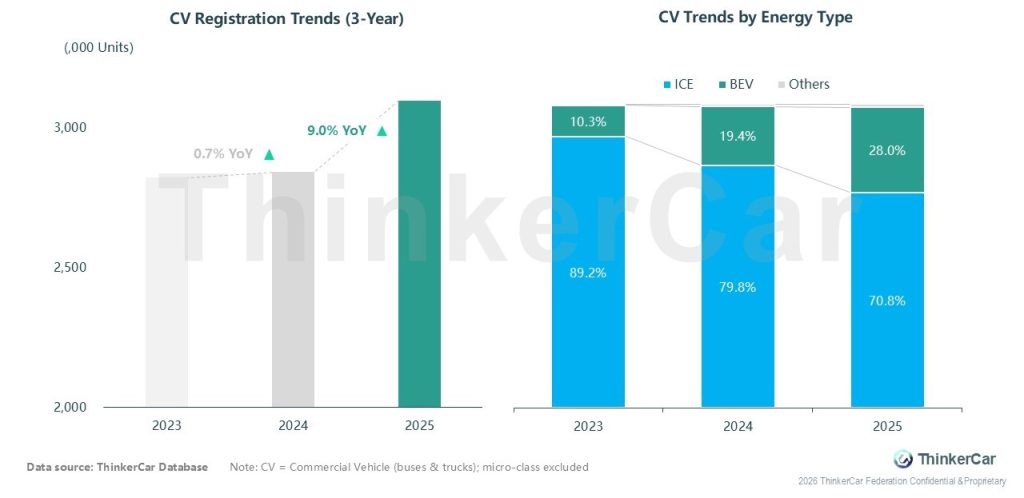

Over the past three years, the commercial vehicle market has seen both volume acceleration and structural shifts: Registrations grew 0.7% YoY in 2023–2024, then surged 9.0% in 2025 to exceed 3 million units. Meanwhile, the energy mix shifted dramatically: ICE share fell from 89.2% (2023) to 70.8% (2025), while BEV share jumped from 10.3% to 28.0%, highlighting rapid electrification

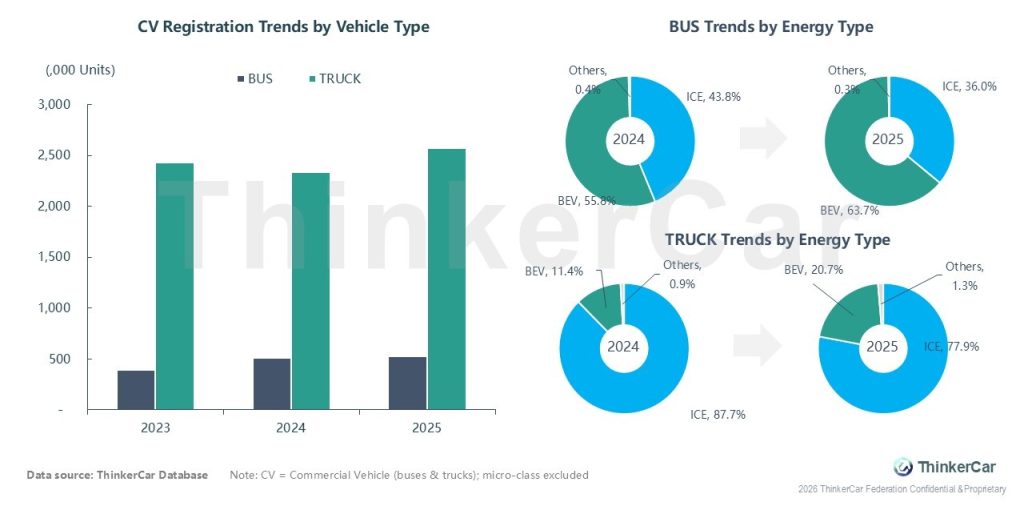

Over the past 3 years, the CV market has seen truck-driven growth and stable bus volumes—2025 truck registrations topped 2.55 million while buses stayed at ~500k—and electrification advanced, with BEV buses reaching 63.7% share (up from 55.8%) and BEV truck share doubling to 20.7%

