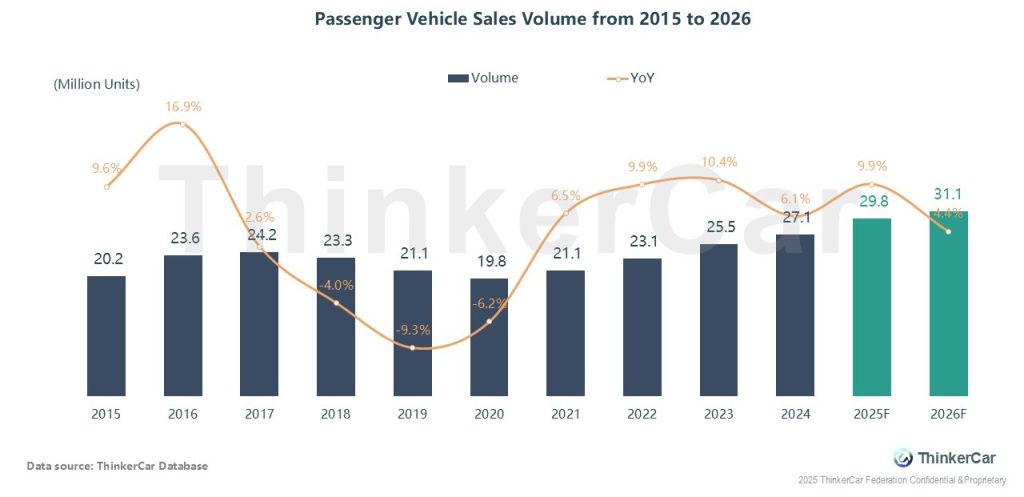

China’s passenger vehicle sales reached 26.7M units (Jan-Nov 2025, +11.2% YoY), with full-year 2025 forecast at 29.8M units (+9.9% YoY). Driven by rising NEV penetration and extended trade-in policies, 2026 sales are expected to hit 31.1M units (+4.4% YoY) with steady growth.

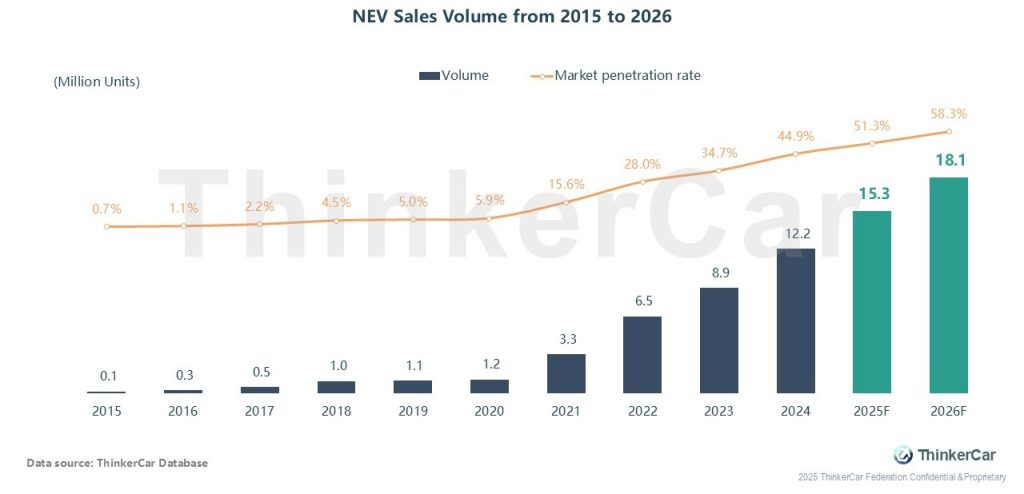

China’s NEV sales reached 13.8M units (Jan-Nov 2025, +29% YoY), with full-year 2025 forecast at 15.3M units and a penetration rate of 51.3%. 2026 will see continued growth but at a moderated growth of 18.6%, with the penetration rate hitting 58.3%.

