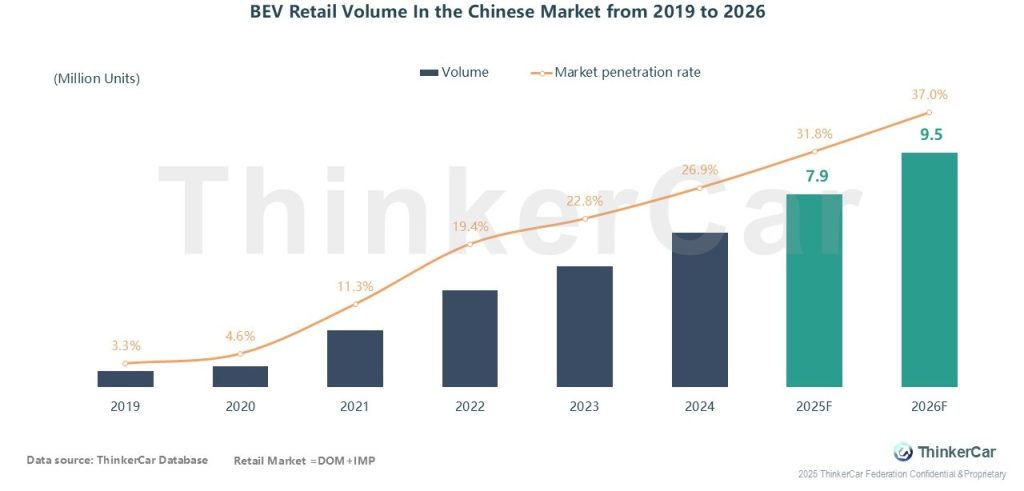

China’s BEV retail market saw continuous volume expansion from 2019 to 2024, with penetration rate steadily rising from 3.3% to 26.9% and initial market adoption completed; projections show retail volume will reach 7.9M units (31.8% penetration) in 2025 and further increase to 9.5M units (over 37.0% penetration) in 2026.

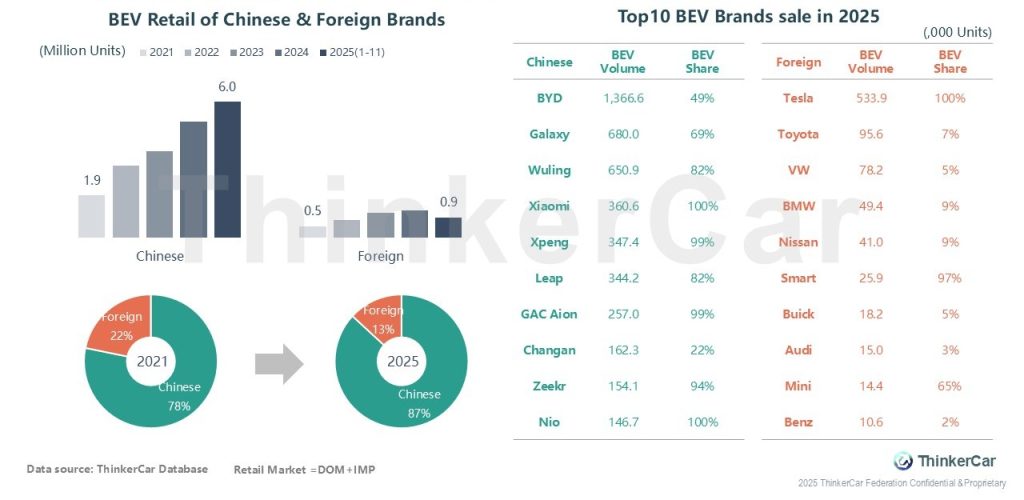

In the BEV retail market, Chinese brands boast surging volume: their share rose from 78% (2011) to 87%, while foreign brands’ fell to 13% from 22%. Top 10 BEV brands: BYD leads with 1,366.6k units, followed by Galaxy and Wuling. Among foreign brands, only Tesla tops 500k units; others are under 100k.

