Passenger Vehicle Export Volume Report in Sep 2024

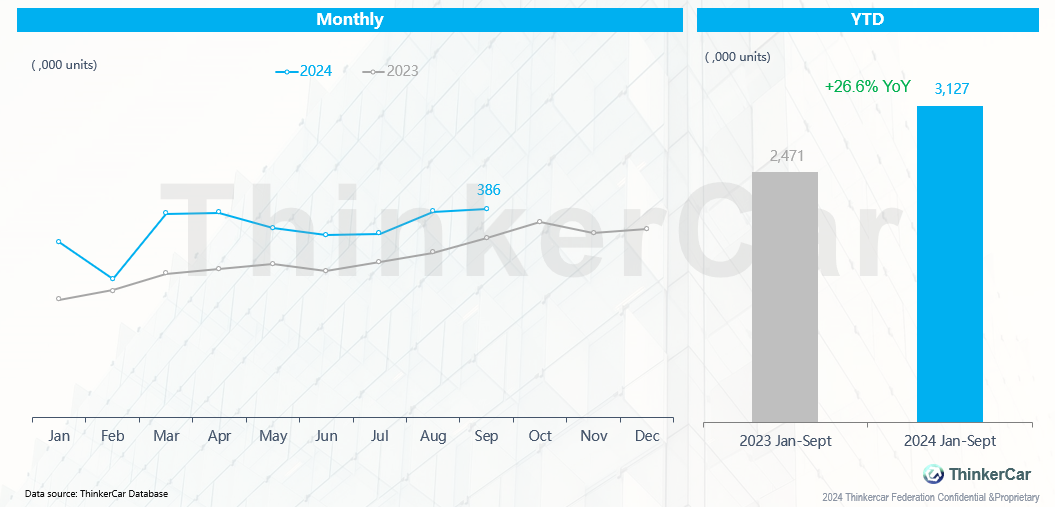

China’s passenger vehicle exports were 386k units, +1.5% MoM and +16.1% YoY.

The outlook for 2024 is positive, with cumulative exports at 3,127k units by Sept, +26.6% YoY.

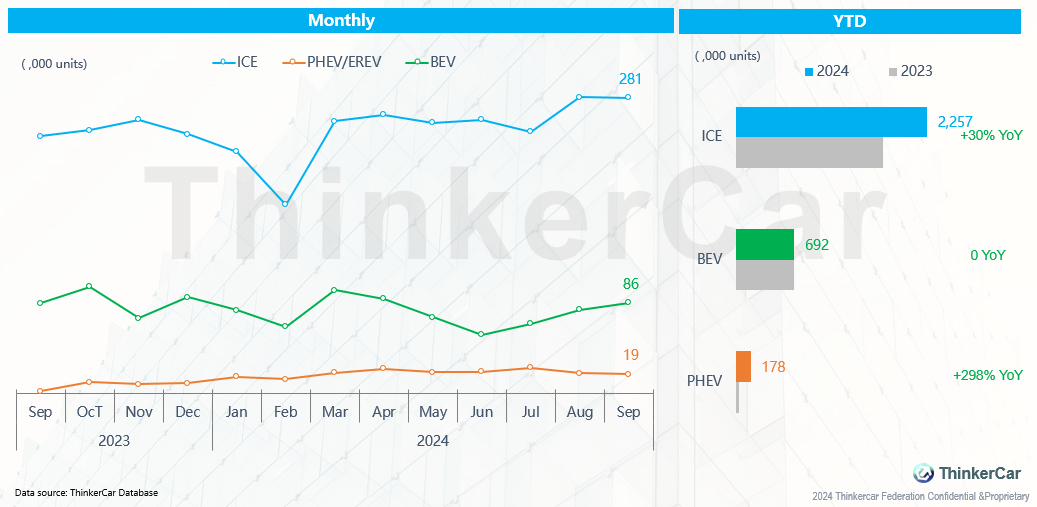

ICE exports were 281k units (-0.1% MoM), PHEV/EREV exports were 19k units (-3.6% MoM), and BEV exports were 86k units (+8.4% MoM).

- ICE remains the main export, but PHEV/EREV exports are rising fast. In Sept, ICE exports reached 281k (+15.1% YoY); PHEV/EREV exports were 19k (+645.8% YoY); BEV exports were 86k (+0.7% YoY).

- In the first 9 months, total ICE exports were 2,257k (+30% YoY); PHEV/EREV exports hit 178k (+298% YoY); BEV exports totaled 692k, flat YoY.

