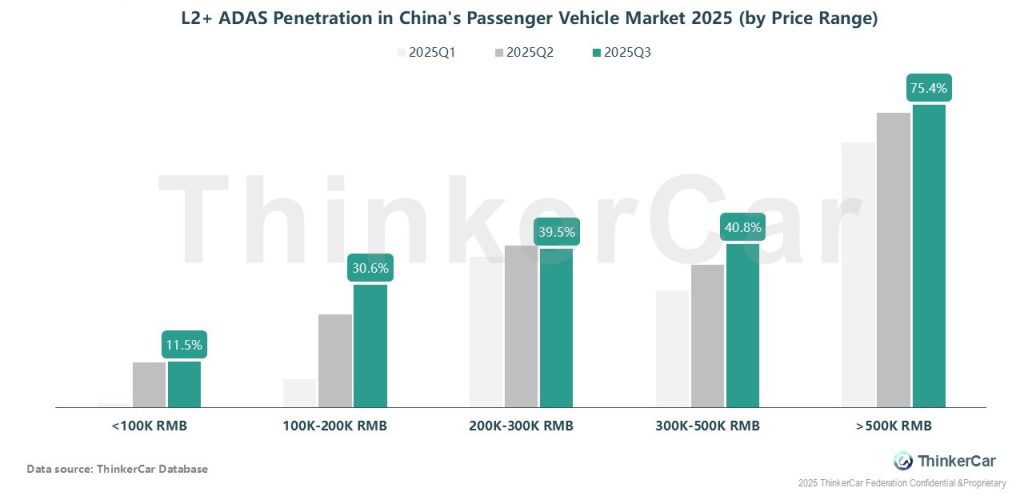

In 2025, the penetration rate of L2+ ADAS in China’s passenger vehicles increases significantly as price rises. It reaches 75.4% for vehicles over 500K RMB but only 11.5% for those under 100K RMB. All price segments see quarterly growth, with the 200K-500K RMB mid-range segment becoming the core of popularization, while the sub-100K RMB segment needs to break cost bottlenecks.

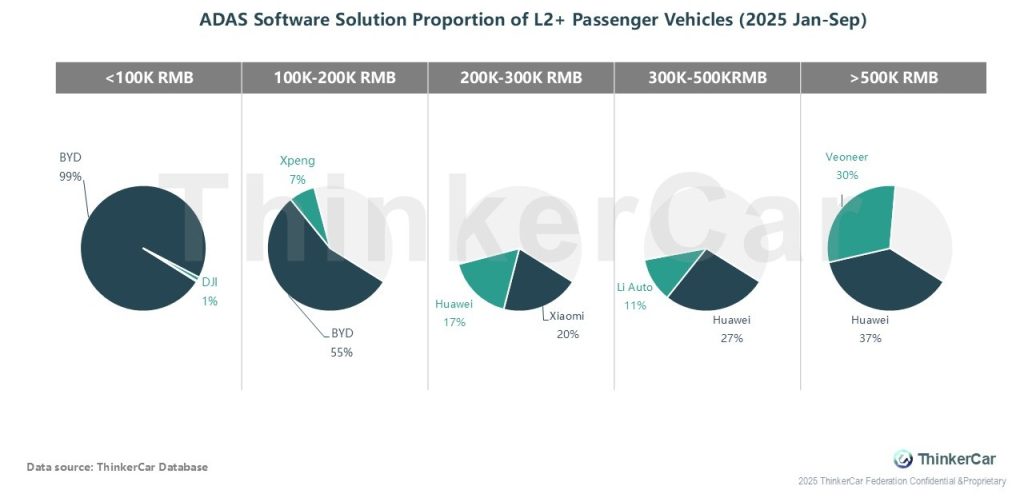

In Jan-Sep 2025, among ADAS software solutions for L2+ passenger vehicles in China, BYD dominates segments below 200K RMB, accounting for 99% in the sub-100K RMB range and 55% in the 100K-200K RMB range. In the 200K-300K RMB segment, Xiaomi and Huawei compete fiercely. For segments above 300K RMB, Huawei takes the leading position.

ThinkerCar Data

chosen by over 200 renowned global enterprises