In 2025, domestic sales of China’s NEVs totaled ~12.8 million units. The market maintained positive YoY growth for the full year, but the YoY growth rate followed a “high early, low late” trend: >27% at the start of the year, narrowed in H2, and fell to 2.7% in December. This reflects stabilized growth after market expansion.

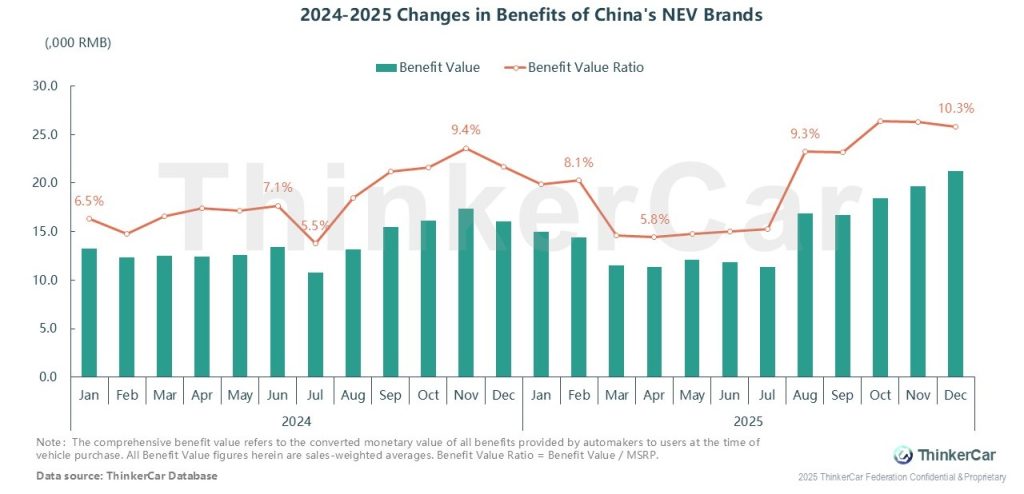

In 2024, the comprehensive Benefit Value fluctuated between 10-17K RMB, with the maximum Benefit Value Ratio hitting 9.4%. In 2025, the Benefit Value climbed to 21K RMB in Dec, while the Ratio surged to 10.3% by year-end—both major brands’ benefit investment and benefit value ratios saw a notable uptick.

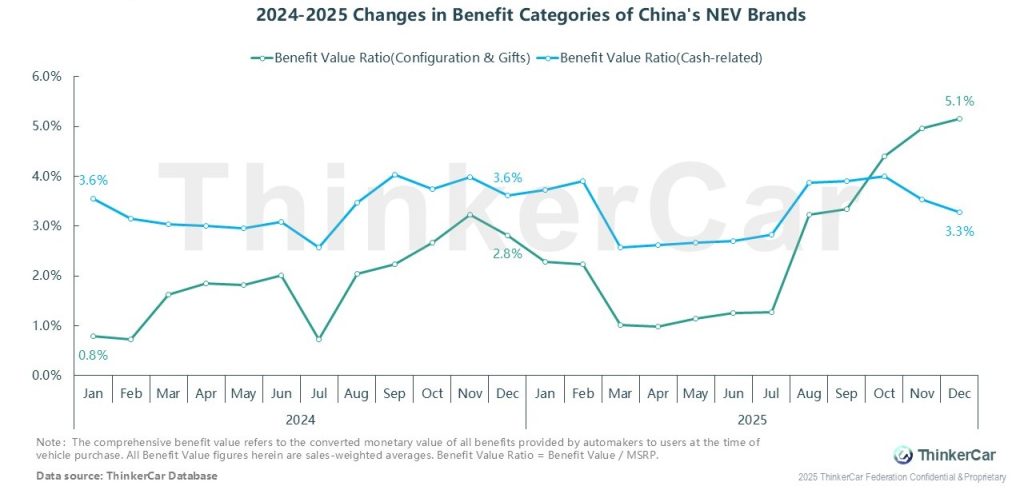

In 2024, cash-related benefit ratios for NEV brands stayed around 3%-4%: intense price wars pushed brands to use cash discounts for sales. By 2025, with price wars easing and user demand for experience and differentiation rising, brands reduced cash discounts, shifting to non-cash perks (e.g., configuration upgrades). Non-cash benefit ratios rose and overtook cash ones—marking the industry’s shift from price to value competition.

