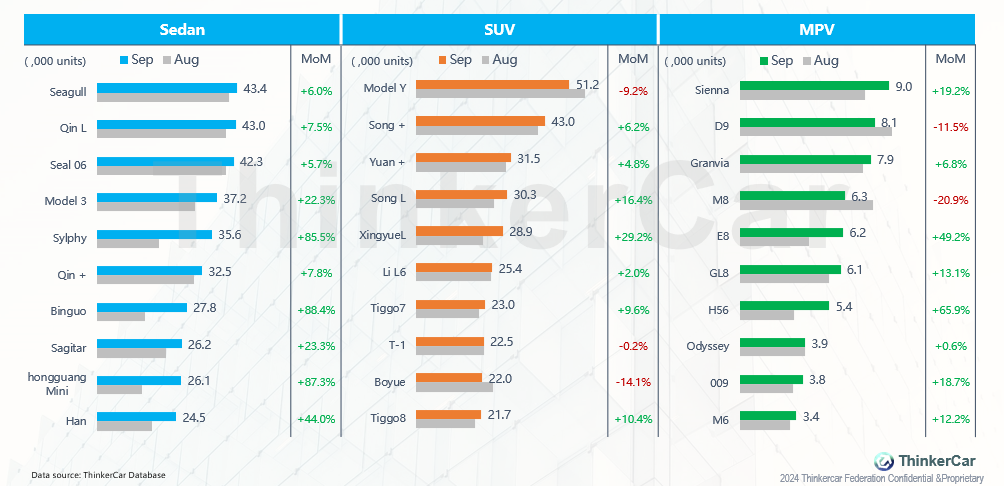

Top 10 Monthly Sales Models by Vehicle Type

- In Sept, the top three best-selling sedans were all BYD models: Seagull, Qin L, and Seal 06, with MoM sales increases of 6%, 7.5%, and 5.7%, and monthly sales exceeding 40,000 units.

- The SUV market, Tesla Model Y ranked first with 51.2k units but saw a rare 9.2% MoM decline. BYD's Song+, Yuan+, and Song L took the 2nd to 4th spots. Li Auto's L6 entered the top ten.

- The MPV market, Denza D9 dropped 11.5% MoM, falling to second place, while Toyota's Sienna ranked first.

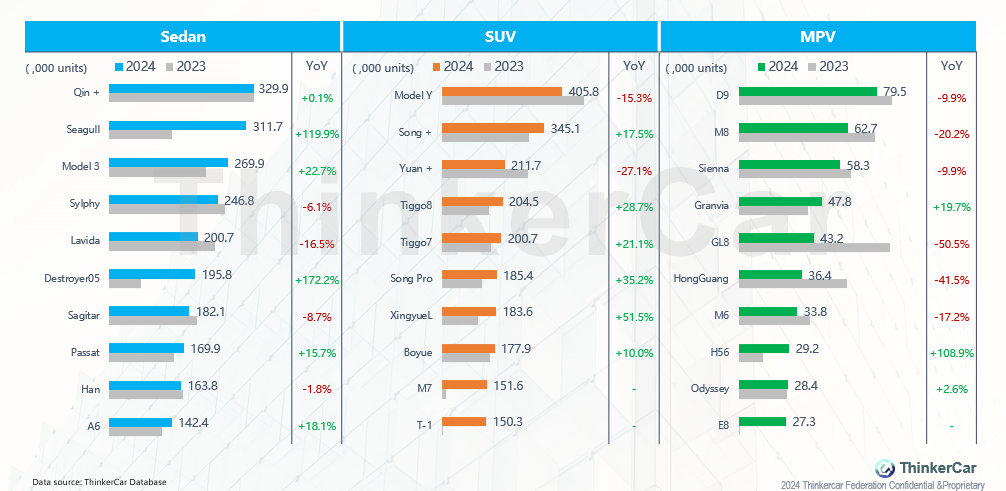

Top 10 Models by Vehicle Body Type for Cumulative Sales

- For cumulative sales, the top three sedans were BYD Qin+ (329.9k), BYD Seagull (311.7k), and Tesla Model 3 (269.9k). Nissan Sylphy and VW Lavida dropped 6.1% and 16.5% YoY, respectively.

- The SUV market, Tesla Model Y fell 15.3% YoY, and BYD Yuan+ dropped 27.1%, while other models showed solid growth.

- The MPV market, all top ten models saw declines, with Buick GL8 down 50.5%, the largest drop. Denza D9's cumulative sales also fell 9.9%