2023-2025 witnessed robust growth in China’s auto exports: PV exports rose from 4.4M to 7.1M units with sustained double-digit growth; NEV exports performed even more remarkably, hitting 2.4M units in 2025 with a 102.1% YoY surge, including 1.6M BEVs and 0.8M PHEVs, making PHEVs a key growth driver

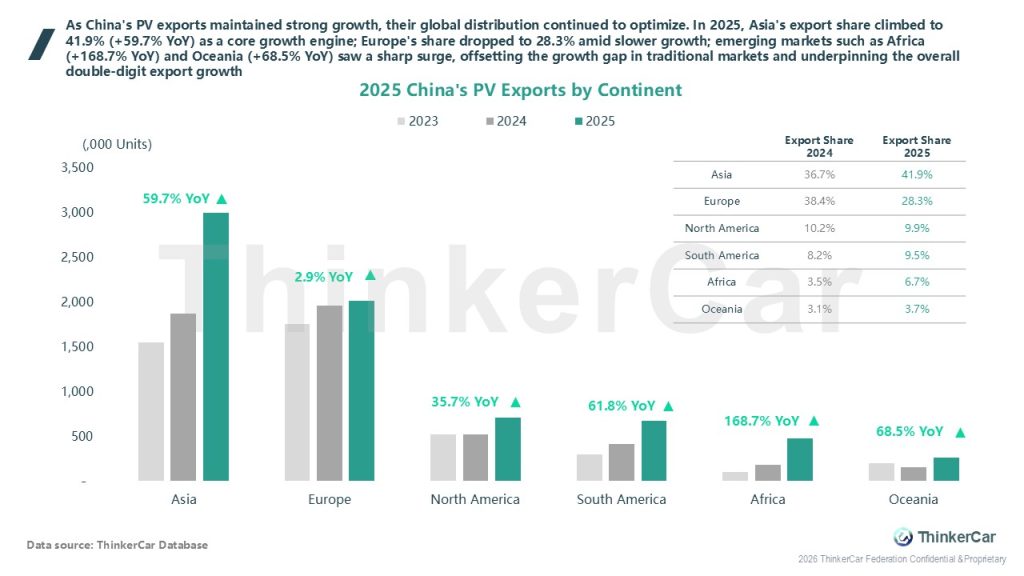

As China’s PV exports maintained strong growth, their global distribution continued to optimize. In 2025, Asia’s export share climbed to 41.9% (+59.7% YoY) as a core growth engine; Europe’s share dropped to 28.3% amid slower growth; emerging markets such as Africa (+168.7% YoY) and Oceania (+68.5% YoY) saw a sharp surge, offsetting the growth gap in traditional markets and underpinning the overall double-digit export growth

