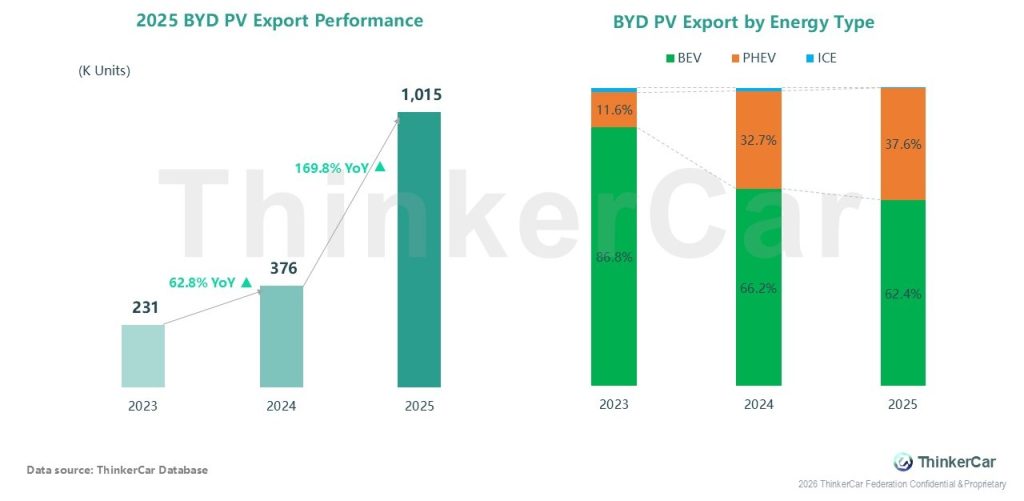

From 2023 to 2025, BYD’s passenger vehicle exports achieved explosive growth, surging from 230k units to 1,015k units, with a 169.8% YoY increase in 2025. In terms of energy structure, its export mix shifted from BEV dominance to a BEV-PHEV dual focus: BEV share fell from 86.8% to 62.4%, while PHEV share rose from 11.6% to 37.6%

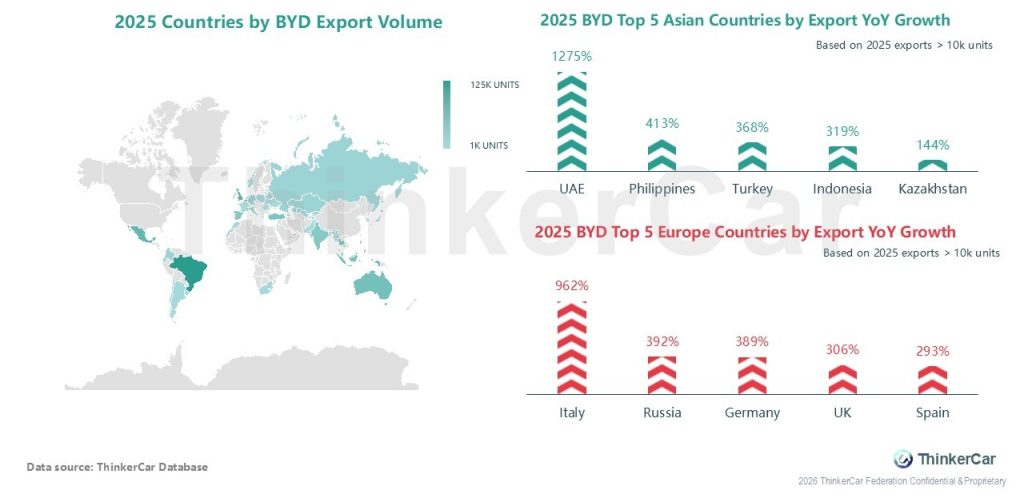

Geographically, exports across all continents recorded robust growth, with Europe and North America leading the surge at 246.3% and 233.3% YoY respectively; Asia maintained its position as the largest export market with 179.2% YoY growth, while South America, Oceania, and Africa all posted YoY growth exceeding 80%. In terms of regional export share, Europe’s share climbed from 23.9% to 30.7%, Asia’s share edged up to 41.5%, and South America’s share declined from 21.8% to 14.6%

At the country level, Asia saw the UAE lead with 1275% YoY export growth, followed by the Philippines (413%), Turkey (368%), Indonesia (319%) and Kazakhstan (144%). In Europe, Italy surged 962% YoY, with Russia (392%), Germany (389%), the UK (306%) and Spain (293%) also posting strong gains. The global export map highlights Asia as BYD’s largest footprint, with expanding presence in Europe and South America