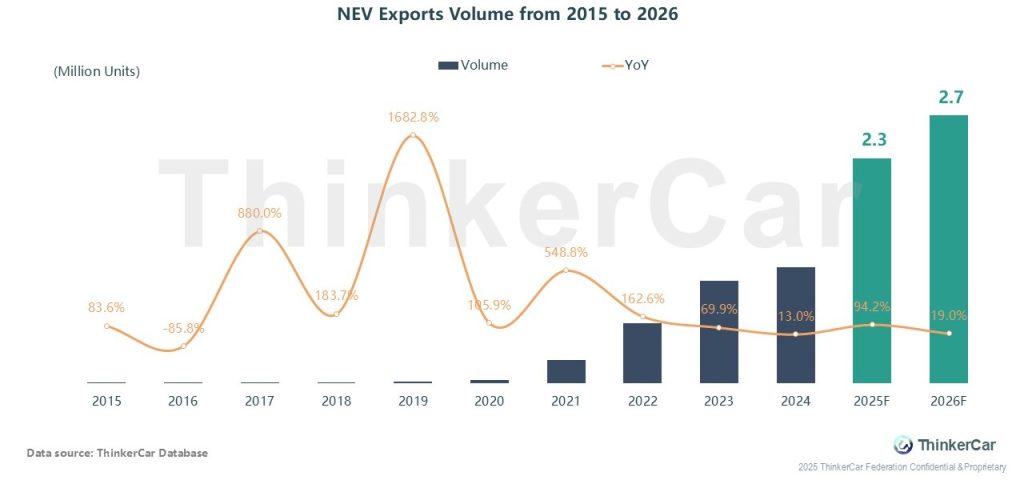

China’s NEV exports maintain rapid growth, with cumulative shipments exceeding 2 million units in Jan-Nov 2025, full-year 2025 forecast at 2.27 million units (+94.2% YoY). 2026 will see continued growth but at a moderated pace, as more Chinese automakers adopt the in-depth layout model of “overseas factory construction + industrial chain synergy”, with full-year exports projected at 2.7 million units.