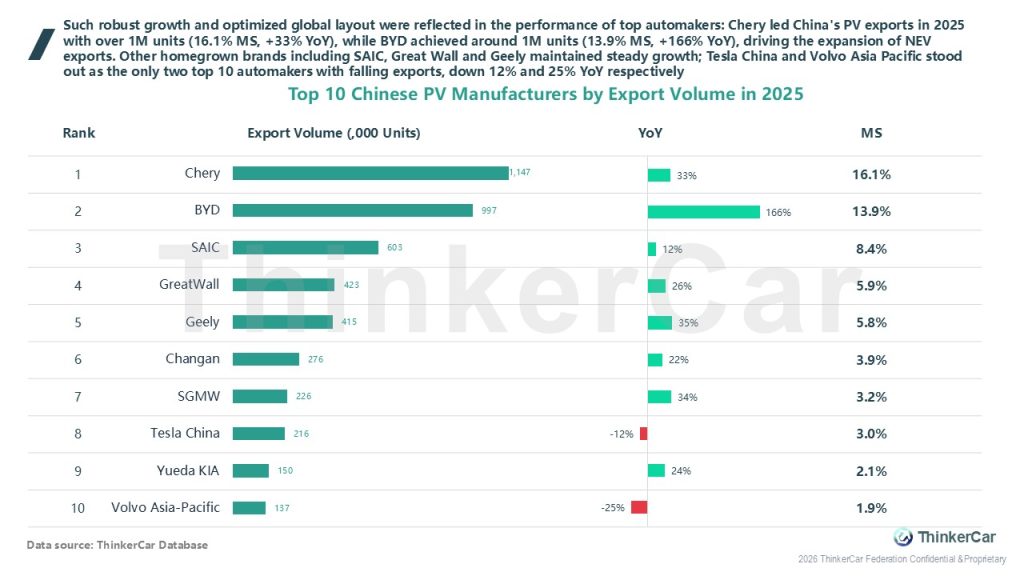

Such robust growth and optimized global layout were reflected in the performance of top automakers: Chery led China’s PV exports in 2025 with over 1M units (16.1% MS, +33% YoY), while BYD achieved around 1M units (13.9% MS, +166% YoY), driving the expansion of NEV exports. Other homegrown brands including SAIC, Great Wall and Geely maintained steady growth; Tesla China and Volvo Asia Pacific stood out as the only two top 10 automakers with falling exports, down 12% and 25% YoY respectively

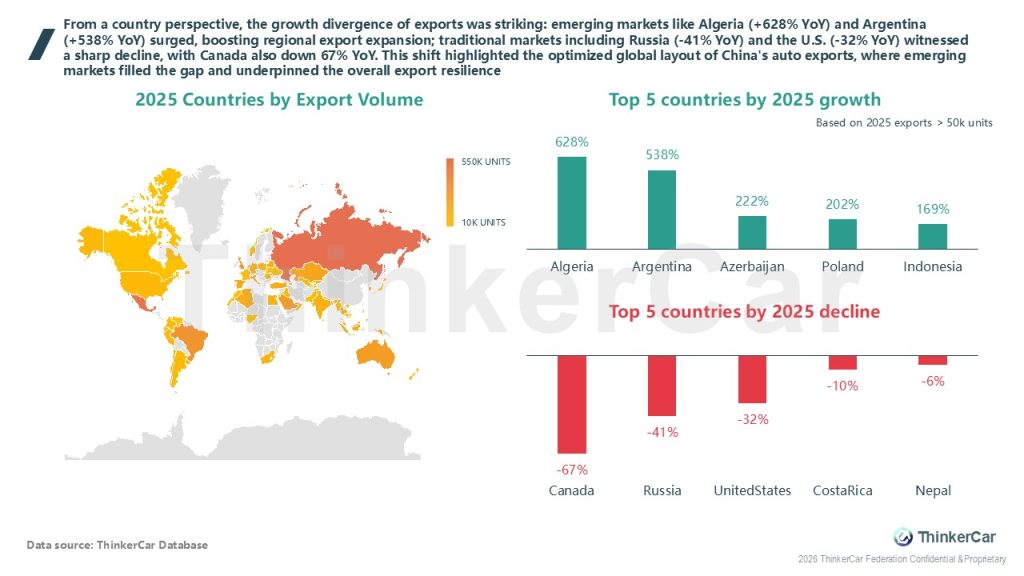

From a country perspective, the growth divergence of exports was striking: emerging markets like Algeria (+628% YoY) and Argentina (+538% YoY) surged, boosting regional export expansion; traditional markets including Russia (-41% YoY) and the U.S. (-32% YoY) witnessed a sharp decline, with Canada also down 67% YoY. This shift highlighted the optimized global layout of China’s auto exports, where emerging markets filled the gap and underpinned the overall export resilience