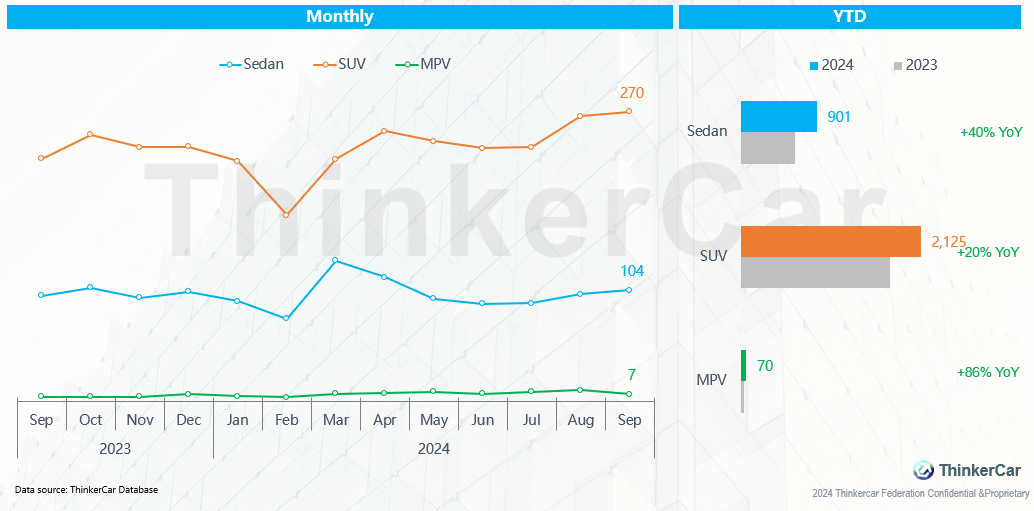

Sedan exports were 104k (+3.4% MoM), SUV exports were 270k (+1.5% MoM), and MPV exports were 7k (-33.2% MoM)

- By vehicle type, SUVs are the main export category, accounting for nearly 70% of the total. In the first nine months, cumulative exports reached 2,125k, a YoY increase of 20%. Sedan exports totaled 901k, up 40% YoY, while MPV exports reached 70k, with an increase of 86% YoY.

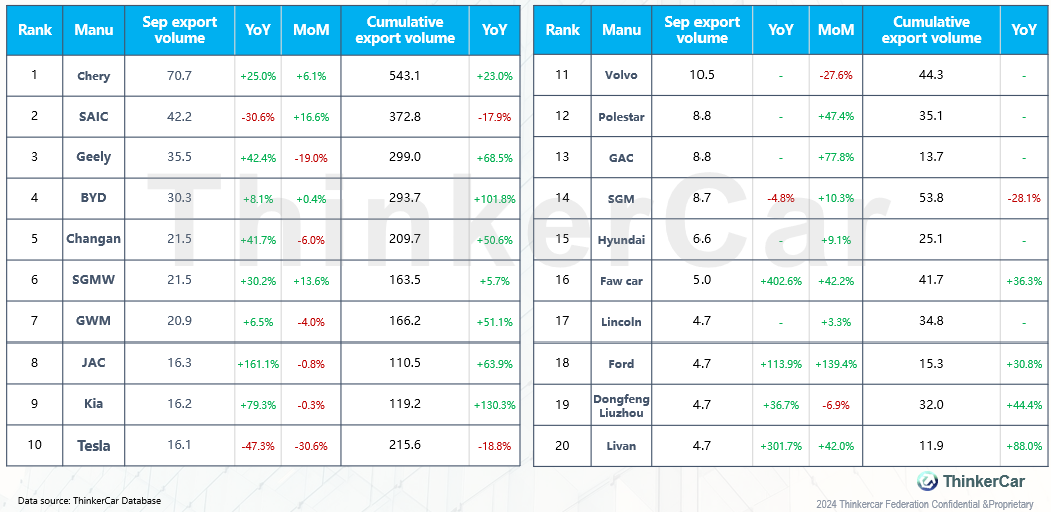

Top 20 passenger vehicle manufacturers by export volume

- Among the top 20 manufacturers by export volume, Chery, SAIC, and Geely rank 1st, 2nd, and 3rd, with cumulative export volumes of 543.1k, 372.8k, and 299k, respectively. However, due to the EU's tariff increases, SAIC's export volume, which is primarily focused on the European market, has decreased by 17.9% YoY.

- In recent years, BYD has made significant strides in the overseas market, with its cumulative export volume reaching 293.7k, representing a YoY increase of 101.8%.

- Tesla China has reported a cumulative export volume of 215.6k this year, down 18.8% YoY, while JV manufacturers such as Kia and Hyundai have also begun their export efforts.

