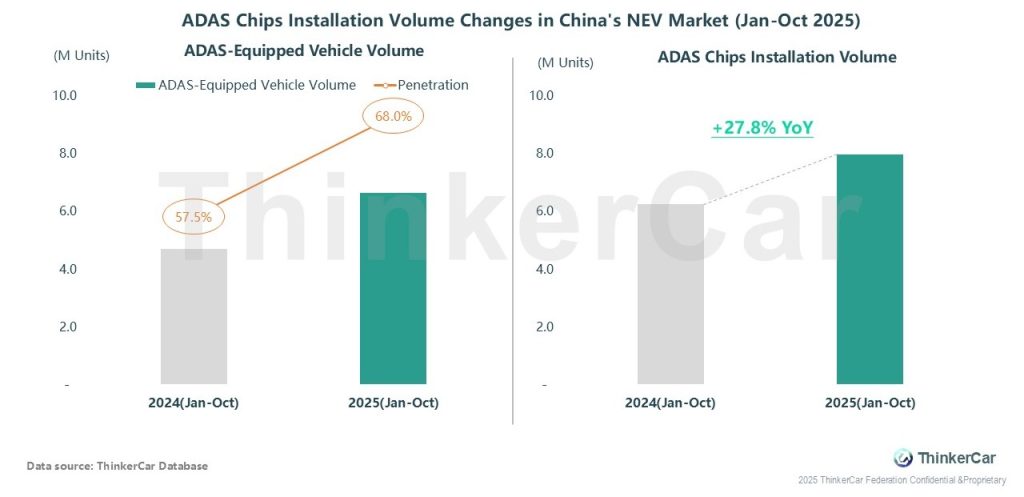

In the first 10 months of 2025, ADAS adoption in China’s NEV market has accelerated: the penetration rate rose from 57.5% (same period in 2024) to 68.0%, while ADAS chips installation volume saw a 27.8% YoY growth. Both its penetration and supporting demand are expanding at a faster pace.

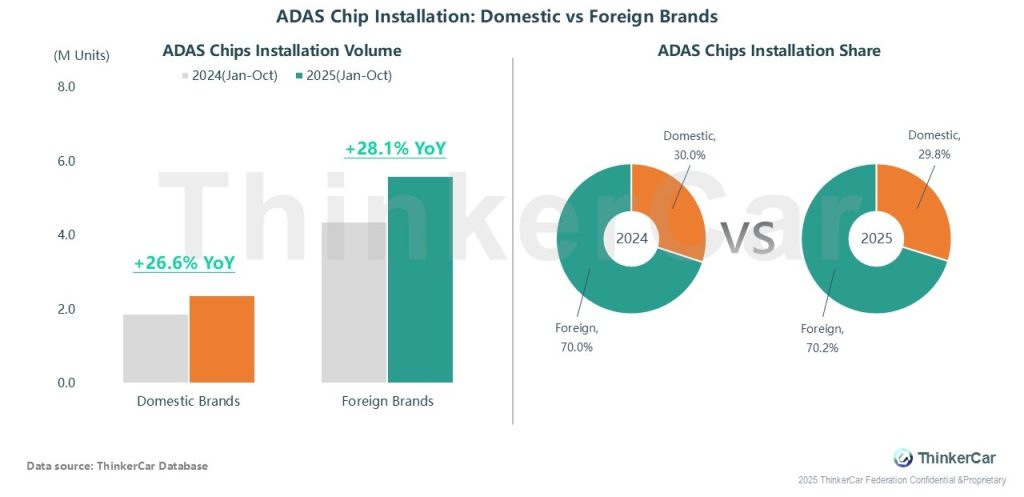

For ADAS chip installation by brand in Jan-Oct 2025: both domestic and foreign brands recorded YoY growth (26.6% for domestic, 28.1% for foreign). The share structure stayed stable: domestic brands took 29.8% (slightly down from 30.0% in 2024), while foreign brands held 70.2% (marginally up from 70.0%), remaining dominant.

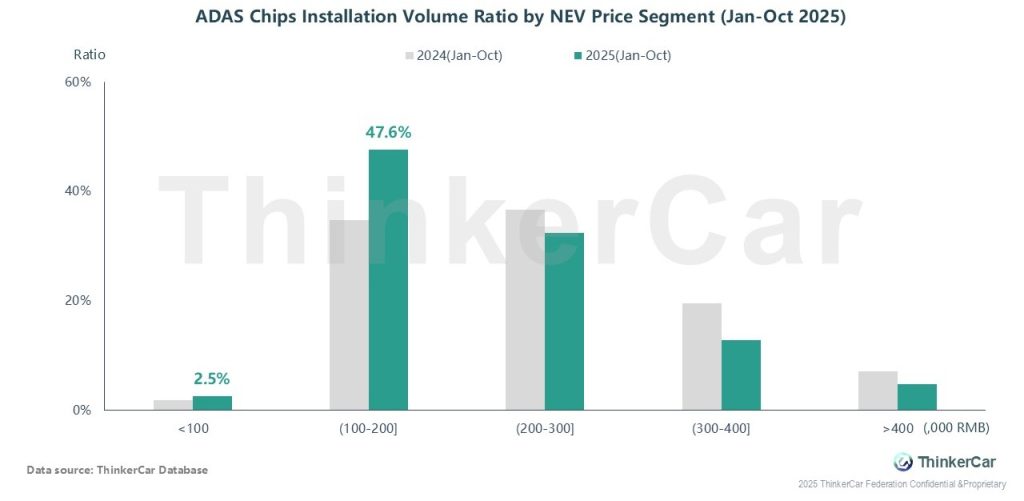

ADAS chip installation shifted toward affordable NEVs: the 100-200k RMB segment (top share) jumped from 34.8% (2024) to 47.6%, while higher-end segments saw declining shares.

This reflects ADAS’ rapid penetration into mass-market NEVs, making the affordable segment the key driver of chip demand growth.

In Jan-Oct 2025, the top 5 ADAS chip suppliers in China’s NEV market showed mixed trends: Nvidia ranks first, with installation volume up 116% YoY and 42.4% market share (+17.3 pct); Horizon Robotics, Tesla and Mobileye recorded 4%-32% YoY declines, and their market shares dropped by 5.8, 4.6 and 8.7 pct respectively; HiSilicon grew 54% YoY, holding 7.0% market share (+1.2 pct)

ThinkerCar Data

chosen by over 200 renowned global enterprises