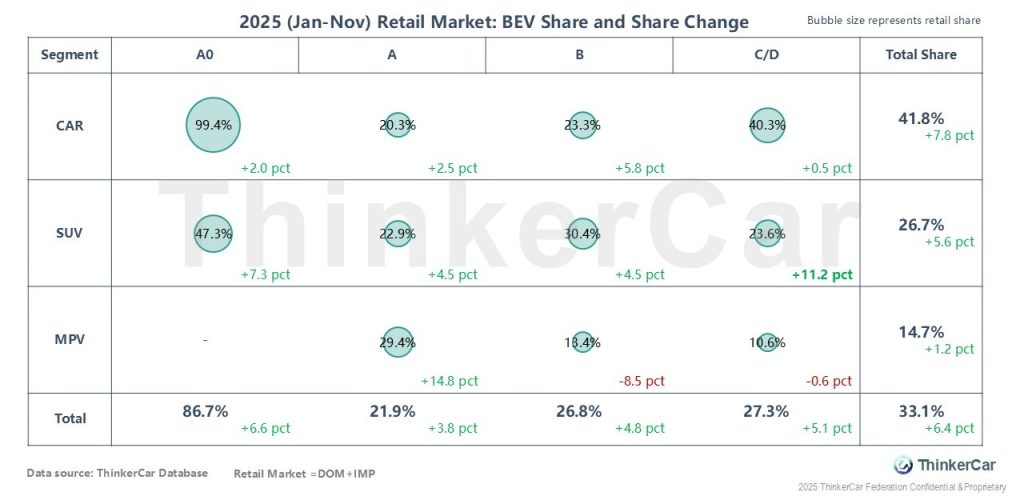

The A0 segment leads in share (99.4% for A0 cars, 86.7% for A0 across all vehicle types). BEV shares for cars and SUVs stand at 41.8% (+7.8 pct) and 26.7% (+5.6 pct) respectively, with the C/D SUV segment seeing an 11.2 pct growth. MPV’s share is 14.7% (a slight 1.2 pct rise) with mixed performance across segments.

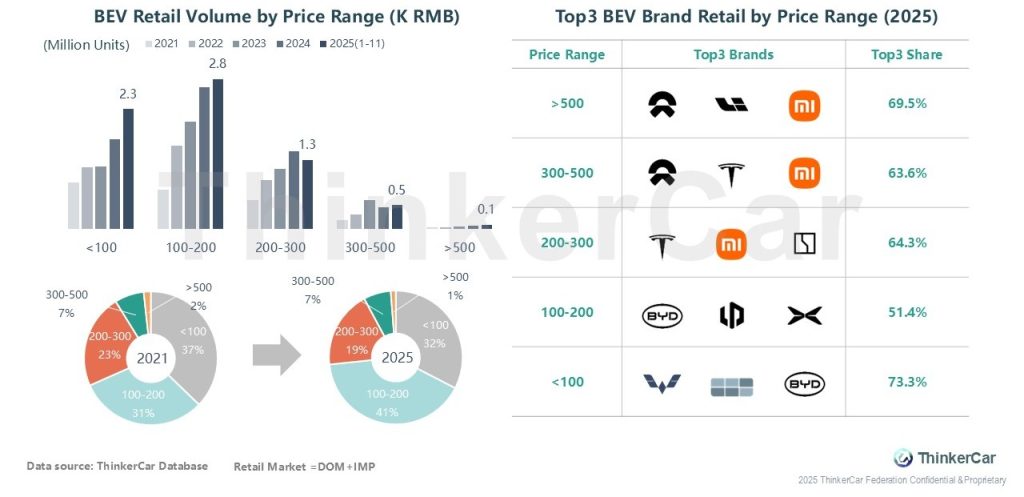

In recent years, the 100-200K RMB BEV segment leads growth—its share rose from 31% (2021) to 41% (2025), while <100K and 200-300K shares fell. Meanwhile, the top 3 BEV brands in each price segment have a high concentration rate: NIO leads >300K, Tesla tops 200-300K, BYD heads 100-200K, and Wuling leads <100K.

