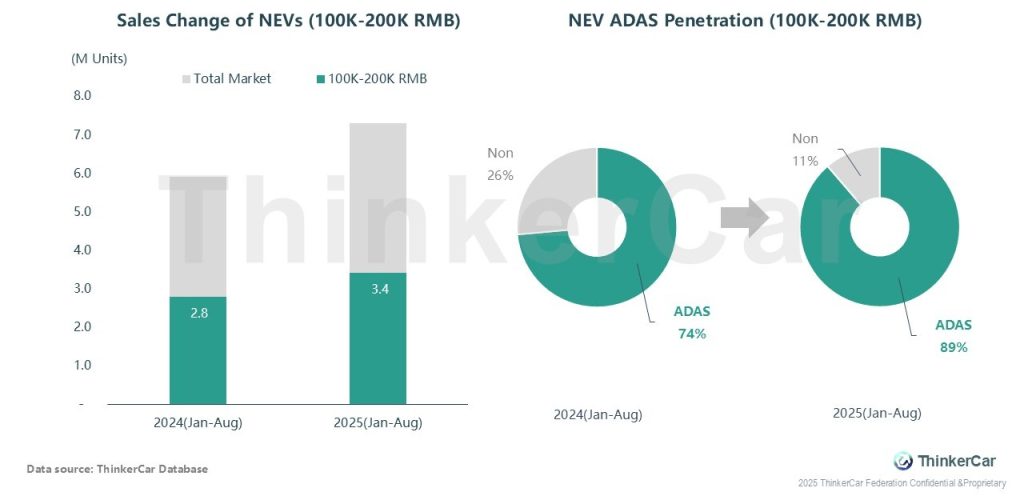

The 100K-200K RMB segment is the most important one in China’s NEV market. In the first eight months of 2025, cumulative sales in this segment reached 3.4 million units, a YoY increase of 22.8%, accounting for 47% of the total NEV market. Meanwhile, the proportion of NEVs equipped with ADAS functions rose from 74% last year to 89% this year, with penetration rate increasing by 15 pct.

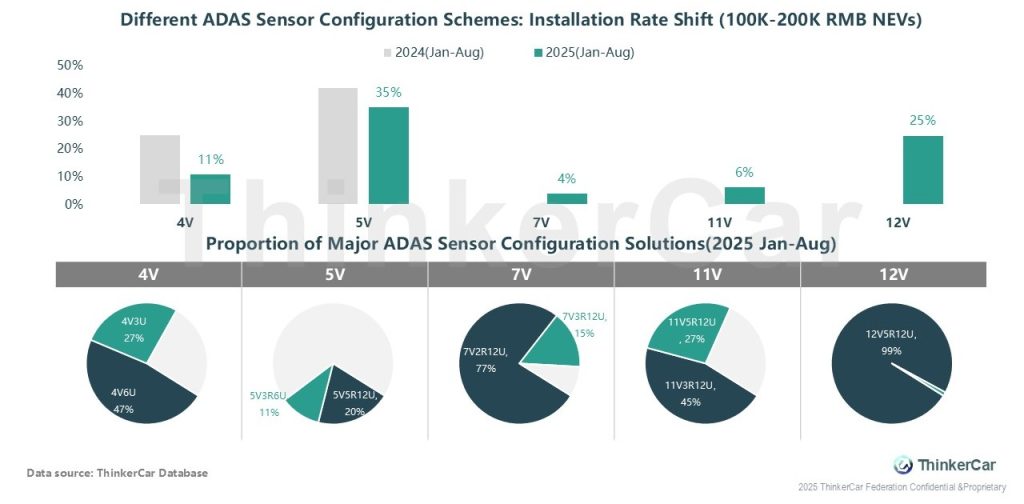

In the 100K-200K RMB NEV market, the ADAS sensor configuration installation rates for the 4V/5V series dropped from Jan-Aug 2024 to the same period in 2025, while those for the 12V series rose sharply. Moreover, 5V5R12U and 5V3R6U made up 31% of the total ADAS sensor configurations, with 12V5R12U dominating the 12V series and 7V2R12U leading the 7V series—reflecting the concentrated use of specific ADAS sensor configurations.

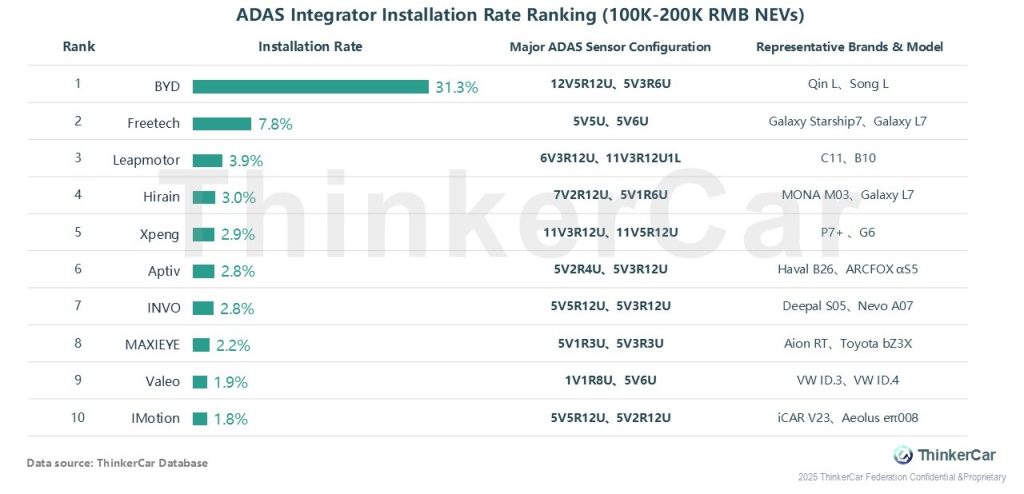

In the 100K-200K RMB NEV market, BYD—an ADAS integrator—benefits from its leading sales performance and achieves an ADAS installation rate as high as 31.3%, with its 12V5R12U sensor configuration solution accounting for 78%. Ranking 2nd is Freetech, which mainly provides ADAS solutions for the Geely Galaxy brand. Securing third place is Leapmotor, another automaker with strong sales; its ADAS installation rate stands at 3.9%, and 6V3R12U is its primary sensor configuration solution. Additionally, XPeng has entered the top 10 in this segment, ranking 5th.

ThinkerCar Data

chosen by over 200 renowned global enterprises