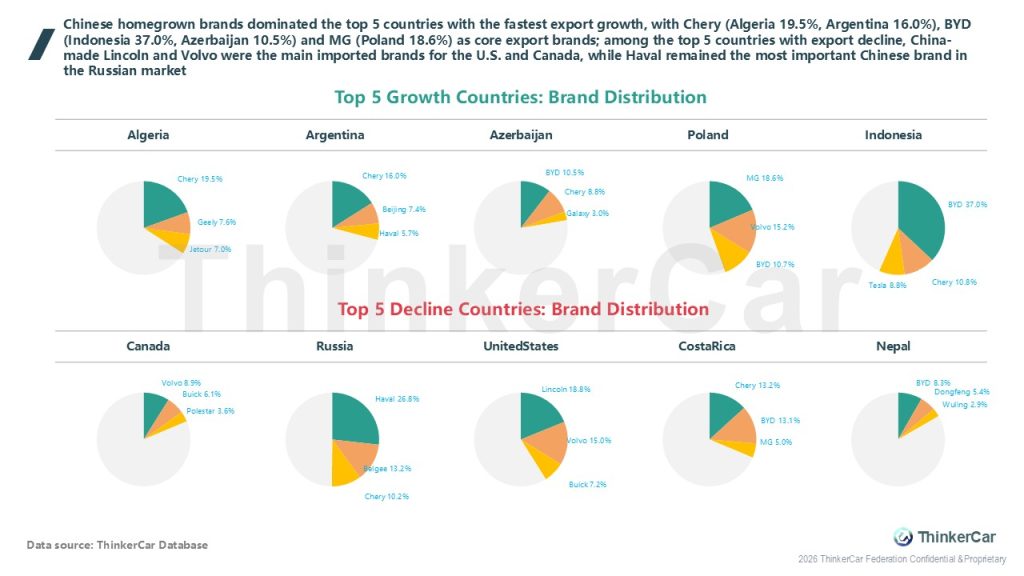

Chinese homegrown brands dominated the top 5 countries with the fastest export growth, with Chery (Algeria 19.5%, Argentina 16.0%), BYD (Indonesia 37.0%, Azerbaijan 10.5%) and MG (Poland 18.6%) as core export brands; among the top 5 countries with export decline, China-made Lincoln and Volvo were the main imported brands for the U.S. and Canada, while Haval remained the most important Chinese brand in the Russian market

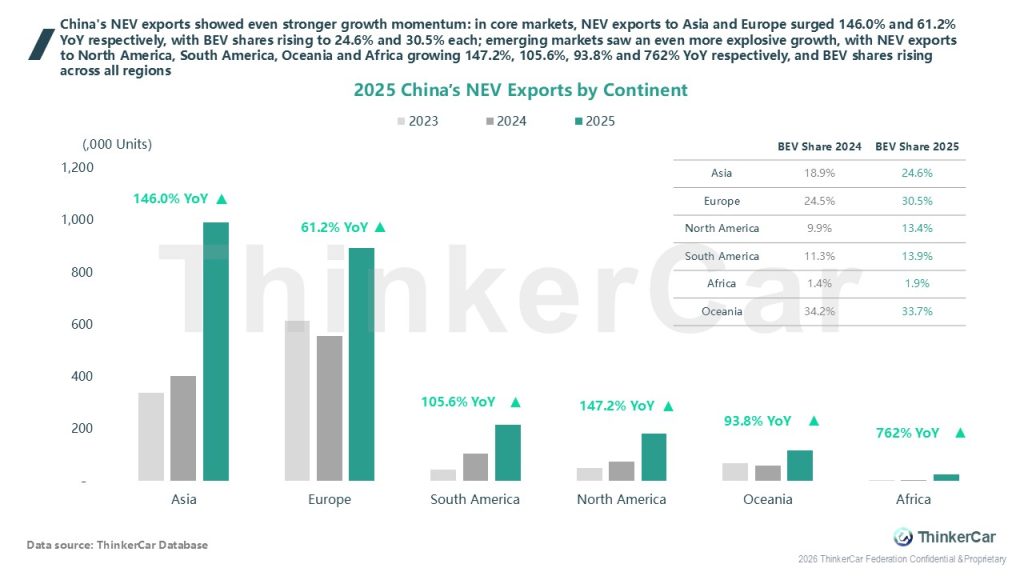

China’s NEV exports showed even stronger growth momentum: in core markets, NEV exports to Asia and Europe surged 146.0% and 61.2% YoY respectively, with BEV shares rising to 24.6% and 30.5% each; emerging markets saw an even more explosive growth, with NEV exports to North America, South America, Oceania and Africa growing 147.2%, 105.6%, 93.8% and 762% YoY respectively, and BEV shares rising across all regions