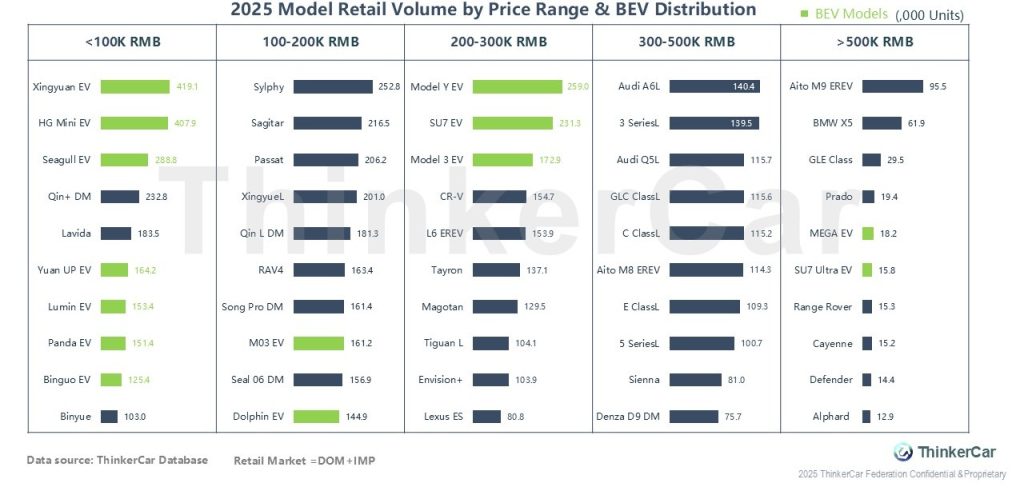

In terms of models, among the top 10 in each price segment: 7 models including Xingyuan EV and HG Mini EV made the list for under 100K RMB; Xpeng Mona and Dolphin EV entered the top 10 for 100–200K RMB; Tesla Model Y and Model 3 ranked top 3 for 200–300K RMB; no BEVs made the top 10 for 300–500K RMB; and 2 BEVs like Su7 Ultra EV joined the top 10 for over 500K RMB, achieving an initial breakthrough in the premium market.