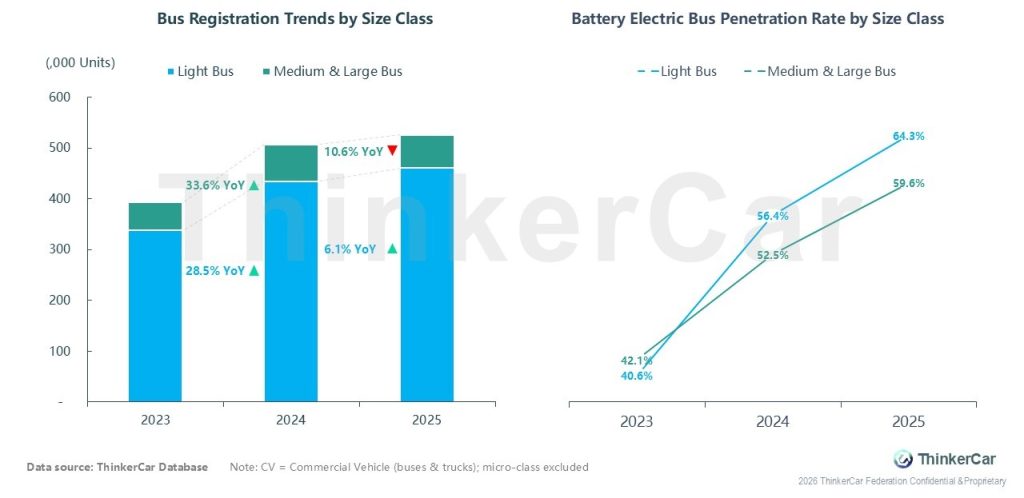

Over the past 3 years, light bus registrations climbed 28.5% in 2024 and 6.1% in 2025, topping 460k units; medium & large bus registrations surged 33.6% in 2024, then fell 10.6% YoY in 2025, stabilizing at ~60k units. BEB penetration rose sharply for both: light buses hit 64.3% (from 40.6%), medium & large buses 59.6% (from 42.1%), with light buses leading electrification

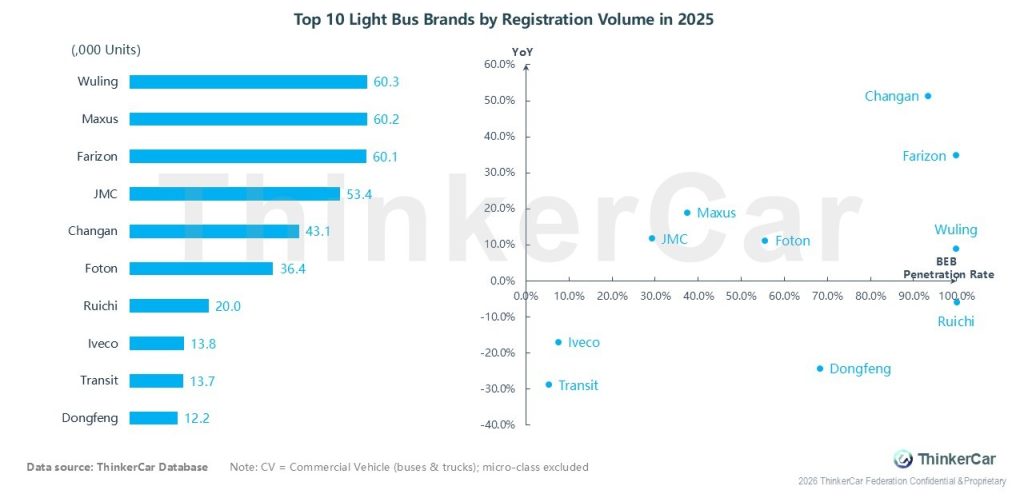

In 2025, Wuling led the light bus market with 60.3K registrations, followed by Maxus (60.2K) and Farizon (60.1K); Changan recorded the strongest YoY growth of over 50%, while Transit, Iveco and Dongfeng saw declines, and Ruichi achieved near-100% BEB penetration, with Wuling, Farizon and Changan also showing high electrification levels