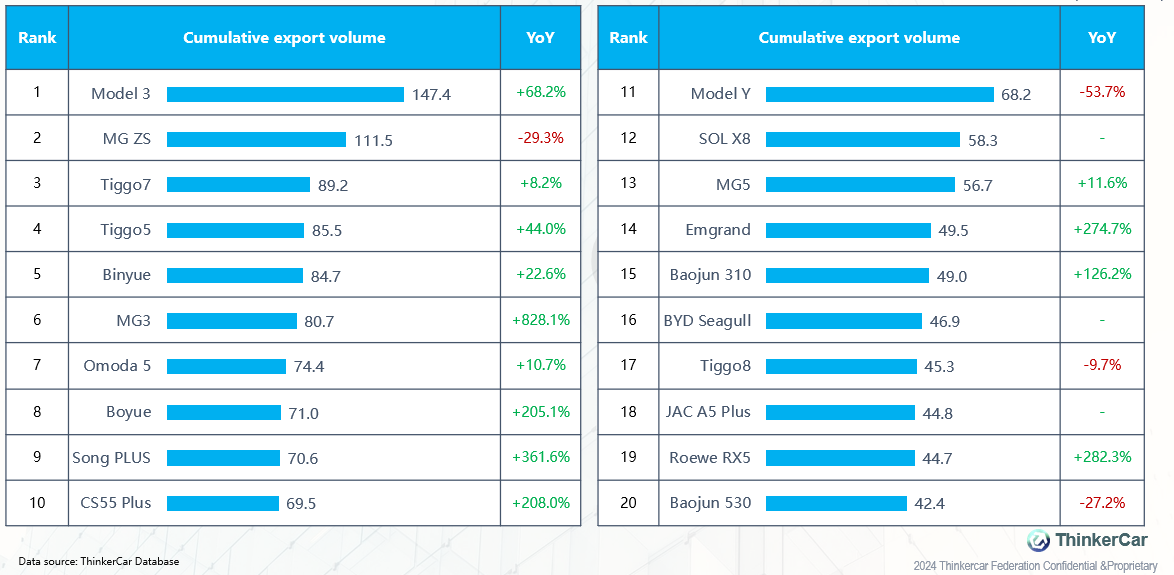

Top 20 models by export volume

- The top three models by cumulative export volume are the Tesla Model 3 (147.4k, +68.2% YoY), MG ZS (111.5k, -29.3% YoY), and Chery Tiggo 7 (89.2k, +8.2% YoY). The Song Plus has become BYD's best-exporting model, with a cumulative export volume of 70.6k in the first nine months, reflecting a YoY increase of 361%.

- Another Tesla model, the Model Y, saw its export volume drop to 68.2k this year, a YoY decrease of 53.7%.

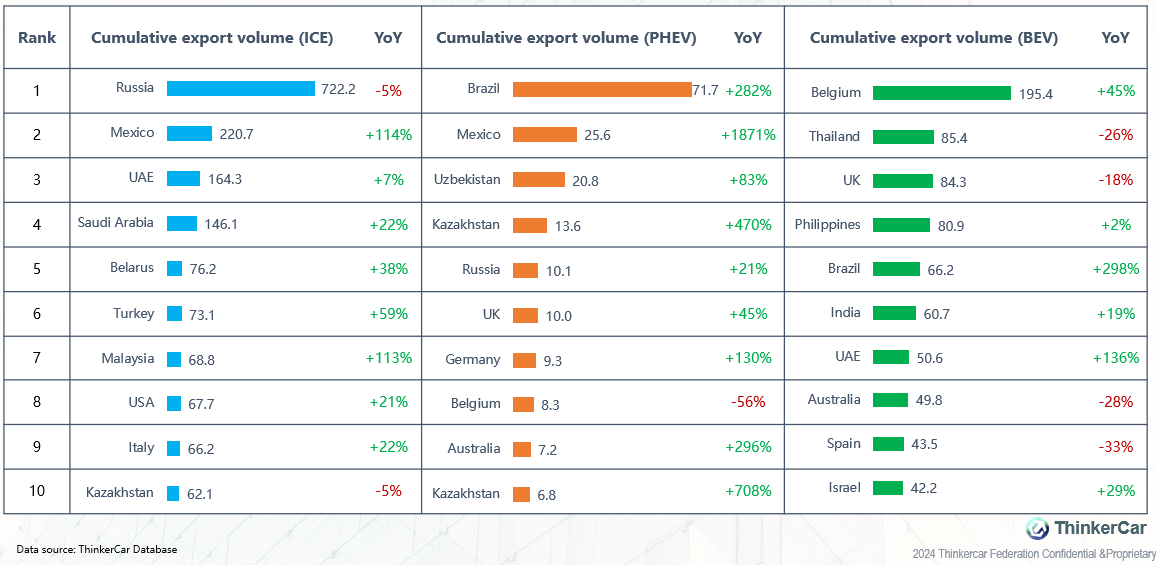

As of Sept, the top 10 countries by cumulative export volume

- As of Sept, the top 3 countries in terms of cumulative exports of ICEs were Russia (722.2k, -5% YoY), Mexico (220.7k, +114% YoY), and the UAE (164.3k, +7% YoY).

- The top 3 countries in terms of cumulative exports of PHEVs were Brazil (71.7k, +282% YoY), Mexico (25.6k, +1871% YoY), and Uzbekistan (20.8k, +83% YoY).

- The top 3 countries in terms of cumulative exports of BEVs were Belgium (195.4k, +45% YoY), Thailand (85.4k, -26% YoY), and the UK (84.3k, -18% YoY).