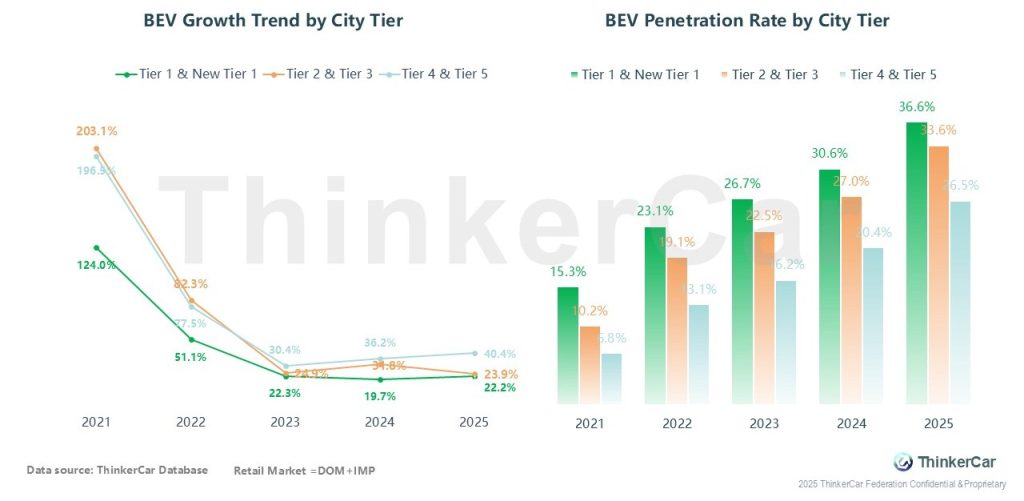

By city tier: In recent years, overall growth has remained high at over 20% — among which the growth rate of Tier 4 & Tier 5 cities (>30%) is significantly higher than that of Tier 1 to Tier 3 cities. Penetration rates have also risen steadily: compared with 2021, the penetration rate of Tier 1 & New Tier 1 cities has increased to 36.6%, that of Tier 2 & Tier 3 cities to 33.6%, and that of Tier 4 & Tier 5 cities to 26.5%.

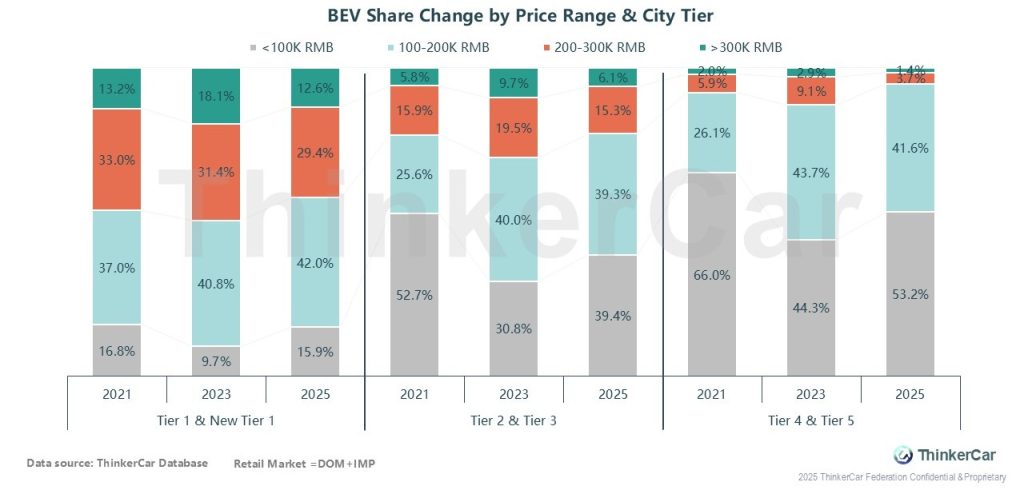

In Tier 1 & New Tier 1 cities, the 100-200K RMB price segment remains the mainstay (37.0%-42.0% share), while the >300K RMB share stays stable at 12%-18%. In Tier 2 & Tier 3 cities, the <100K RMB share plummets from 52.7% (2021) to 39.4% (2025), while the 100-200K share rises from 25.6% to 39.3%. In Tier 4 & Tier 5 cities, <100K RMB is the mainstay but its share falls year-on-year (66.0%→53.2%), while the 100-200K share surges (26.1%→41.6%).

