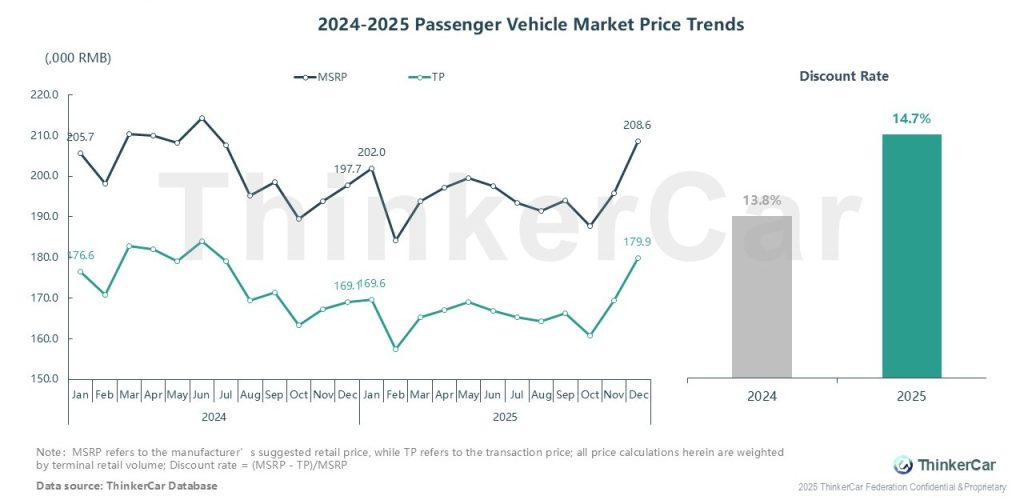

In 2024, PV MSRP and TP fluctuated in sync, with an average discount rate of 13.8%. In 2025, both prices staged a V-shaped rebound: MSRP reached a period high of 208.6k RMB by year-end, TP recovered to 179.9k RMB, and the average discount rate rose to 14.7%, with the rate peaking early in the year then falling, reflecting reduced terminal promotions as the market warmed

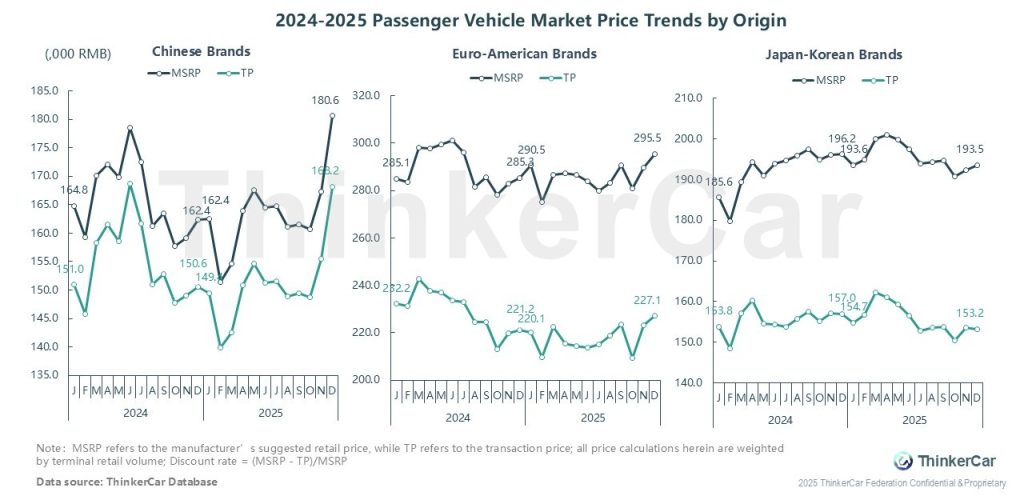

From 2024 to 2025, passenger vehicle prices and discounts diverged sharply across the three origin groups: Chinese brands saw rising MSRP and TP with narrowing gaps (weaker discounts); Euro-American brands fluctuated at a high level with a large 60K–70K RMB gap (strong discounts); Japan-Korean brands had mild price swings and stable 35K–45K RMB gaps