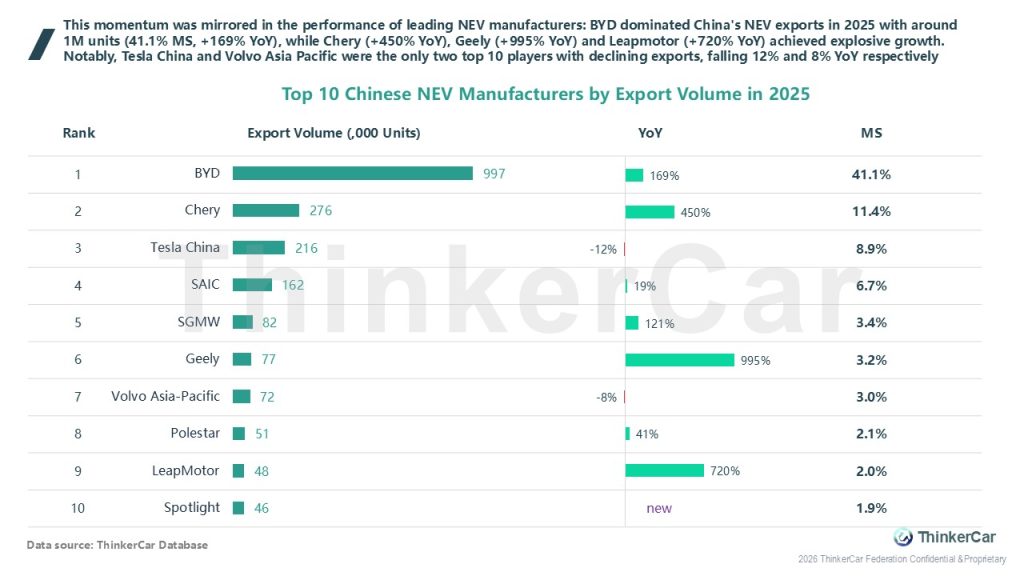

This momentum was mirrored in the performance of leading NEV manufacturers: BYD dominated China’s NEV exports in 2025 with around 1M units (41.1% MS, +169% YoY), while Chery (+450% YoY), Geely (+995% YoY) and Leapmotor (+720% YoY) achieved explosive growth. Notably, Tesla China and Volvo Asia Pacific were the only two top 10 players with declining exports, falling 12% and 8% YoY respectively