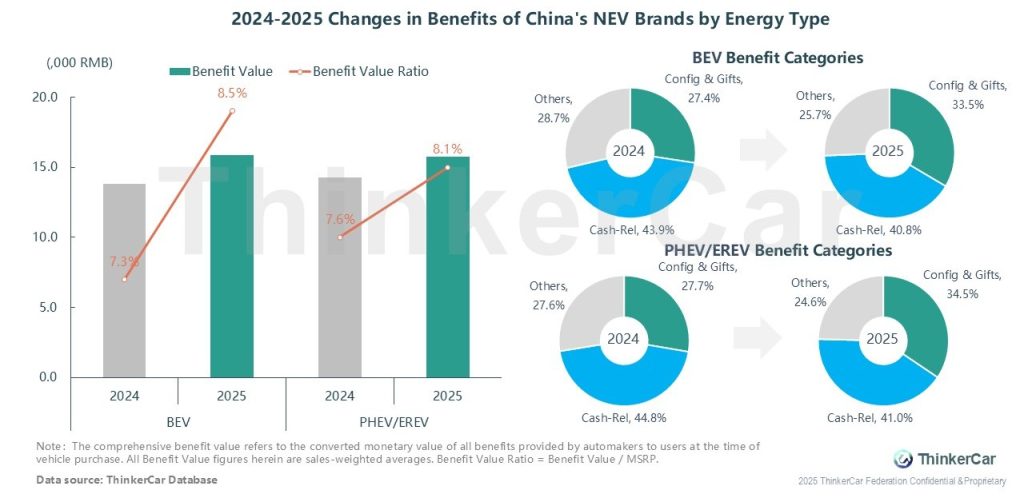

Among China’s NEV brands (2024-2025), BEV and PHEV/EREV differ in benefits in two key ways: BEV’s benefit value ratio rose more than 1 pct (7.3%→8.5%), outpacing PHEV/EREV’s 0.5pct gain (7.6%→8.1%); PHEV/EREV also made more aggressive structure tweaks, with its Config & Gifts share jumping 6.8pct (27.7%→34.5%) and Cash-Rel share falling 3.8pct (44.8%→41.0)—both larger shifts than BEV’s.