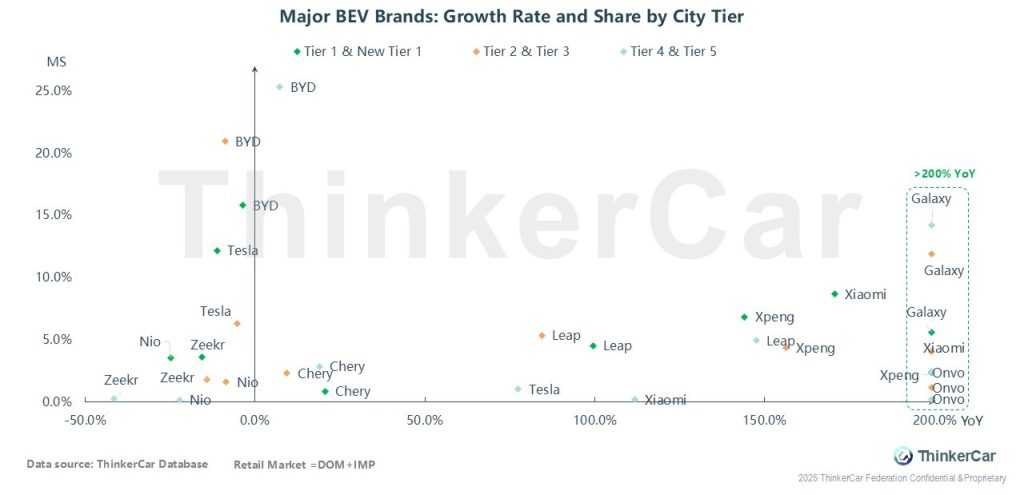

BYD and Tesla hold relatively high shares in Tier 1 & New Tier 1 cities (e.g., ~15% for BYD), but their growth is mediocre. Galaxy delivers over 200% robust growth with a prominent share in Tier 4 & 5 cities. Xpeng and Onvo also see high growth there but with low shares. Nio underperforms in both share (0%-5%) and growth across all tiers. Xiaomi posts ~200% growth but only ~5% share, mainly in Tier 1 & New Tier 1 cities.

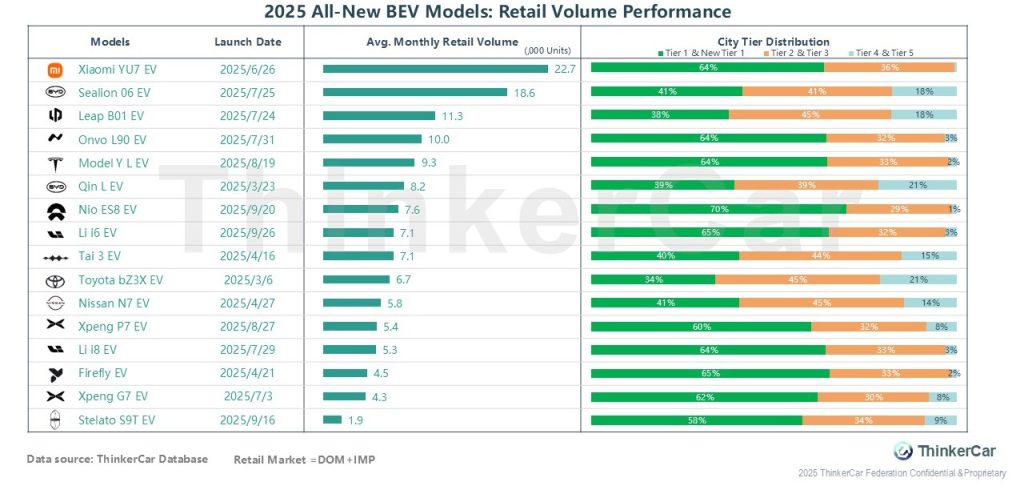

2025 New BEV Retail Performance: Launched in June, Xiaomi YU7 EV led with 22.7k monthly sales (64% in Tier 1 & New Tier 1, 36% in Tier 2-3). July-launched models like Sealion 06 hit 10k-unit monthly sales. Onvo L90 and Model Y L both held 64% share in Tier 1 & New Tier 1. JV models Toyota bZ3X and Nissan N7 posted 5k–6k monthly sales, with over 60% in Tier 2-5. Overall, some models focused on high-tier cities while Sealion 06 and peers achieved higher lower-tier penetration.