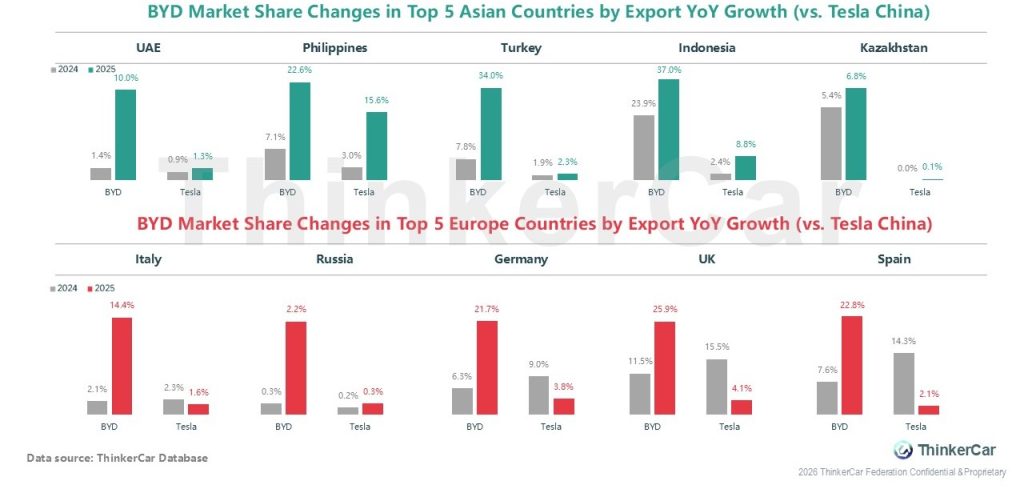

In Asia, BYD saw sharp export share gains: from 1.4% to 10.0% in the UAE, 7.1% to 22.6% in the Philippines, 7.8% to 34.0% in Turkey, 23.9% to 37.0% in Indonesia, and 5.4% to 6.8% in Kazakhstan, while Tesla China’s share stayed below 3.0%. Similarly in Europe, BYD’s export share rose dramatically from 2.1% to 14.4% in Italy, 0.3% to 2.2% in Russia, 6.3% to 21.7% in Germany, 11.5% to 25.9% in the UK, and 7.6% to 22.8% in Spain, with Tesla China’s share peaking at just 4.1% in the UK

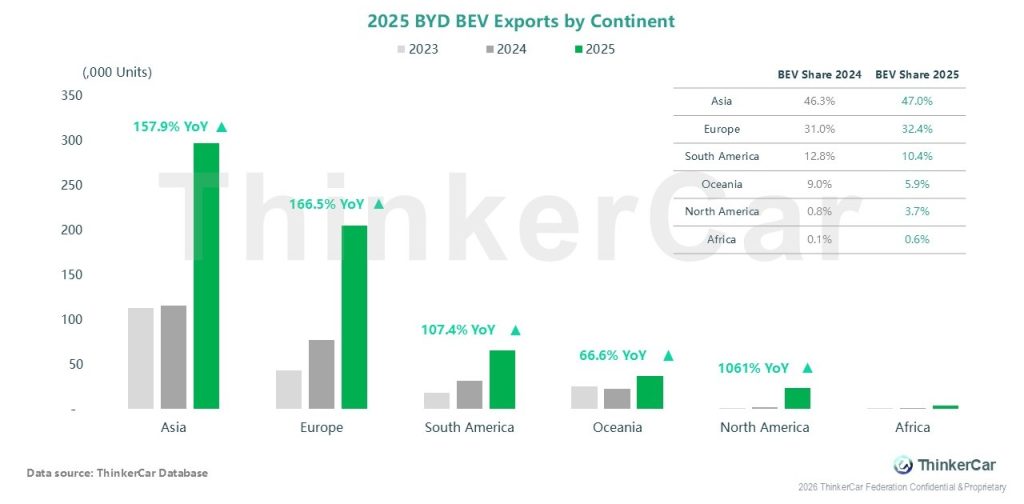

For BEVs, BYD saw strong export growth across major continents: Asia led with 157.9% YoY growth, Europe surged 166.5% YoY (BEV share up from 31.0% to 32.4%), and South America and Oceania expanded at 107.4% and 66.6% YoY respectively. Overall, BYD’s BEV exports accelerated in both mature and emerging markets, with robust growth highlighting its fast-paced global electrification push

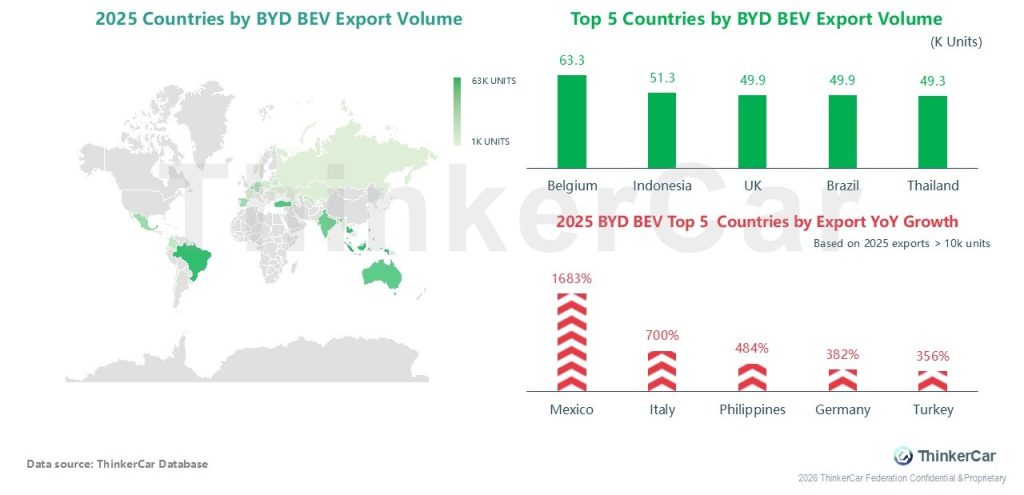

At the country level, BYD’s top 5 BEV export destinations in 2025 were Belgium (63.3k units), Indonesia, the UK, Brazil and Thailand, covering core markets in Europe, Southeast Asia and South America. In terms of growth, Mexico led with a 1683% YoY surge, while Italy, the Philippines, Germany and Turkey also saw explosive growth, reflecting BYD’s simultaneous penetration of both emerging and mature markets