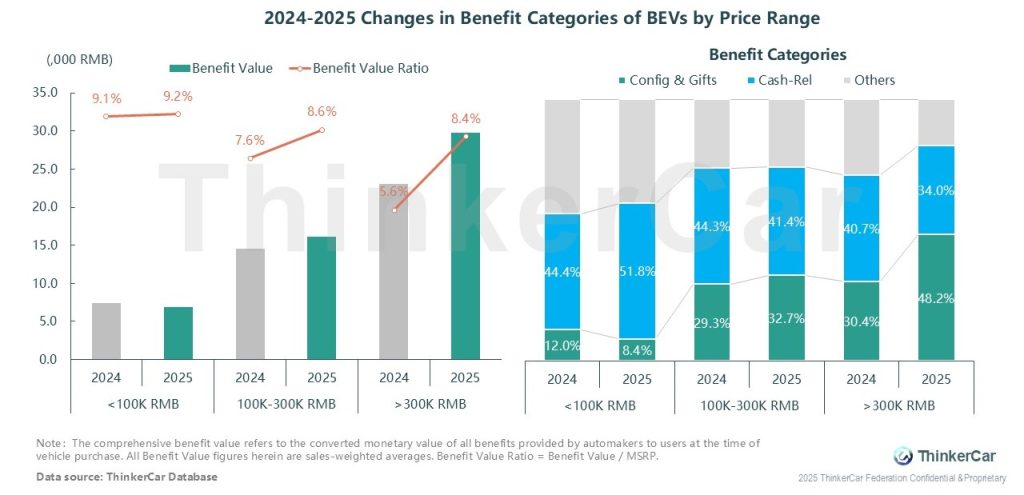

From 2024-2025, BEV benefits varied by price range: <100K RMB models saw slight rises in benefit value and its ratio (9.1%→9.2%), with Cash-Rel share up (44.4%→51.8%); 100K-300K RMB models had notable benefit value growth (ratio:7.6%→8.6%), Config & Gifts up, Cash-Rel down; >300K RMB models saw sharp gains (ratio:5.6%→8.4%), Config & Gifts surging (30.4%→48.2%) while Cash-Rel shrank.

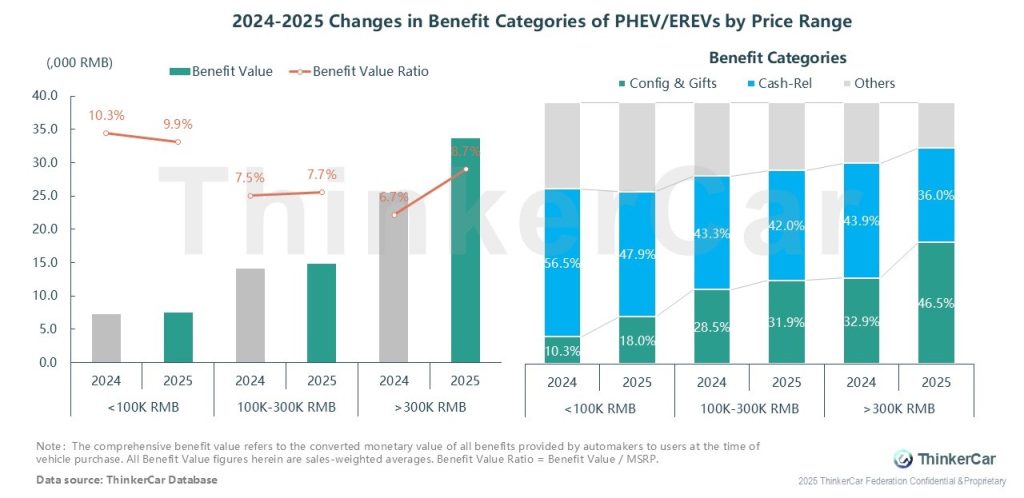

2024-2025 PHEV/EREV benefits by price range: <100K: benefit value up, ratio slight dip (10.3%→9.9%), Config & Gifts up (10.3%→18.0%), Cash-Rel down (56.5%→47.9%); 100K-300K: benefit value/ratio minor rise (7.5%→7.7%), category tweaks; >300K: sharp gains in value/ratio (6.7%→8.7%), Config & Gifts surging (32.9%→46.5%), Cash-Rel dropping (43.9%→36.0%).

