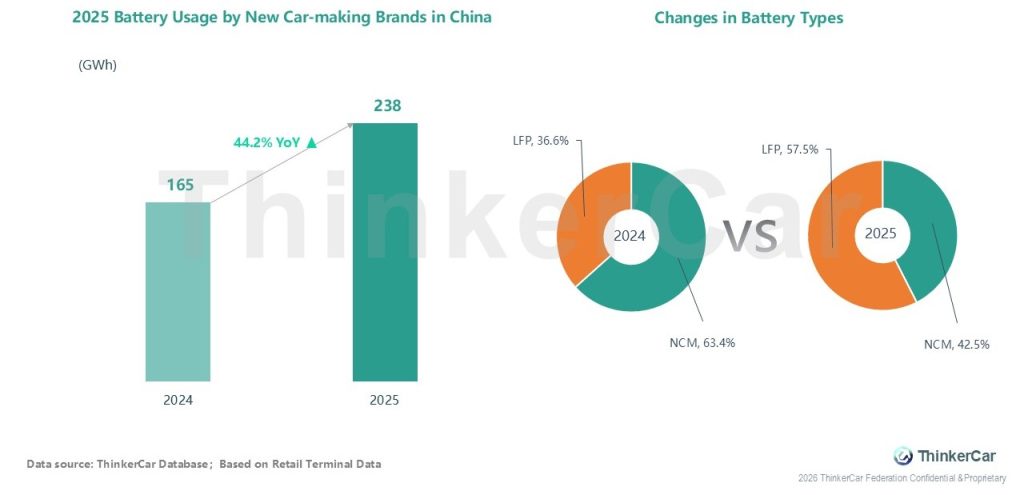

In 2025, battery usage by Chinese New Car-making Brands hit 238 GWh, up 44.2% year-on-year from 165 GWh in 2024. The battery type mix shifted sharply: LFP’s share jumped from 36.6% to 57.5%, surpassing NCM (which fell from 63.4% to 42.5%) as the mainstream choice, driven by the industry’s focus on cost efficiency and safety.

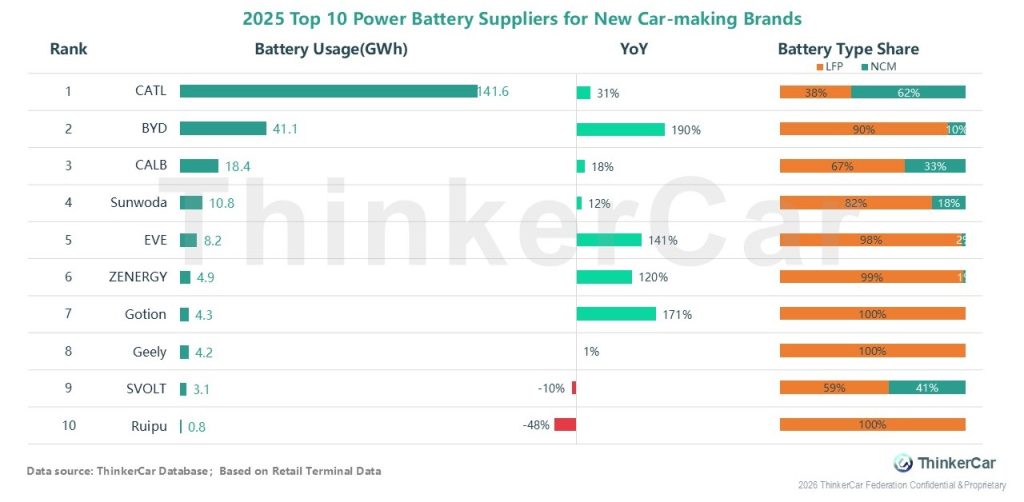

Against this growth, the supplier landscape stayed highly concentrated. CATL led with 141.6 GWh, accounting for nearly 60% of the total, followed by BYD (41.1 GWh) and CALB (18.4 GWh). BYD posted explosive 190% year-on-year growth backed by a 90% LFP ratio, while other fast-growing suppliers including EVE (141%), Gotion (171%) and ZENERGY (120%) also relied heavily on LFP, with most exceeding 98%.