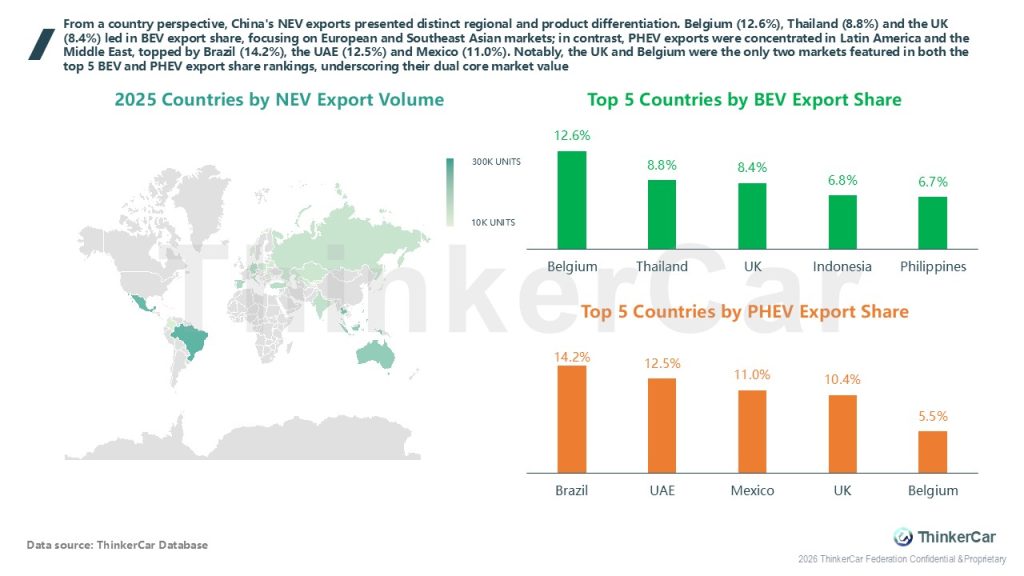

From a country perspective, China’s NEV exports presented distinct regional and product differentiation. Belgium (12.6%), Thailand (8.8%) and the UK (8.4%) led in BEV export share, focusing on European and Southeast Asian markets; in contrast, PHEV exports were concentrated in Latin America and the Middle East, topped by Brazil (14.2%), the UAE (12.5%) and Mexico (11.0%). Notably, the UK and Belgium were the only two markets featured in both the top 5 BEV and PHEV export share rankings, underscoring their dual core market value

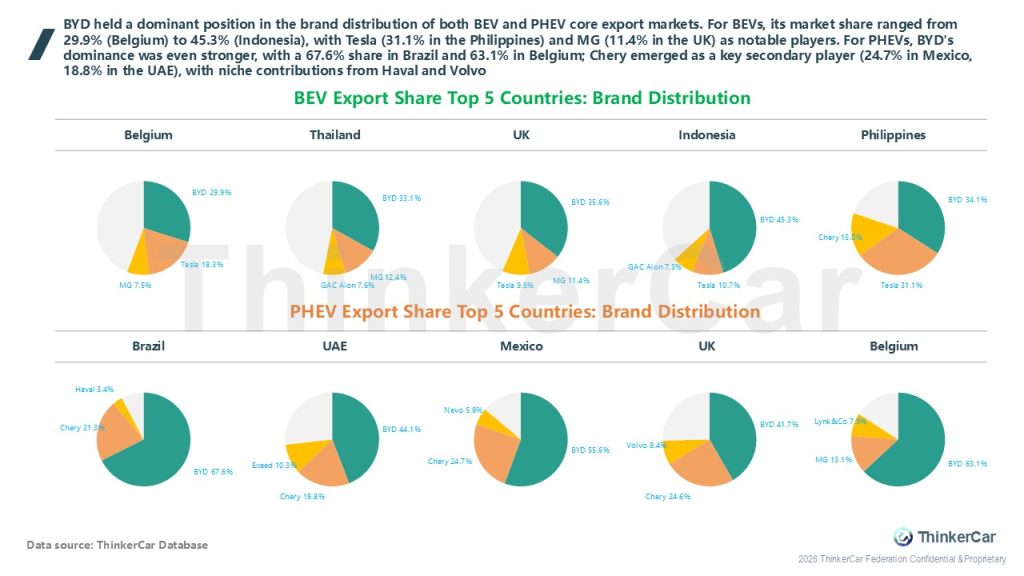

BYD held a dominant position in the brand distribution of both BEV and PHEV core export markets. For BEVs, its market share ranged from 29.9% (Belgium) to 45.3% (Indonesia), with Tesla (31.1% in the Philippines) and MG (11.4% in the UK) as notable players. For PHEVs, BYD’s dominance was even stronger, with a 67.6% share in Brazil and 63.1% in Belgium; Chery emerged as a key secondary player (24.7% in Mexico, 18.8% in the UAE), with niche contributions from Haval and Volvo