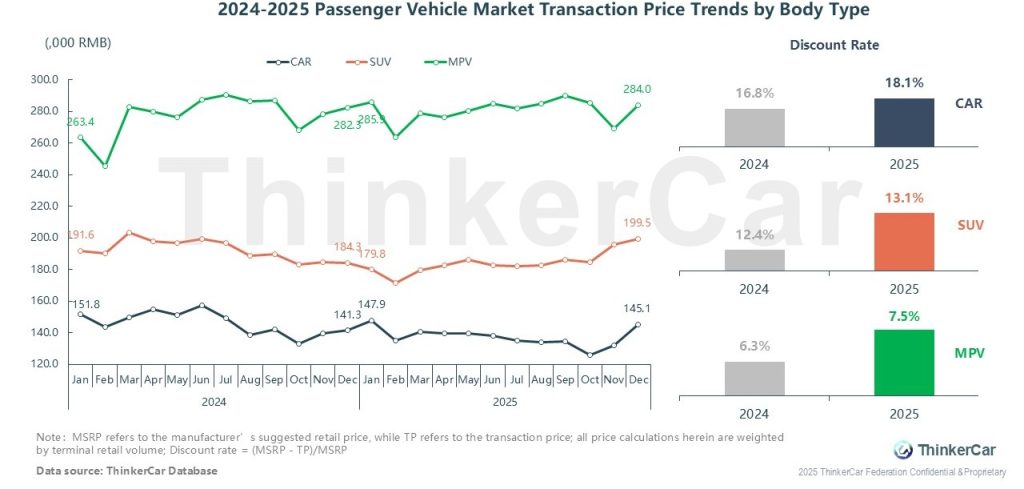

In 2024–2025, TP and discount rates of passenger vehicles diverged by body type: MPVs stayed the priciest, rebounding to 284.0k RMB in 2025 after fluctuations, with discounts up from 6.3% to 7.5%; SUVs saw TP fluctuate between 179.8k and 199.5k RMB, discounts rising from 12.4% to 13.1%; cars saw TP fluctuate in the 140–150k RMB range, recovering to 145.1k RMB by year-end, with discounts climbing from 16.8% to 18.1%—the strongest and most sustained promotions among the three categories

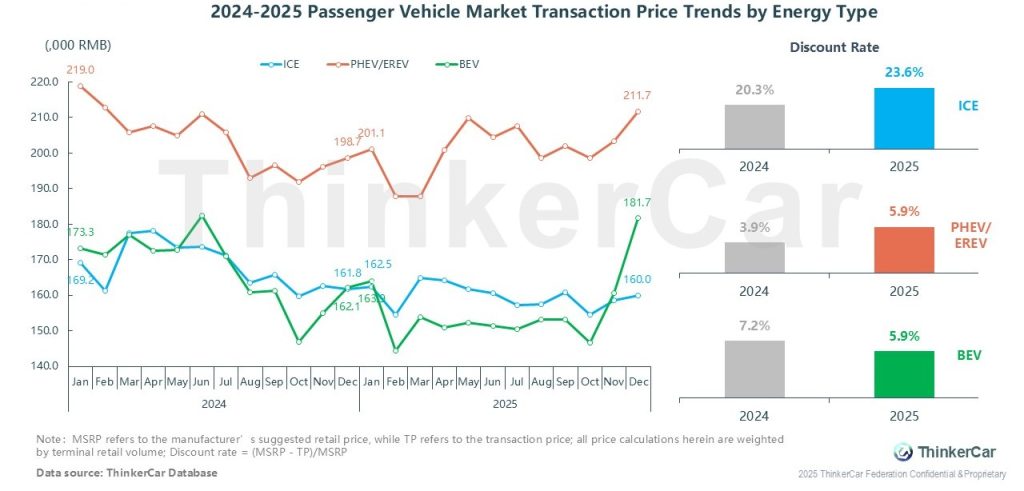

In 2024–2025, TP and discount rates of PVs diverged sharply by energy type: PHEV/EREV models stayed the priciest, rebounding in 2025 after fluctuations, with discounts up moderately from 3.9% to 5.9%; ICE vehicles saw TP fluctuate between 160k and 180k RMB, discounts climbing from 20.3% to 23.6% (strongest promotions); BEVs saw TP rebound sharply post-trough to 181.7k RMB by year-end, with discounts down from 7.2% to 5.9% as TP recovered