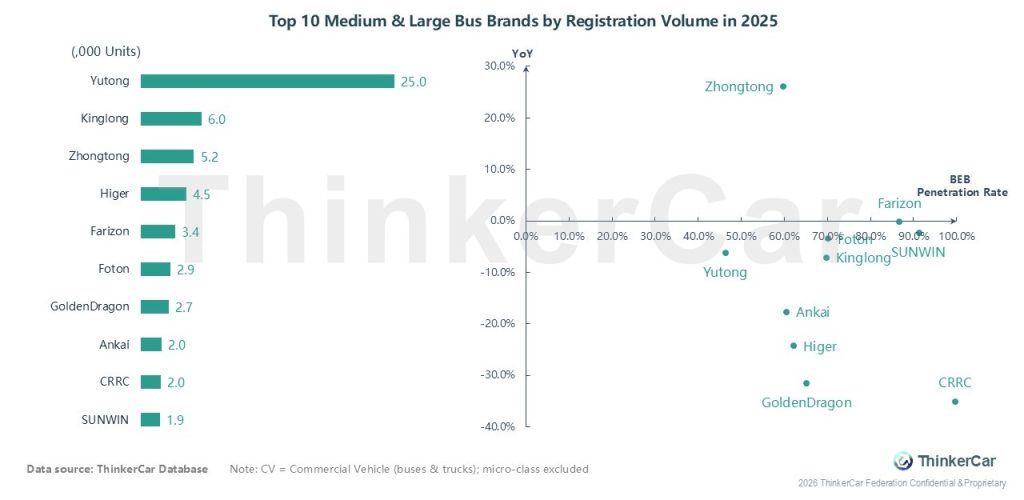

In 2025, Yutong dominated the medium & large bus market with 25.0K registrations, followed by Kinglong (6.0K) and Zhongtong (5.2K); Zhongtong recorded the only positive YoY growth of over 25%, while most other brands declined, and SUNWIN and Farizon achieved near-100% BEB penetration, with Yutong and Kinglong also showing high electrification levels

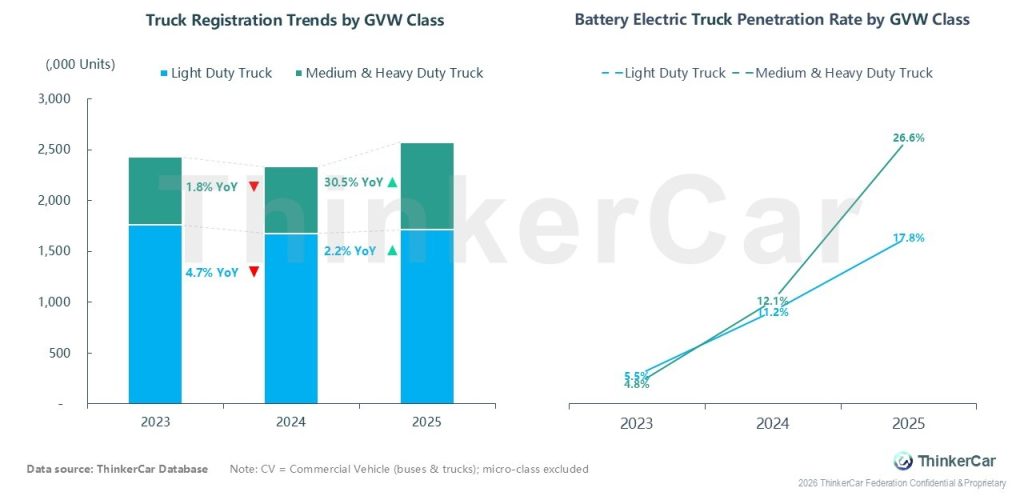

In 2023–2025, light duty truck registrations fell 4.7% YoY in 2024 then rose 2.2% YoY in 2025, while medium & heavy duty trucks declined 1.8% YoY in 2024 before surging 30.5% YoY in 2025; battery electric penetration increased sharply for both classes, reaching 17.8% (from 5.5%) for light duty trucks and 26.6% (from 4.8%) for medium & heavy duty trucks by 2025