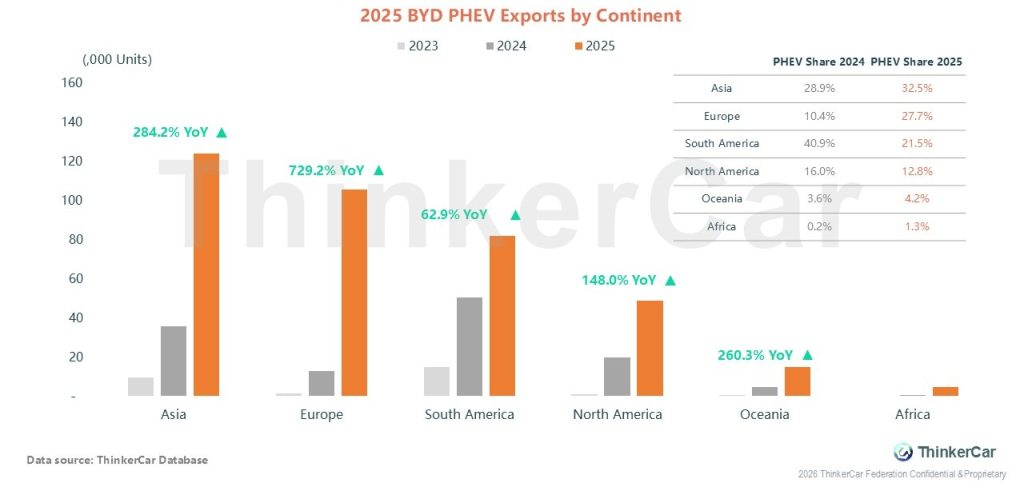

Alongside robust BEV export growth, BYD’s PHEV exports also saw explosive global growth: Asia posted 284.2% YoY growth with PHEV share rising from 28.9% to 32.5%, Europe led with 729.2% YoY growth (share up from 10.4% to 27.7%), and South America, North America, and Oceania expanded at 62.9%, 148.0%, and 260.3% YoY respectively, with Africa also showing strong gains. While PHEV share fluctuated in some regions, its global penetration is accelerating, particularly in Europe

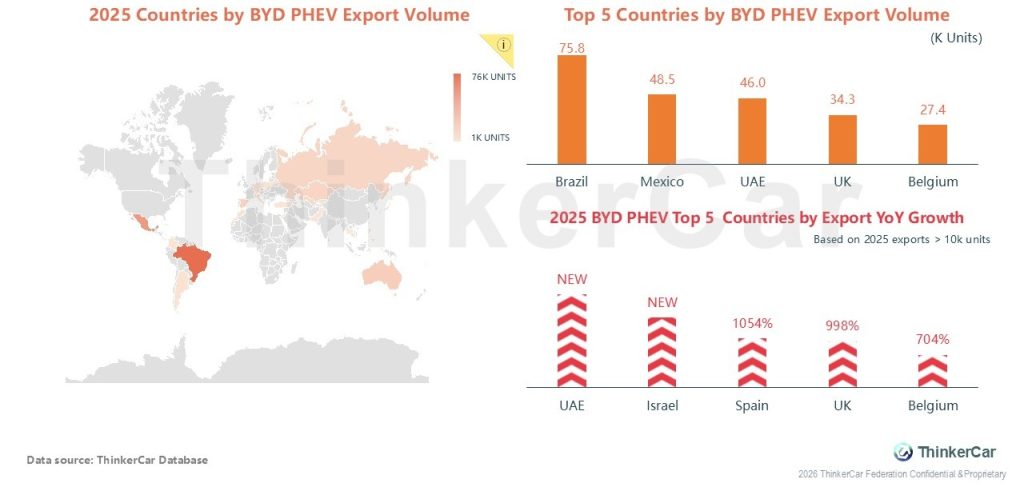

Building on PHEV’s strong continental growth, BYD’s country-level performance also stands out: the global map highlights concentration in South America, the Middle East and Europe. Brazil (75.8k units) leads in export volume, with Mexico, the UAE, the UK and Belgium following closely. Growth-wise, the UAE and Israel are new high-growth markets, while Spain (1054% YoY), the UK (998% YoY) and Belgium (704% YoY) saw explosive gains, underscoring BYD’s accelerating PHEV penetration across both emerging and mature markets

ThinkerCar Data

chosen by over 200 renowned global enterprises