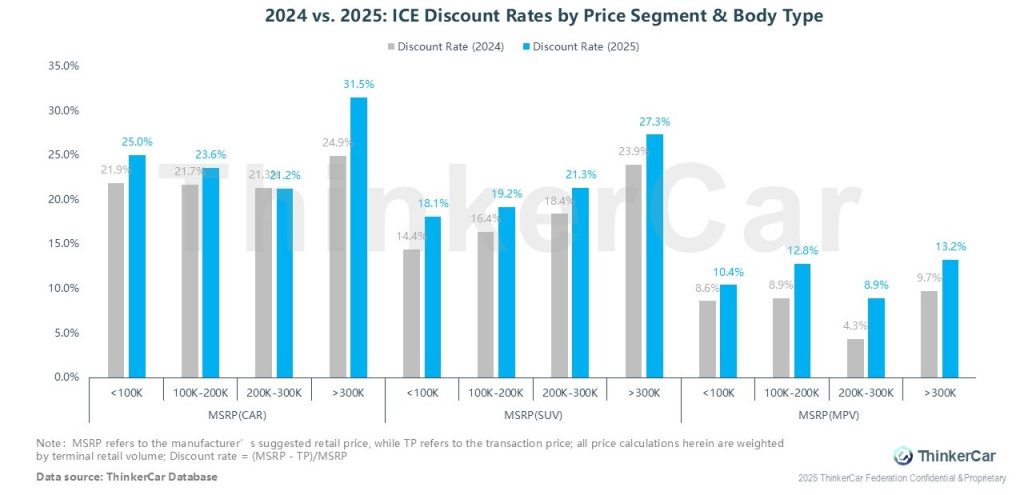

In 2025, discount rates for ICE vehicles across price segments and body types generally rose from 2024: cars saw the sharpest increase in the >300k segment (24.9% → 31.5%); SUV discounts climbed across all segments, with the >300k segment up from 23.9% to 27.3%; MPV discounts also rose, especially in the >300k segment (9.7% → 13.2%), reflecting stronger promotions for higher-priced models.

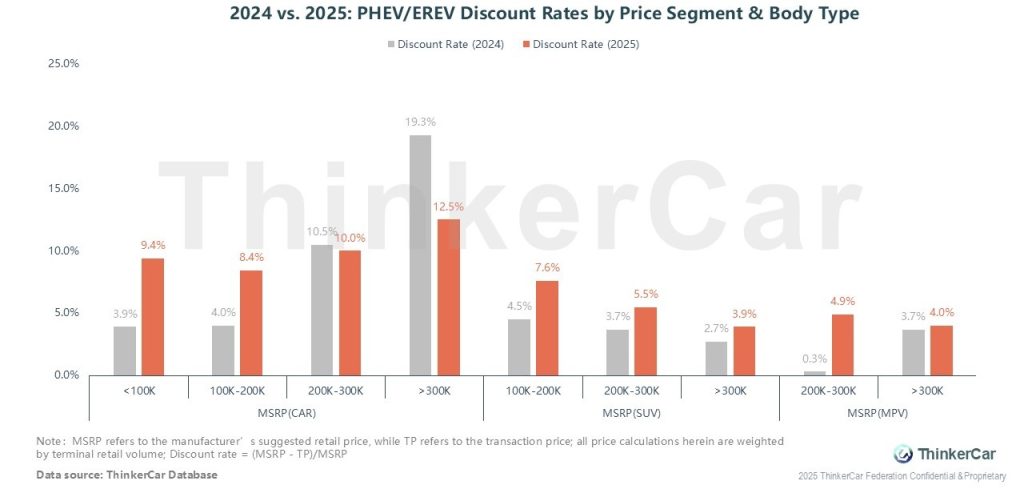

In 2025, discount rates for PHEV/EREV vehicles generally rose from 2024, with notable exceptions: car discounts in the >300k segment fell from 19.3% to 12.5%, while mid-to-low price car segments saw increases; SUV discounts climbed across all segments; MPV discounts in the 200k–300k segment surged from 0.3% to 4.9%, reflecting stronger promotions for mid-to-low priced models and reduced incentives for high-priced cars