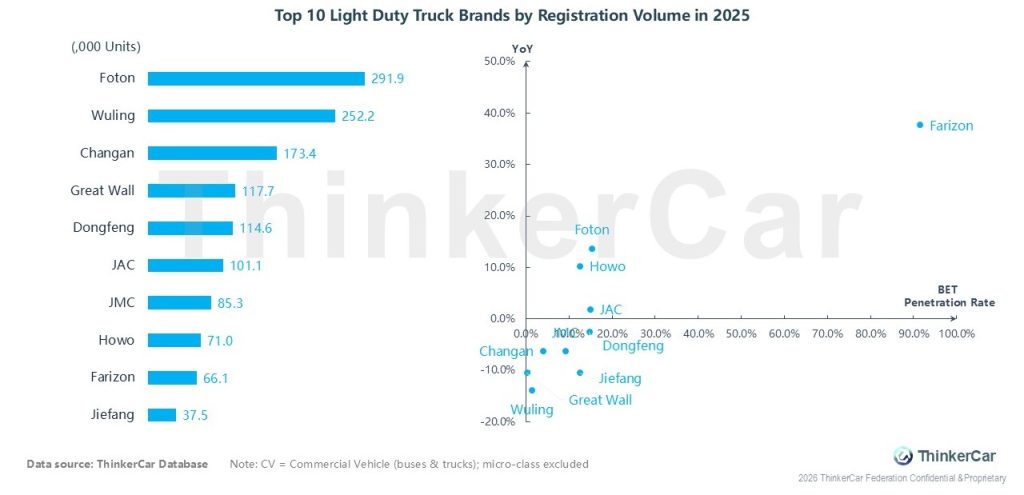

In 2025, Foton led the light duty truck market with 291.9K registrations, followed by Wuling (252.2K) and Changan (173.4K); Farizon achieved the strongest YoY growth of nearly 40%, while Wuling and Great Wall saw declines, and Farizon also posted the highest BET penetration among the top brands

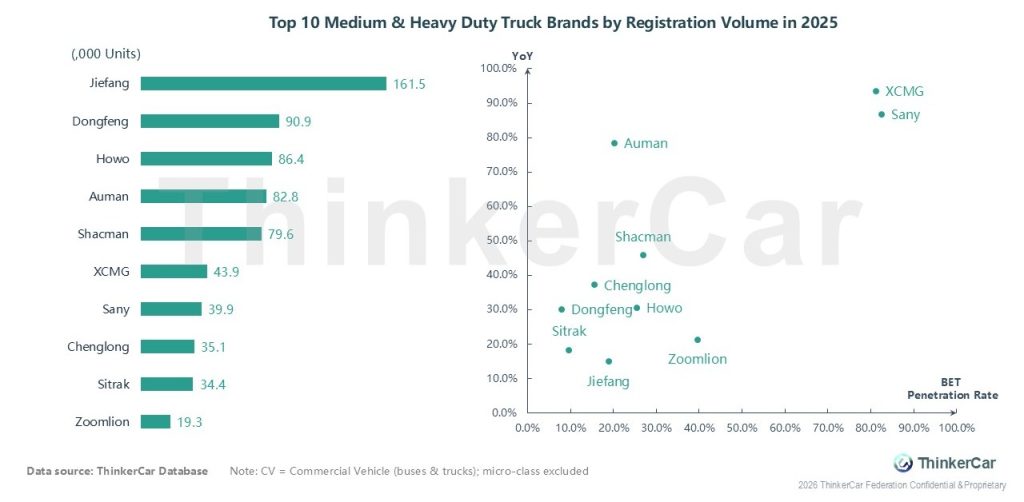

In 2025, Jiefang led the medium & heavy duty truck market with 161.5K registrations, followed by Dongfeng (90.9K) and Howo (86.4K); XCMG and Sany achieved the strongest YoY growth of nearly 100%, and also posted the highest battery electric truck (BET) penetration rates, approaching 100%