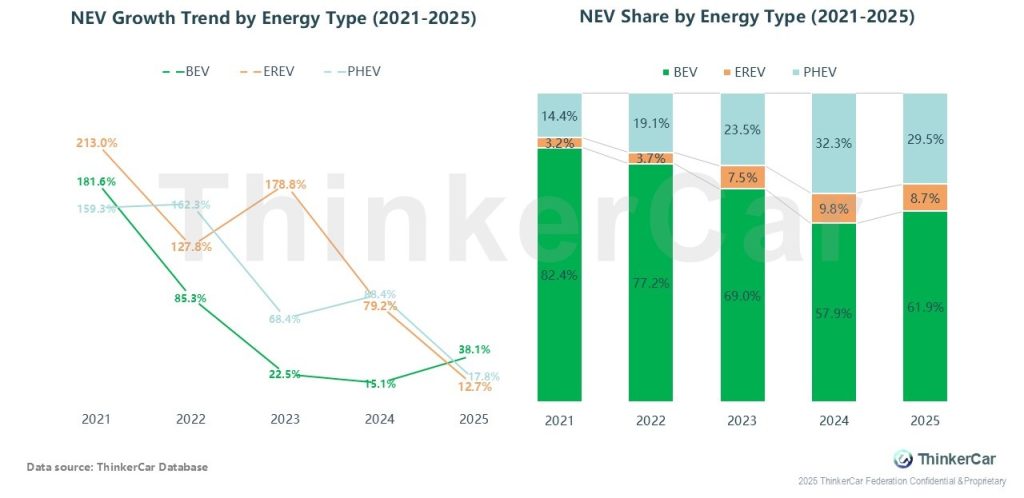

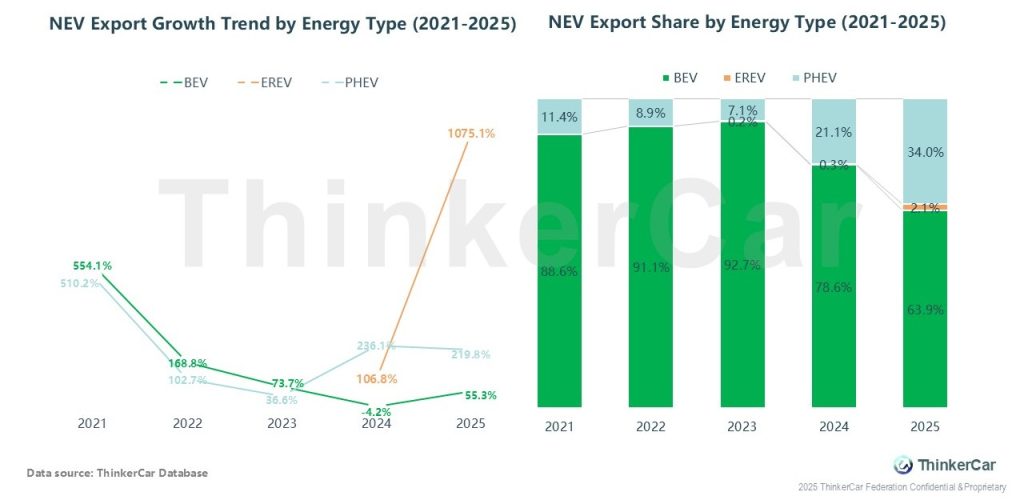

From 2021 to 2025, NEV growth rates generally declined, with BEV’s share falling steadily. Between 2023-2025, NEV growth fluctuated sharply (e.g., EREV surged then dropped), BEV’s share edged down, while EREV and PHEV shares stayed high, making the market more diversified.

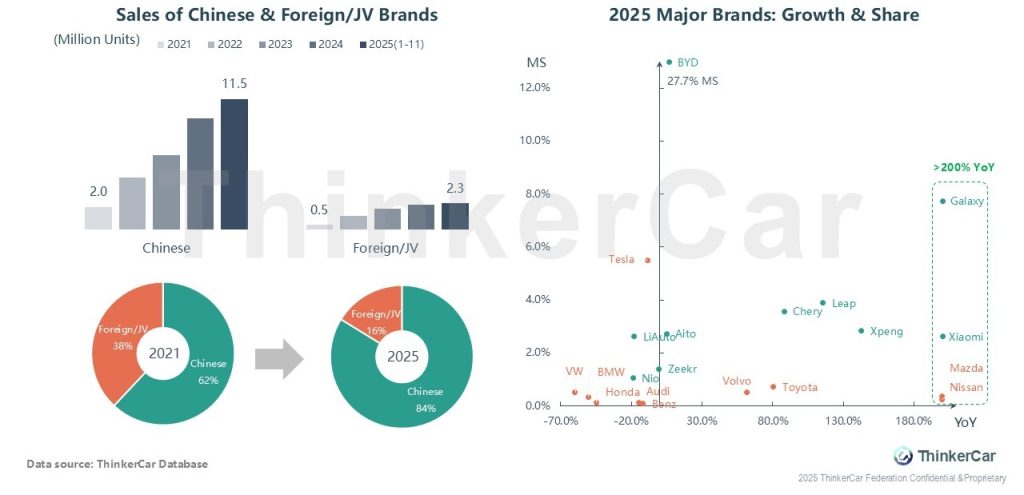

2025 NEV market: Chinese brands strengthen dominance, with share rising from 62% to 84% vs. foreign/JV’s share drop to 16% from 38%. Jan-Nov sales: 11.5M units for Chinese brands, ~5x foreign/JV’s 2.3M. BYD leads with 27.7% share; Galaxy, Xiaomi, Mazda and Nissan grow over 200%, while Volkswagen, BMW et al. post negative growth.

SUVs led sales (6,876k units), edging out cars (6,334k); MPVs had a small share (536k). By subclass: A0 cars led growth (+66.2%); A-class SUVs (top-selling at 2,584k) grew +39.8%, C/D SUVs +49.7%. MPVs diverged: B-class -4.5%, C/D-class +69.4%.