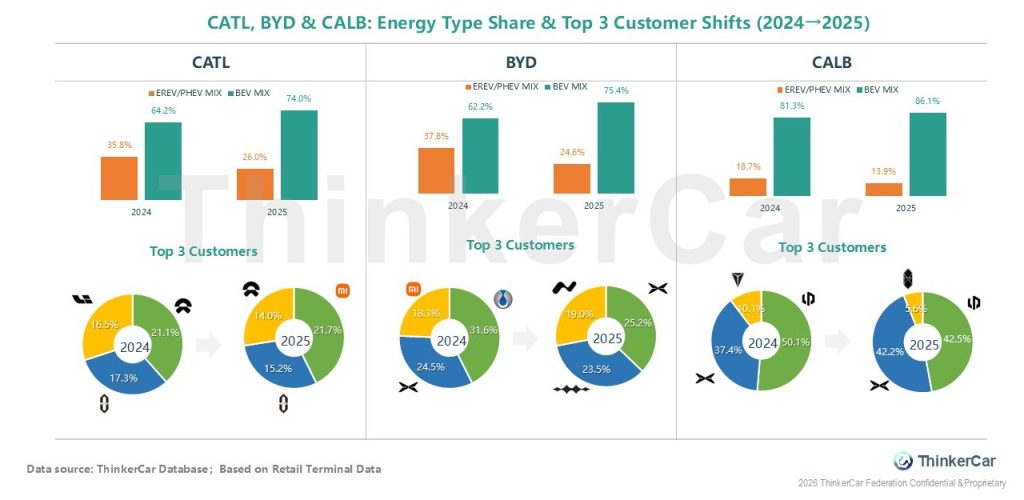

The top three battery suppliers all lifted their BEV proportions and adjusted their core customers. CATL’s BEV mix rose from 64.2% to 74.0%, with LiAuto dropping out of its top 3, which shifted to Nio, Xiaomi and Aito. BYD’s top three customers became Xpeng, FCB and Onvo, replacing Denza and Xiaomi. For CALB, its top customers turned to Leap, Xpeng and Luxeed, with Luxeed taking Deepal’s place.

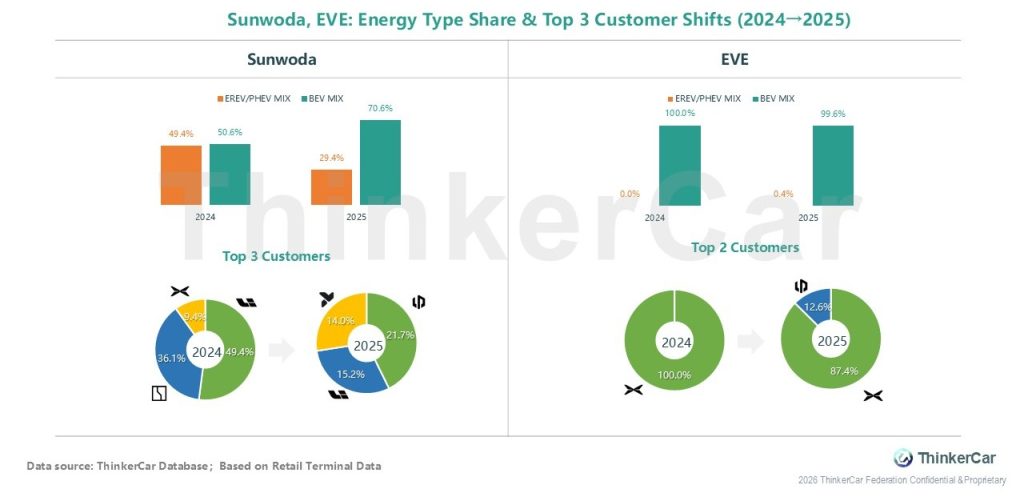

Sunwoda and EVE, ranked fourth and fifth, also revised their customer portfolios. Sunwoda’s BEV share increased to 70.6%, with its top 3 customers changing from LiAuto, Zeekr, Xpeng to Leapmotor, LiAuto and Firefly. EVE maintained a nearly 100% BEV ratio and expanded its customer base by adding Leapmotor alongside Xpeng.

ThinkerCar Data

chosen by over 200 renowned global enterprises