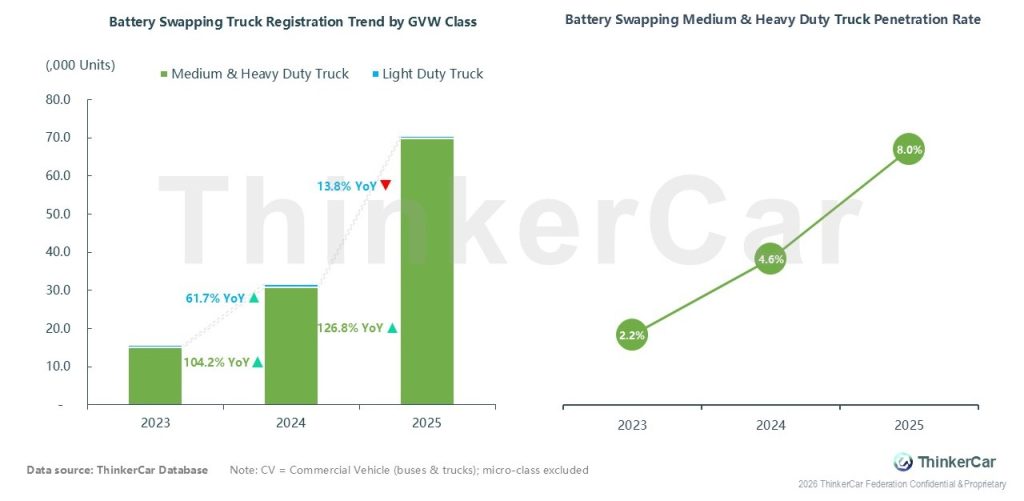

Battery swapping adoption in trucks was heavily concentrated in the medium & heavy duty segment: registrations surged with 104.2% YoY growth in 2024 and 126.8% YoY growth in 2025, reaching 70K units by 2025, while light duty battery swapping truck registrations declined 13.8% YoY in 2025; penetration for medium & heavy duty trucks also rose steadily from 2.2% in 2023 to 8.0% in 2025

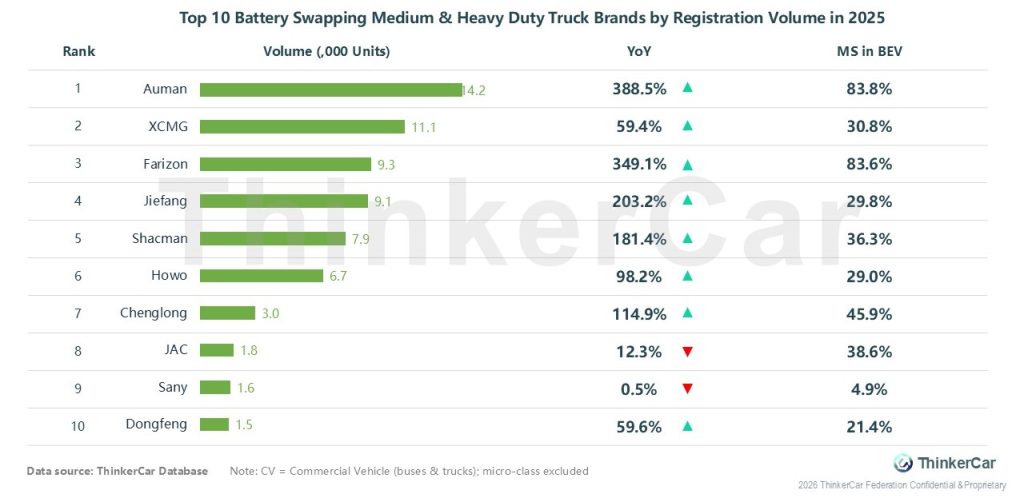

In 2025, Auman led the battery swapping medium & heavy duty truck market with 14.2K registrations and 388.5% YoY growth, followed by XCMG (11.1K) and Farizon (9.3K); notably, Auman and Farizon saw battery swapping models account for over 83% of their own battery electric heavy duty trucks, while most top brands posted strong YoY growth, with only JAC and Sany experiencing declines

ThinkerCar Data

chosen by over 200 renowned global enterprises