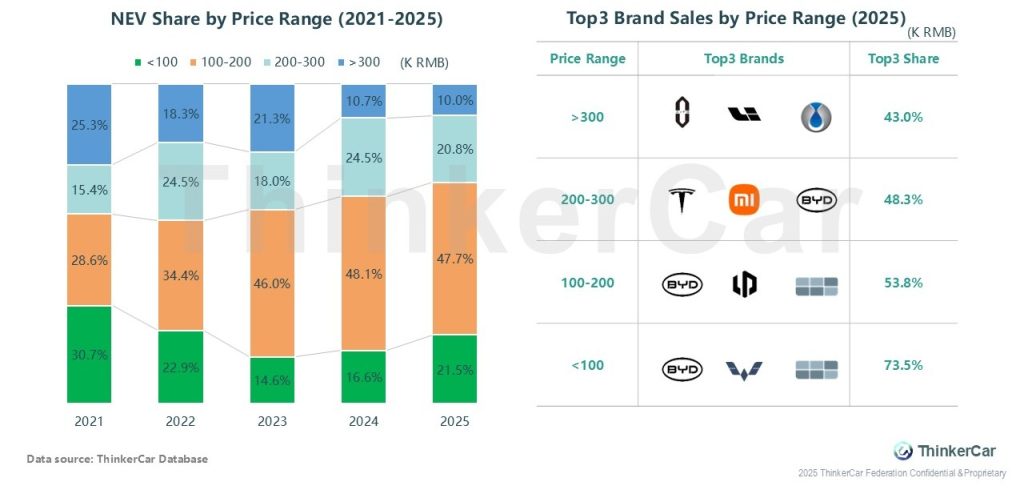

2021-2025 NEV market: 100-200K RMB led share (rising to 47.7%), with >300K share narrowing and <100K recovering from a decline. Brand-wise, the <100K segment had the highest Top3 concentration (73.5%), and BYD (incl. Denza) ranked among top players across segments.

2021–2025: BYD stayed NEV sales ranked first, hitting 3,804.0k units (YoY +6%) in Jan–Nov 2025. Galaxy jumped to 2nd with 254% YoY growth; Tesla slid to 3rd (-8% YoY). Xiaomi entered the top 10 for the first time (+218% YoY). Top 5 share dipped slightly from 53.4% (2021) to 49.8% (2025). Brands diverged: Li Auto fell 18% YoY, while Galaxy/Leap kept high growth.

From 2021 to 2025, BEVs led NEV exports, share falling from >88% to 63.9% (2025). PHEVs rose to 34% (from 11.4%); EREVs entered (2.1%) in 2025. Growth: BEVs fluctuated (554.1% up 2021→4.2% down 2024); PHEVs/EREVs grew fast.

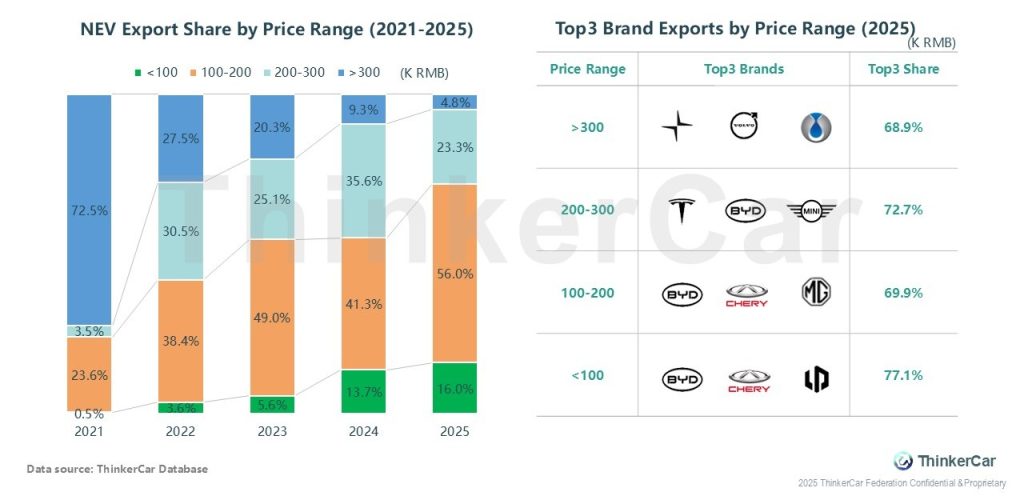

From 2021-2025, NEV export price mix shifts to mid/low tiers: <100K share rises 0.5%→16%, 100-200K hits 56%, >300K drops 72.5%→9.3%. In 2025, Top3 brands in each price tier have high concentration; BYD covers multiple tiers.

2022-2025: The landscape of Top 10 NEV export brands has shifted. Tesla led in 2022-2023, while BYD claimed the top spot from 2024 onward—BYD’s export volume hit 790.0k units (YoY +126%) in Jan-Nov 2025. Chery rose to 2nd place (225.9k units, +489%); brands like Galaxy and Baojun saw over 200% YoY growth. MG and Tesla experienced ranking fluctuations.

ThinkerCar Data

chosen by over 200 renowned global enterprises