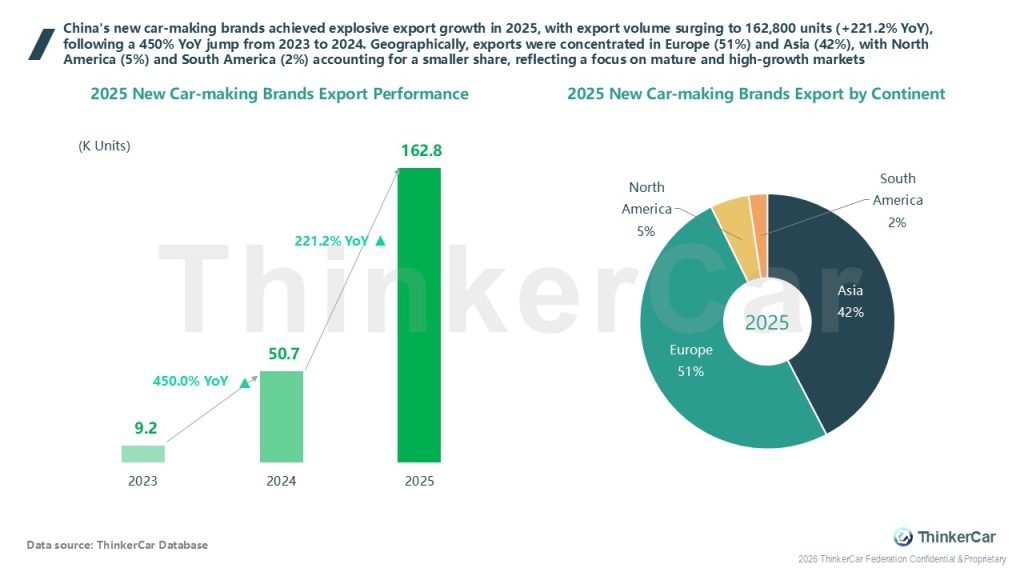

China’s new car-making brands achieved explosive export growth in 2025, with export volume surging to 162,800 units (+221.2% YoY), following a 450% YoY jump from 2023 to 2024. Geographically, exports were concentrated in Europe (51%) and Asia (42%), with North America (5%) and South America (2%) accounting for a smaller share, reflecting a focus on mature and high-growth markets

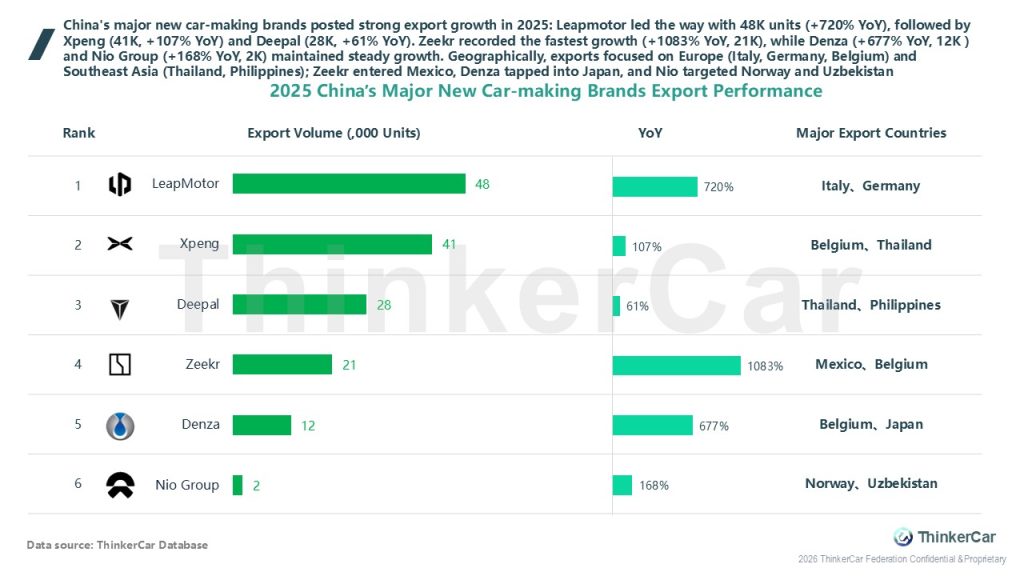

China’s major new car-making brands posted strong export growth in 2025: Leapmotor led the way with 48K units (+720% YoY), followed by Xpeng (41K, +107% YoY) and Deepal (28K, +61% YoY). Zeekr recorded the fastest growth (+1083% YoY, 21K), while Denza (+677% YoY, 12K ) and Nio Group (+168% YoY, 2K) maintained steady growth. Geographically, exports focused on Europe (Italy, Germany, Belgium) and Southeast Asia (Thailand, Philippines); Zeekr entered Mexico, Denza tapped into Japan, and Nio targeted Norway and Uzbekistan

ThinkerCar Data

chosen by over 200 renowned global enterprises