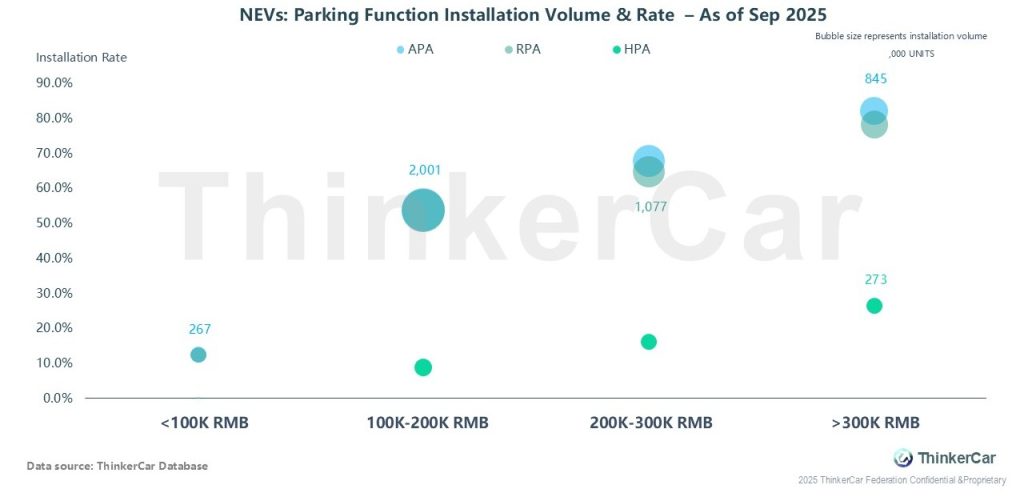

By Sep 2025, NEVs show hierarchical parking function differences: RPA boasts an 80% installation rate above 300K RMB, a mid-to-high-end “technical standard”; APA hits ~50% in 100K-200K RMB, dominating low-to-mid-end; HPA, a high-level function, reaches ~25% above 300K RMB, targeting high-end.

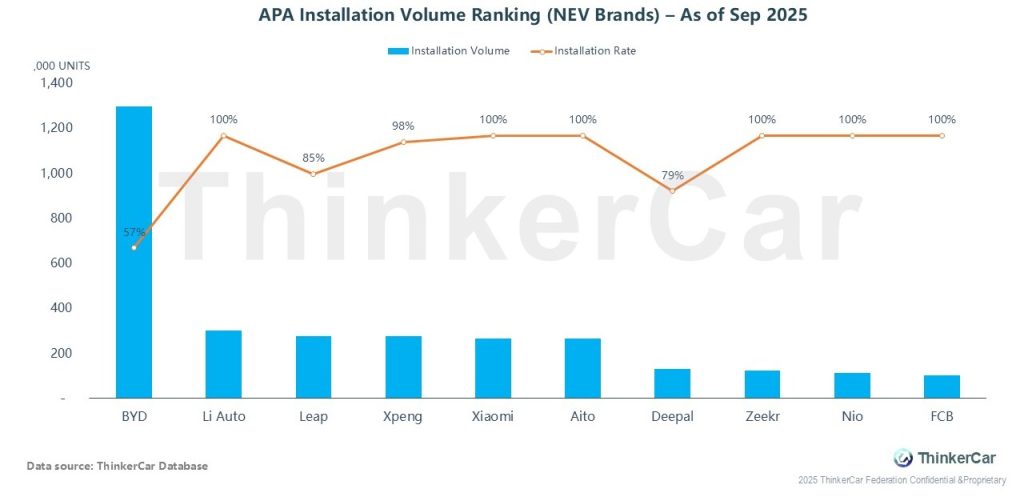

As of Sep 2025, NEV brands show divergence in APA: BYD leads in installation volume with over 1,200K units but only 57% rate; Li Auto, Xiaomi, etc. achieve 100% rate (full-line standard equipment); with Xpeng at 98%, Leap 85%, Deepal 79%, forming a pattern of “BYD leading in scale, most mid-to-high-end brands with full-line standardization”