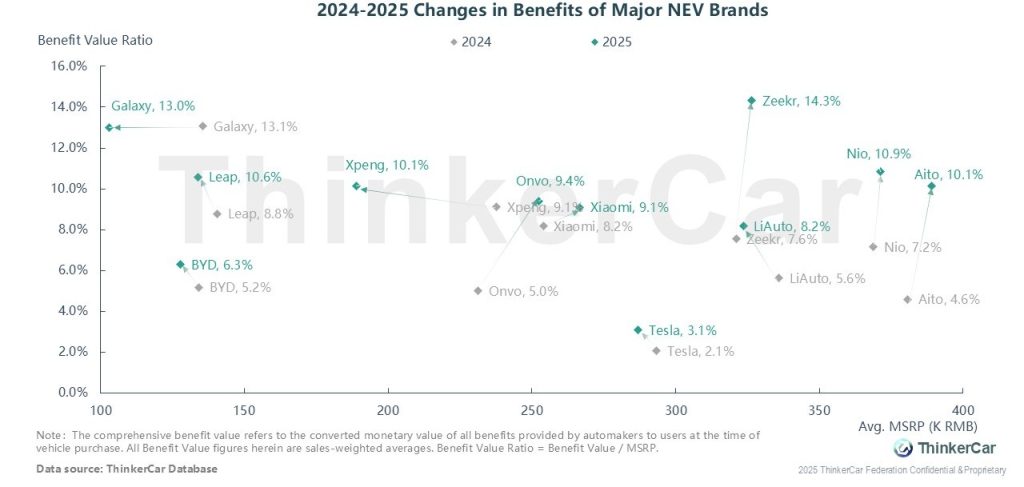

Among major brands (2024–2025): Galaxy’s Benefit Value Ratio stayed around 13%; BYD’s rose from 5.2% to 6.3%; Xpeng’s edged up to 10.1% with MSRP falling from ~230K to under 200K; Onvo lifted both price and ratio. Among >300K mid-to-high-end brands, Zeekr posted the sharpest gain (7.6%→14.3%), LiAuto, Nio and Aito climbed to 8.2%, 10.9% and 10.1% respectively, while only Tesla maintained a relatively low ratio.

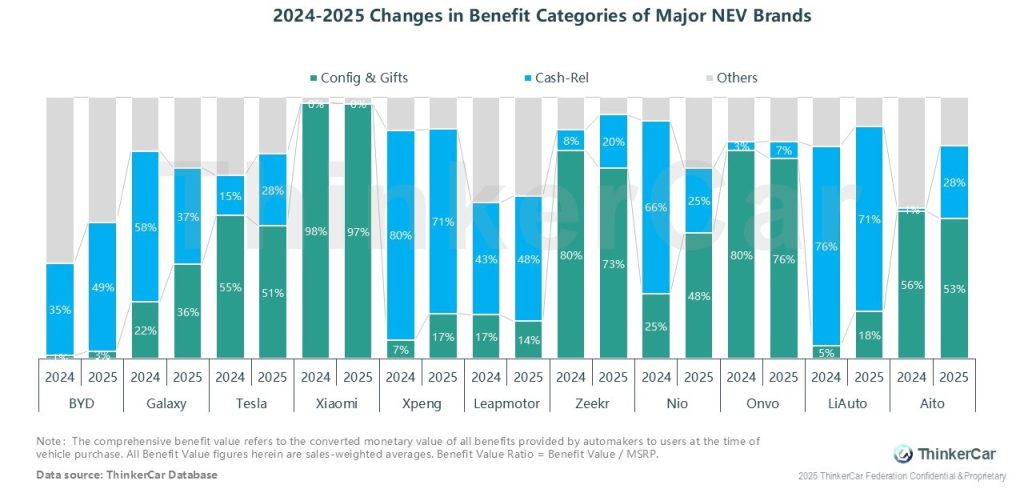

2024–2025, major NEV brands adjusted benefit category shares: most shifted toward “Config & Gifts” while cutting “Cash-Rel”. Galaxy (Cash-Rel: 58%→37%; Config: 22%→36%), Nio (Cash-Rel: 65%→25%; Config: 25%→48%) and LiAuto (Cash-Rel: 76%→71%; Config: 5%→18%); Xpeng’s Cash-Rel dipped (80%→71%) as Config rose (7%→17%). A few (e.g., BYD) upped Cash-Rel (35%→49%) alongside Config (4%→22%); Xiaomi stayed heavy on Config (over 97%). Overall, brands leaned more into Config & Gifts, with only a few keeping high Cash-Rel shares.

ThinkerCar Data

chosen by over 200 renowned global enterprises