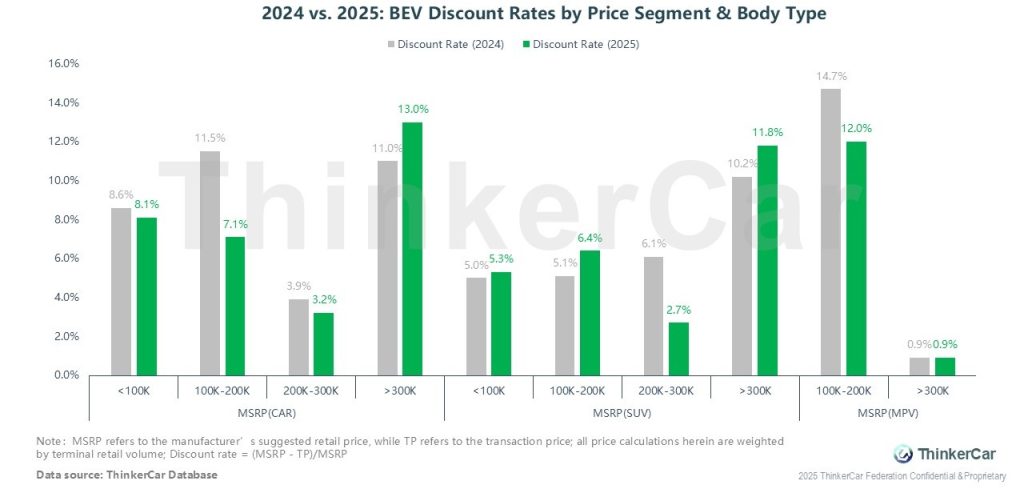

In 2025, BEV discount rates showed divergent trends: car discounts in the >300k segment rose from 11.0% to 13.0%, while mid-to-low price car segments saw declines; SUV discounts in the >300k segment increased from 10.2% to 11.8%, but fell from 6.1% to 2.7% in the 200k–300k segment; MPV discounts in the 100k–200k segment dropped from 14.7% to 12.0%, reflecting stronger promotions for high-priced models and reduced incentives for some mid-to-low priced ones

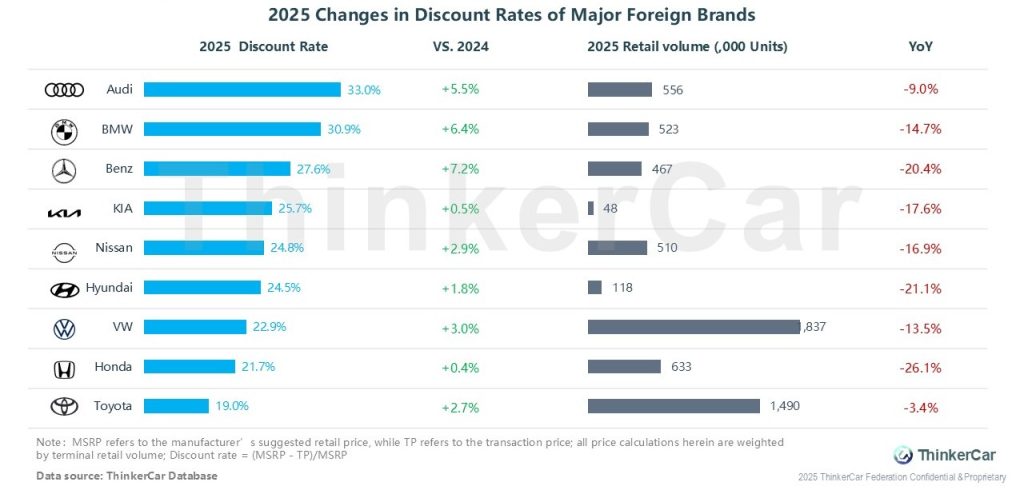

In 2025, major foreign passenger vehicle brands generally intensified their discounts: Luxury brands (Audi, BMW, Benz) offered the deepest discounts (27.6%–33.0%) with the strongest YoY growth, while Japanese/Korean brands had the weakest discounts (Toyota at 19.0%) and smallest increases. Despite higher discounts, all brands saw YoY retail volume declines, with Honda and Hyundai posting sharp drops and Toyota recording the mildest decrease

In 2025, most major Chinese passenger vehicle brands intensified their discounts, with Galaxy offering the deepest discounts (19.4%) and posting the strongest YoY growth (+12.8%), while Xpeng was the only brand with a discount rate decline (-2.6%). Sales performance diverged sharply: Galaxy (+120.6%) and Xpeng (+123.9%) saw explosive growth, yet BYD (the largest seller) and others like Geely and Li Auto experienced YoY declines

Among top-selling models, ICE vehicles offered the steepest discounts, with popular models like Sylphy and Sagitar exceeding 30% and leading in retail volume. PHEV/EREV models had moderate discounts (5%–10%), except for the M8 EREV with near-zero discounts. BEV discounts varied sharply: entry-level models like Wuling Hongguang MINI EV and Lumin EV had over 10% discounts, while hot models like Model Y and SU7 EV had near-zero discounts.

ThinkerCar Data

chosen by over 200 renowned global enterprises