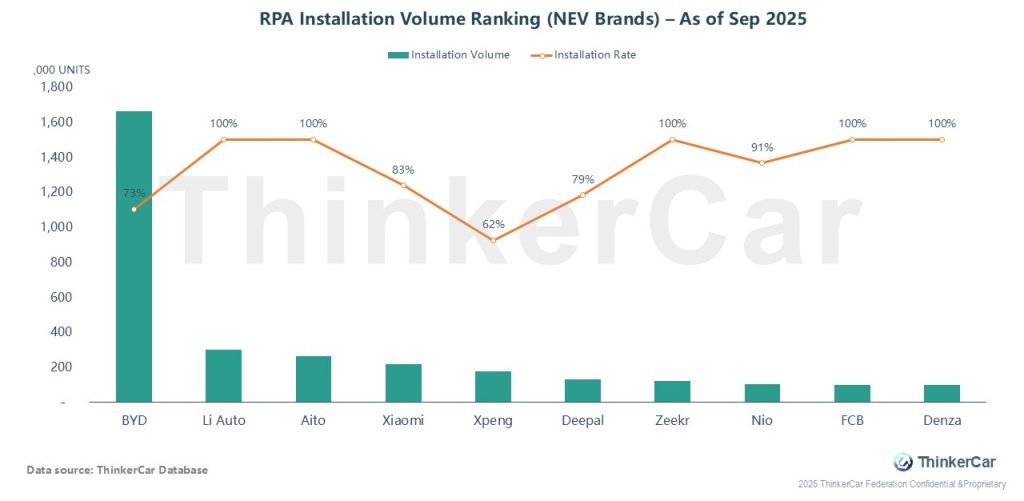

As of Sep 2025, NEV brands differ in RPA: BYD leads with 1.6K+ units (73% rate); Li Auto, Aito, Zeekr, Nio hit 100% (full-line standard); Xpeng (62%), Xiaomi (83%), Deepal (79%) follow, with BYD leading in scale and most mid-high brands going full-line standard.

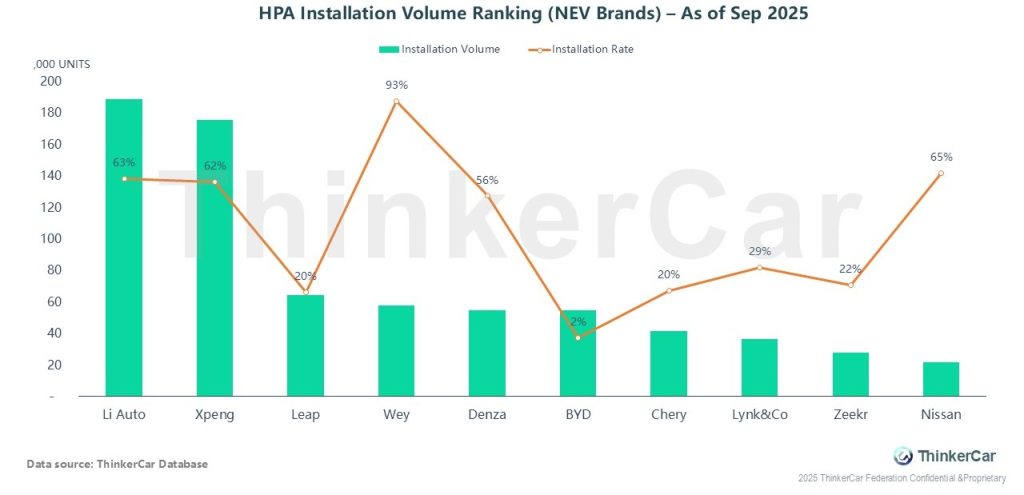

As of Sep 2025, NEV brands show significant divergence in HPA deployment: Li Auto and Xpeng lead in volume with ~190K and ~180K units; Wey stands out with a 93% installation rate (full-line standard), Nissan leads JV brands with a 65% rate; BYD, despite large scale, has only 2% HPA rate.

ThinkerCar Data

chosen by over 200 renowned global enterprises