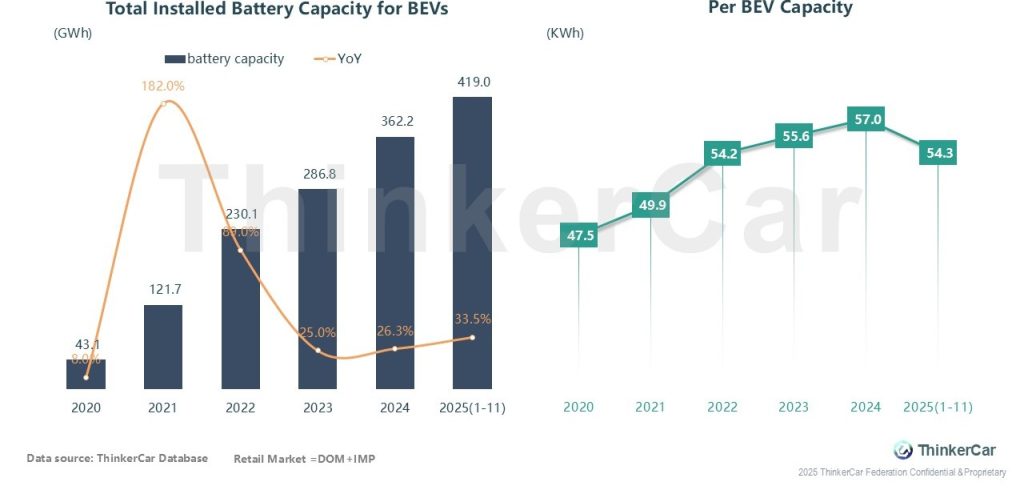

Over the past three years, BEV total installed battery capacity kept expanding—from 286.8 GWh (2023) to 362.2 GWh (2024) and 419.0 GWh (Jan-Nov 2025)—with YoY growth rising steadily from 25.0%/26.3% to 33.5%. Per-BEV capacity peaked at 57.0 kWh in 2024 (up from 55.6 kWh) then edged down to 54.3 kWh, reflecting steady capacity expansion, mild growth rebound and minor configuration adjustments driven by market demand.

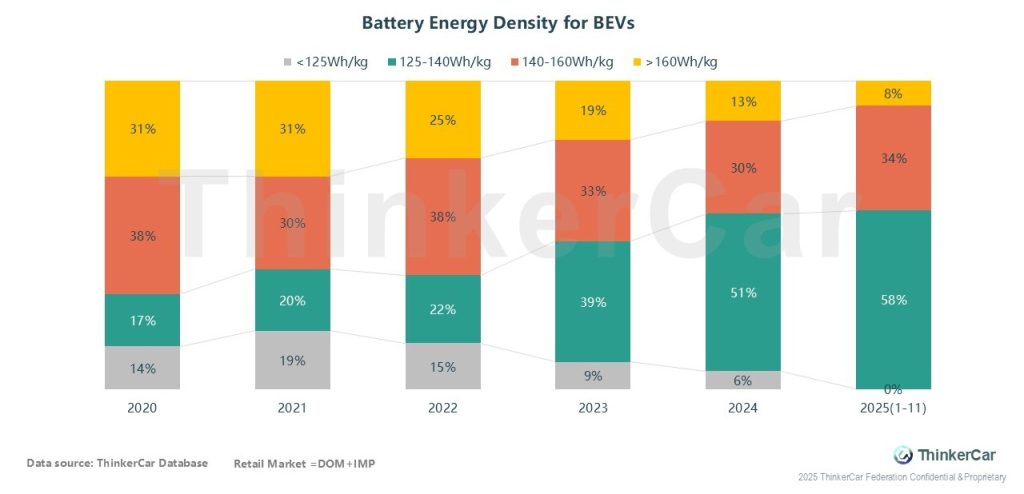

2020–Jan-Nov 2025: BEV battery energy density segment shares shifted sharply. The <125Wh/kg segment dropped to 0%; 125–140Wh/kg (now mainstream) rose to 58%; 140–160Wh/kg rebounded to 34%; >160Wh/kg declined. Overall, density focused on mid-high segments, with low-density options phased out.

ThinkerCar Data

chosen by over 200 renowned global enterprises